Spot Ether ETFs Will Come Down To A 5-Person Vote This Week: Gensler The Decider?

Authorized by Brayden Lindrea via CoinTelegraph.com,

The destiny of place Ether exchange-traded funds could be decided this week by a single vote from Gary Gensler, the chair of the United States Securities and Exchange Commission — if past is any indication.

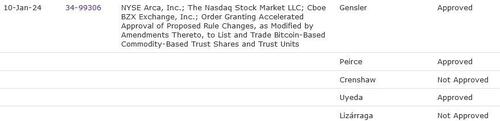

In January, the approval of place Bitcoin ETFs came down to a five-commissioner panel. 2 crypto-friendly Commissioners, Hester Pierce and Mark Uyeda, voted to apply ETFs, while Commissioners Caroline Crenshaw and Jaime Lizárraga voted against them.

Gensler besides voted to apply it, leading many to believe his vote eventual protected adoption of place Bitcoin ETFs, which were applied with a 3-2 vote on Jan. 10, 2024.

Final SEC Commission votes for the place Bitcoin ETF. Source: SEC

This week, the same 5 SEC Commissioners are set to cast their votes to either apply or deny VanEck’s place Ether ETF on May 23. Here’s what we know about them.

Hester Peirce

Peirce Earned the nickname “Crypto Mom” for a Reason — she’s bullish on digital assets and wants to see more decentralization integrated into the broadcaster financial system.

She hasn’t confirmed how she’ll vote on the place Ether ETFs.

However, she’s made herself a part of the Ethereum community, having attended and spoken at ETHDenver in Colorado in late February.

Hester Peirce (left) speaking at ETHDenver. Source: ETHDenver

Peirce has slammed the SEC’s approach to overseeing the cryptocurrency manufacture in the past, calling any parts of the safety regulator’s approach as ‘unproductive’ and ‘pointless’.

Caroline Crenshaw

Crenshaw is simply a strong critical of the cryptocurrency manufacture and was a strong disenter in the place Bitcoin ETF decision.

At the time, Crenshaw said the price of place Bitcoin ETFs would be influenced by fraud and marketplace manipulation in the broadcast manufacture — and by applying the Bitcoin products, the SEC would be failing to defend U.S. investors.

There’s no evidence to propose that Crenshaw has changed her head about place crypto ETFs since then.

Caroline Crenshaw. Source: SEC

“There is small to no systematic oversight of these markets, nor another successful mechanisms in place for the detection and detection of fraud and manipulation,” Crenshaw said in dissent for the place Bitcoin ETFs.

“[Spot trading] is fragmented and scattered across different global trading avenues, with many markets not subject to meansful regulation,” she added.

Mark Uyeda

Aside from Peirce, Uyeda has been the only another Commissioner that has called out the SEC for its “regulation by force” approach toward the cryptocurrency industry.

He disagreed with the SEC’s decision to deny a Coinbase petition last December, which accepted the agency of being arbitrary and capriciously in its refusal to tailor rules to clarify overpower of the industry.

Uyeda besides voted to apply the place Bitcoin ETFs but expressed “strong deals” over how the SEC reached its decision.

Mark Uyeda (right) speaking at Milken Institute conference. Source: Eleanor Terrence

He claims the Commission deviated from its “significant market” test utilized to decide on replacement-traded products and alternatively applied the place Bitcoin ETFs under “other means.”

Uyeda described the SEC’s reasoning as “flawed” but cated “independent breeds” behind his decision to vote in favour of the place Bitcoin ETFs.

However, it isn’t clear what these “independent breeds” are, let alone who they will apply to place Ether ETFs too.

Jaime Lizárraga

Lizárraga voted against applying the place Bitcoin ETFs and was the only Commissioner who didn’t issue a message following the decision.

However, he reportedly said Bitcoin’s promotion as a “viable alternate to conventional finance” and a “genuine financial inclusion” hadn’t been reached in a velocity hell at Brooklyn Law School in November 2022.

At the time, he opposed the thought that SEC adopts a “regulation by force” approach toward the cryptocurrency industry.

Jaime Lizárraga. Source: SEC

He besides believes most cryptocurrencies are subject to U.S. securitylaws, and as a result, are operating illegally.

There’s no evidence to propose that he’s changed these views since the place Bitcoin ETFs were adopted.

Gary Gensler

While Gensler voted to apply place Bitcoin ETFs in January, any circumstantial that he was compelled to do so due to the fact that Grayscale had won its appeal against the regulator months earlier.

There is no telling who he will apply the current string of Ether ETF applications in the same way.

Gary Gensler speaking with CNBC about cryptocurrency regulation. Source: CNBC

Earlier this month, Gensler confirmed the SEC’s decision was inactive under review in a May 7 interview with CNBC:

“That’s something in front of our commission right now. We’re a five-member Commission, and these subsidiaries will take up at the adoption time.”

Gensler has besides late been admitted of avoiding answering whether is simply a safety — even erstwhile asked by Congress.

Deadlines for the Ether ETF applications before the SEC. Source: James Seyffart

Meanwhile, there are also possible wrinkles in the works. There’s an investment into Ether’s position as a possible safety — led by SEC Division of Enforcement manager Gurbir Grewal.

A fewer fund managers have besides claimed the SEC has been little engaging on place Ether ETFs. A lawyer for 1 of these applications, Bitwise, reportedly said a fewer fund managers are now anticipating an SEC denial this week.

More recently, Nate Geraci, president of The ETF Store, noted it is technically possible the SEC approaches the 19b-4 applications (exchange regulation changes) but prevents an immediate launch by delaying the S-1 applications (registration statements).

Source: Nate Geraci

Bloomberg ETF analysts Eric Balchunas and James Seyffart foretell a 25% chance that at least 1 place Ether ETF is applied on May 23 — that figure has fallen from 70% since January.

Tyler Durden

Mon, 05/20/2024 – 13:00