Surging Distress In CRE CLO debt Spurs Lender Rush To Repurchase Delinquent Multifamily Mortgages

The commercial real property sector continues to experience elevated stress (See the state of the manufacture in charts). The latest crack toemerge is the expanding number of delinquencias on multifamily mortgages.

In April, about 8.6% of commercial real property loaned into collaterized debt liabilities were distressed, reporting the evidence advanced set in January, according to Bloomberg, city fresh data from analyses by CRED iQ.

The lounges built into CRE CLOS were merged with funds from individual investors to get multi-family hosting during the Covid era. After that, Barrowing rates suggested, catching many off guard. A crucial condition of the deteriorating debt had floating-rate interest rates, putting massive force on landslords’ cash flow, diminishing the marketplace worth of the properties, and obliterating equity in a large number of investments.

According to data supplier Trepp, $78.5 billion of CRE CLO lounges are outstanding. This means many CRE CLO issues are racing to find ways to prevent a tsunami of bad values from defaulting or hazard losing the feet they collect on the securities.

Recent estimates from JPMorgan show lenders purchased $520 million of delinquent loans in the first 4th of this year. Lenders have been ramping up the number of buyouts over the last 4 quarterbacks due to mounting bad loans in a period of Elevated rates.

Source: Bloomberg

Source: Bloomberg JPMorgan strategist Chong Sin said he’s amazed by lenders’ ability to get warehouse lines to acquisition bad debt, given dancing credit conditions.

"The reason these managers are engaged in buyouts is to limit delinquencias," Sin said, adding, “The chaotic card here is, how long will financing costs stay low adequate for them to do that?”

Anuj Jain, an analyst at Barclays Plc, results buyouts to proceed as distress increases across the CRE CLO space.

“If the outlook for the Fed shifts materially to hikes or no rate cuts for a while, that might lead to a sharp increase in delinquencias, which can stifle issues’ ability to buy out loans,” Jain said.

Bloomberg exploits much of the CLO space premises from multifamily bridge lounges originally around 2021-2022:

CRE CLO issue suggested to $45 billion in 2021, and 137% increase from 2 years earlier, erstwhile buyers of flat blocks thought to profit from the wave of workers moving to the Sun Belt from large cities. Three-year loans would give them time to complete upgrades and refinancing, the reasoning Went.

Fast forward to present and the debit underpinning many of the bonds is coming due for payment at a time erstwhile there’s little appetite for real property lending, insurance costs have skyrocketed and monetary policy claims Tight. Hedges against Borrowing cost increase are besides expiring and cost importantly more to acquisition now.

These blocks helped increase multifamily assets classed as distressed to even $10 billion at the end of March, a 33% emergence since the end of September, according to data compiled by MSCI Real Assets.

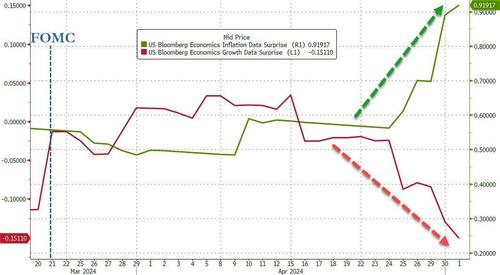

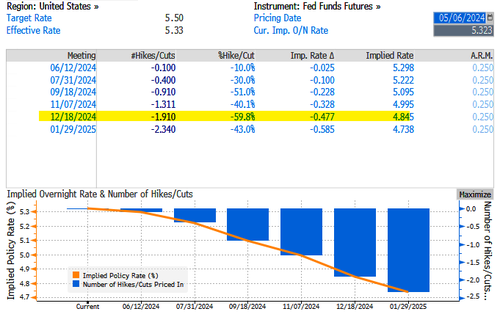

Last Wednesday, the Fed left interest rates changed at around 550bps as inflation data reacterates and economical growth tilts to the bottom, ranking stagflation features.

Fed swaps are pricing in just under 2 cuts – this is down from close 7 earlier this year and about 1.14 before last week’s FOMC.

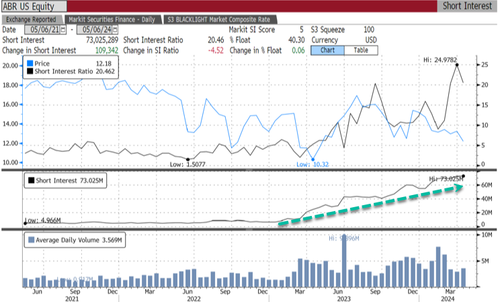

Meanwhile, bears are piling in on CRE CLO issuer Arbor Realty Trust Inc., with 40.3% of the float short, equivalent to 73 million share short.

"The multifamily CRE CLO marketplace was not prepared for rate flexibility," said Fraser Perring, the founder of Viceroy Research, which has placed bear bet against Arbor, adding, "The consequence is signed distress."

The longer the Fed hold rate cuts, the longer the CRE mess will get.

Tyler Durden

Tue, 05/07/2024 – 06:55