Taper 'Tantrum-ette' – Stocks Pump’n’Dump As Fed 'Eases' Balance-Sheet Pressure

Powell to traders today...

h/t @ForexLive

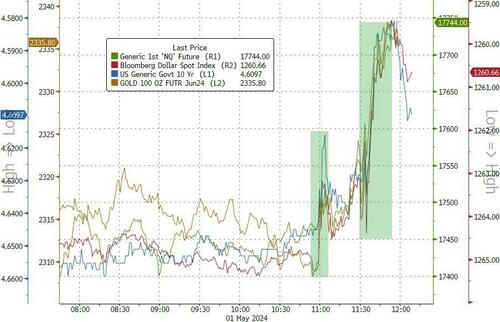

The bigger than expected QT taper cancellation juiced markets (stocks and bond prices up, dollar down) into Powell’s press conference, then got spooked lower as he admitted "inflation has shown a catch of further progress... and gaining assurance to cut will take longer than thought."

But that dip didn’t last long and years knocked, stocks soared, gold rallied and the dollar knocked...

Source: Bloomberg

The marketplace shrugged off Powell’s comments about ‘whother rates are at their highest will depend on date’ which opened up the way of possible rate-hikes, but he dd add that “he doubles next decision will be a hike.”

CNBC’s Steve Liesman asked the large question that everyone should be asking: You are 'sort of easing' by reducing QT while holding rates flat due to the fact that you’re not assured that inflation is under control – wassup with dates?

Powell replied with any words that means nothing, standing that they have long planned on tapering QT and claimed that 'reduction in balance sheet run-off is not policy-raising'.

‘This is not the easier you’re looking for...’

By the close, all of Powell’s pig-kissing lipstick had been wiped off (see below for the coordinated crypto/nasdaq take-down) as stocks Saw solid gain imagined in the hr after Powell stopped speaking... tiny Caps and The Dow managed to hold on to the gain but Nasdaq and S&P closed close the day’s lows...

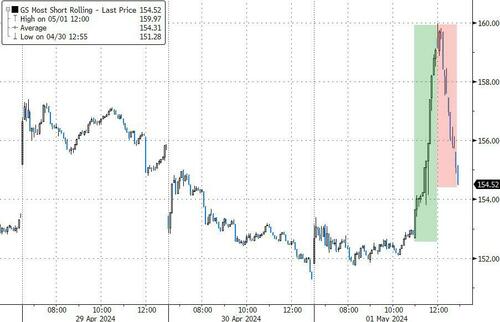

’Most Shorted’ stocks Saw a massive compression (+5%) on the FOMC headslines, before the late day selling force hit...

Source: Bloomberg

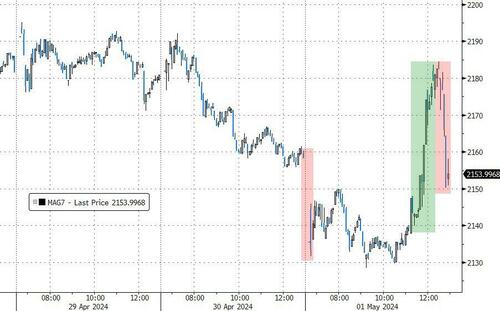

MAG7 stocks ended the day after giving back their post-Powell gain...

Source: Bloomberg

Treasure yields punged 6-8bps across the curve on the day, with the short-end outperforming, dragging all yields lower on the week...

Source: Bloomberg

The 2Y Yield snapped back below 5.00% erstwhile again...

Source: Bloomberg

The young curve (2s30s) jerked flatter initially, then steepened dramatically back to flat on the week...

Source: Bloomberg

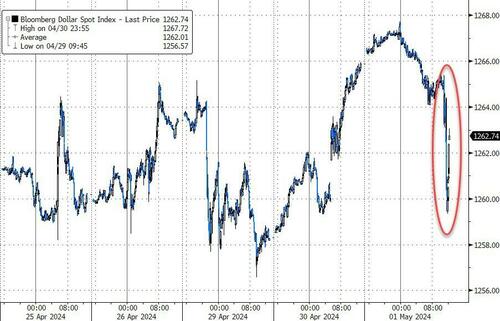

The dollar tucked on the non-easing 'easing' (but bounced back a bit after Powell finished speaking)...

Source: Bloomberg

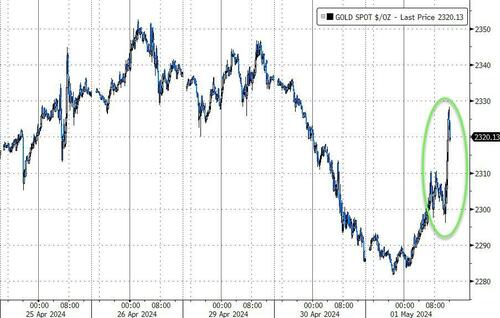

Gold suggested back above $2300 on the non-easting...

Source: Bloomberg

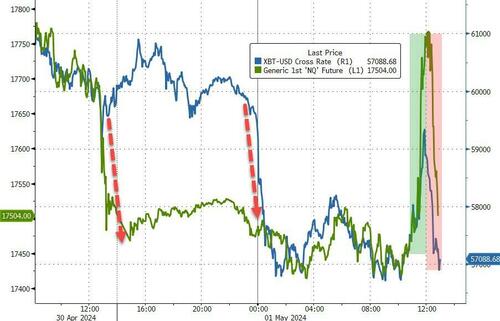

Bitcoin bounced back on the FOMC statement, recovering any of last night's bloodbath, but individual did not want it back to $60,000 and that smoothdown drawn stocks down with it...

Source: Bloomberg

Oil prices ignored all the fuss around The Fed and fell for the 3rd day in a row (its biggest regular drop since early Jan) with WTI back below $80 at six-week lows...

Source: Bloomberg

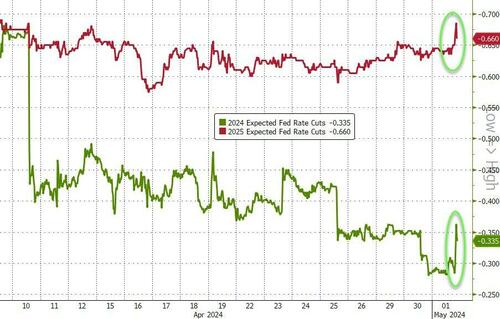

Finally, rate-cut effects (hawkishly) rose on the day with one-or-two cuts in 2024 now 50-50 and two-or-three cuts more in 2025 around 50-50 also...

Source: Bloomberg

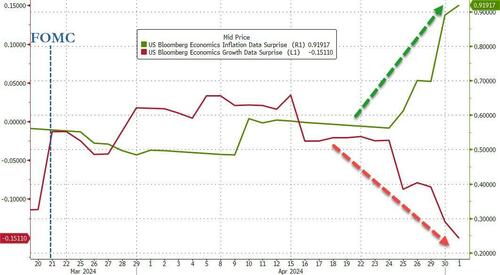

And, besides Powell exploited that he ‘doesn’t see the stag or the 'flation' in markets... well this should aid Jay...

Source: Bloomberg

We can’t aid but feel like Powell is increasingly eager to 'loosen' policy... but he made it clear that the 2024 election “just isn’t a part of the Fed’s thinking.”

So, that’s that then!

Tyler Durden

Wed, 05/01/2024 – 16:00