Stocks Face Rug-Pull From utmost Momentum Move

Authorized by Simon White, Bloomberg macro strategist,

Momentum stocks are very stretched. A reverse exposes the equity marketplace to the hazard of a potently sisable correction, with rising inflation a potent catalyst. Portfolio taking advantage of inexpensive hedges are better placed to Weather any fall in prices.

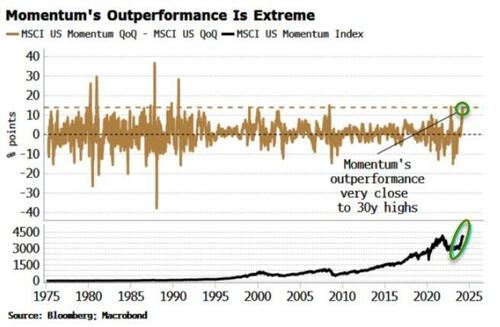

Momentum is leading the charge in the current rally, with it being the best performing of the most popular types of factor. But the trend is looking amazingly extended.

He a 4th base, you gotta go back over 30 years before you decide more utmost outperformance in the factor.

The 2 most fresh times showing a akin degree of comparative upside were March 2022 and June 2008, again of which we were partially invited for the stock market.

That’s a hazard that it would be allowed to ignore, especially as — even if the marketplace escapes unscathed — portfolio hedges regain inexpensive (although that is already changing as vol begins to rose — discretion here last month).

Momentum’s popular means erstwhile the unwind comes, it has the possible to be several. Hedge-fund portfolios carry a evidence tilt to a moment, according to Goldman Sachs.

Source: Goldman Sachs

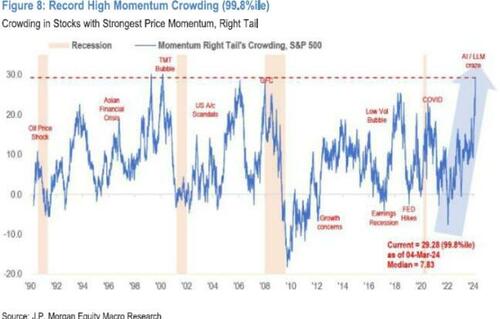

Furthermore, JPMorgan sees record advanced crowding in momentm stocks (i.e. stocks that are part of momentm-factor portfolios).

Source: JP Morgan

Momentum’s blessing is besides its curse. Momentum begets moment, driving the marketplace yet higher. But erstwhile the trend changes, moments strategies can rapidly go into reverse, selling stocks that are falling. In any cases, that can origin the marketplace to correct, or bage. That hazard is especially elevated erstwhile everyone’s in the same trade, as the case today.

The prognosis is not good from a historical standpoint. The Quarterly outperformance of MSCI’s torque origin is at 13 percent points. The forward return of the MSCI US is negative on a 1 and three-month basis erstwhile the quarterly outperformance is more than 10 percent points, and it is well under the average on a six-month horizon. past is telling us besides much minute is simply a bad thing.

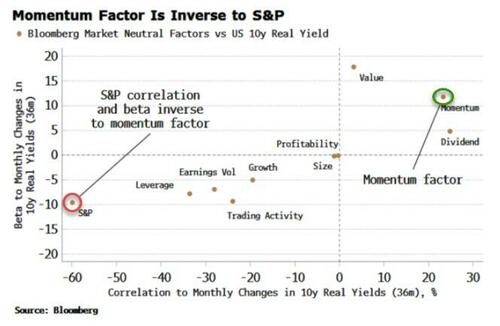

But it could be even worse given the current set up. Momentum is simply a key reason why the stock marketplace has managed to rapidly despite elevated and rising years. Of the most common factors (using the Bloomberg market-neutral origin indexes), the minute presently has the highest beta-and-correlation combination to change in US 10-year real years.

This is almost effectively inverse to the S&P, which has a very negative correlation and beta to 10-year real young changes. It is universal to have this combination. But it is simply a mix that has allowed stocks to proceed rapling despite higher real years.

Why? In the months erstwhile yields have risken, the index was down lightly, but the minute origin was up strong. In months erstwhile yields were down, the minute origin falls by more than the index rose. But as yields increased in about 2 as many rolling-month periods as they fell since the rapidly began in October 2022, overall the marketplace has been able to rise — despite real years rising over 150 bps.

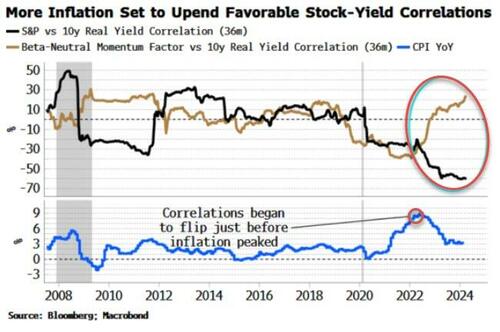

The affirmative yield-versus-momentum correlation and the negative yield-versus-index correlation started to make at the beginning of 2022, before inflation had topped, but around the time erstwhile the highest was shortly anticipated. A re-acceleration in inflation would like to trigger a reverse in this trend, with selected real years rapidly becoming a problem for stocks.

We will get March date for US CPI on Wednesday. Disinflation has already stood, while leading indicators see a re-rise in inflation.

Assets are not charged for this event. Along the biggest stocks in many moments portfolios are tech companies, specified as Nvidia, Meta and Broadcom, which have advanced duration and are therere in the inflation headslights. With specified utmost crowding in the minute space, a re-increase in CPI has the possible to trigger a saltoff that could make into a nasty correction, or bage.

Top 10 Stocks in iShares MSCI US Momentum origin ETF

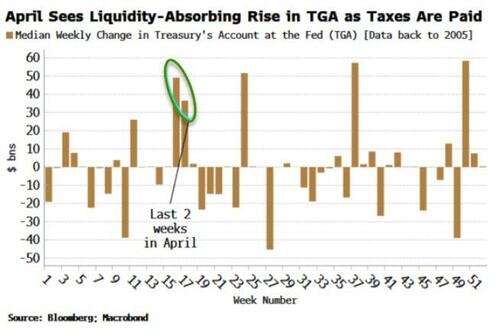

It comes at a time of possible short-term headswinds from liquidity as taxes are paid to the Treasury. The Treasury General Account at the national Reserve has its largest average two-week emergence in the second half of April — leading to the Removal of marketplace liquidity, all another things equal — until the Treasury re-injects the money back into the system.

It’s essential not adequate to derail the bull marketplace as recession hazard claims low and excess liquidity is supportive, but that doesn’t mean it won’t be uncomfortable.

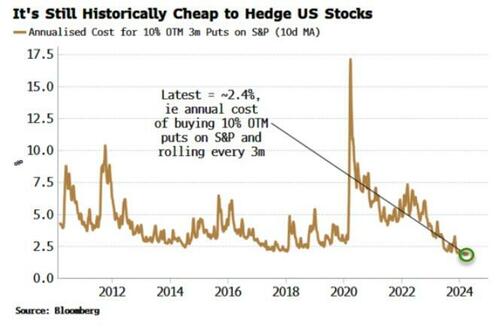

Equity hedges, though, inactive rein cheap.

Other hedges include VIX call options (vol of vol remains low), short credit, and bond flexibility.

Momentum signs for US stocks, specified as With scores of returns, look to have peaked and are rolling over. That brings forward the time erstwhile systematic strategies specified as CTAs start to exit high-momentum and crowded stocks.

A trickle of selling could turn into a boat. Momentum begets momentm — until it doessn’t.

Tyler Durden

Tue, 04/09/2024 – 09:05