SLR: Could It End The Bond Bear Market

Authored by Lance Roberts via RealInvestmentAdvice.com,

On June 25th, the Federal Reserve quietly announced a significant change to the Supplementary Leverage Ratio (SLR). While the headlines were muted, the implications for the U.S. Treasury market were anything but.

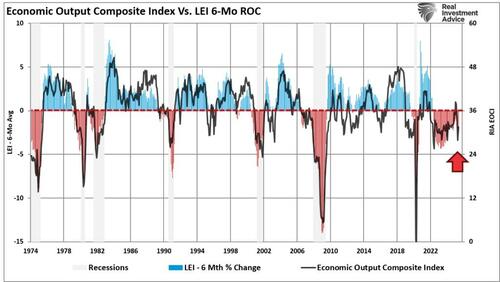

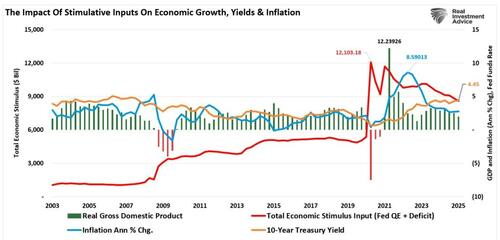

For sophisticated investors, this technical shift marks a subtle but powerful pivot in monetary mechanics. It could create demand for Treasuries, improve market liquidity, and push yields lower at a time when the economy is slowing. As shown in the Economic Output Composite Index (EOCI), which comprises nearly 100 data points, recent reports suggest the economy is weaker than headlines imply. The same is confirmed by the 6-month rate of change in the Leading Economic Index, which remains in contractionary territory.

Historically, such readings have coincided with economic recessions. However, this has not been the case since 2022 due to the massive amounts of monetary stimulus that have kept the economy growing. That support is quickly fading, potentially putting the major banks at risk, which brings us to the SLR.

Understanding the SLR and Why It Matters

The Supplementary Leverage Ratio was initially implemented as a post-GFC (Global Financial Crisis) safeguard. The idea was simple: limit the amount of leverage banks could take on by tying it to their capital base, regardless of the riskiness of the assets. That meant a Treasury bond and a junk loan were treated equally for leverage purposes. Unsurprisingly, the rule disincentivized the major Wall Street banks from holding low-risk assets like U.S. Treasuries, particularly in periods of balance sheet stress, in exchange for debts with higher yields.

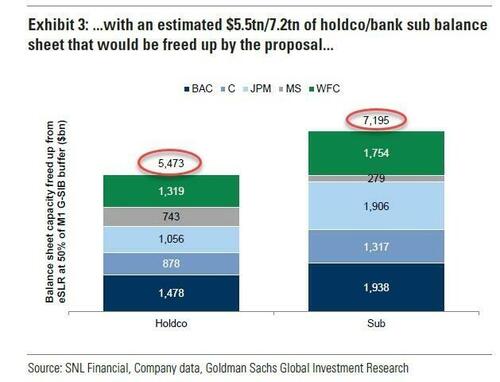

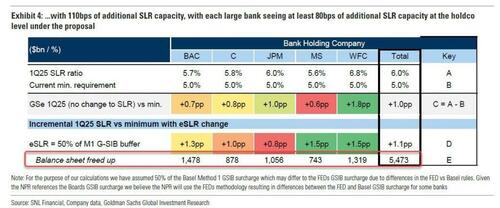

In a welcome reversal, the Fed announced on June 25th that it, the FDIC, and the OCC are easing that constraint by recalibrating the SLR to reflect a more nuanced risk-based approach. Specifically, the new rule adjusts the enhanced SLR (eSLR) add-on to 50% of the Method 1 Global Systemically Important Bank (G-SIB) surcharge, harmonizing it more closely with international standards. This reduces the leverage burden across the largest U.S. banks and opens up substantial balance sheet capacity.

What does this mean in practice? According to Goldman Sachs’ Richard Ramsden, the proposed changes could unlock between $5.5 and $7.2 trillion in bank balance sheet capacity.

To put that number into perspective, the increase in balance sheet capacity for the banks is equivalent to roughly 25% of GDP.

Unsurprisingly, the Federal Reserve’s member banks, JP Morgan, Bank of America, Wells Fargo, and Citigroup, stand to benefit the most. Most importantly, this opens the door for increased repo financing and direct Treasury purchases, particularly during periods of market dislocation.

While repo and Treasury investments offer modest returns, their low-risk nature makes them ideal candidates for bolstering liquidity and meeting capital requirements. Banks can pivot toward these safer assets in an environment where credit spreads are tight and loan demand remains uncertain without incurring regulatory penalties.

SLR Implications for the Treasury Market

So, what does the SLR have to do with the bond market? We discussed this recently in our Daily Market Commentary when this rule change was first mentioned. To wit:

“Yes, I believe we will. I have, for a long time, like others, been somewhat concerned about the levels of liquidity in the Treasury market. The amount of Treasuries has grown much faster than the intermediation capacity has grown, and one obvious thing to do is to lower, is to reduce the effective supplementary leverage ratio, the bindingness of it. So that’s something I do expect we will return to and work on with our new colleagues at the other agencies, and get done.” – Fed Chairman, Jerome Powell.

Following the 2020 COVID pandemic, bonds have been in a bear market as yields have risen with inflationary pressures and increased Fed funds rates. That yield rise was also compounded by increased Treasury debt issuance in recent years to fund the massive stimulus and spending programs during the Biden Administration. However, the largest Wall Street banks have been reluctant to step in due to regulatory capital constraints. That reluctance keeps yields higher, particularly at the long end of the curve.

With the SLR reform, banks can deploy excess capital into Treasuries without running afoul of leverage rules. This newfound demand could absorb a meaningful portion of net new issuance. The result? A downward pressure on yields, particularly during market volatility when banks typically pull back. In effect, this reform could smooth Treasury market functioning and reduce the risk of another episode like the September 2019 repo blow-up or the March 2020 liquidity crisis.

Furthermore, another underappreciated impact of the SLR change is its effect on the Total Loss Absorbing Capital (TLAC) and Long-Term Debt (LTD) requirements. These rules, intended to ensure that large banks can be wound down in an orderly fashion, also tie into leverage ratios.

Under the new proposal, TLAC and LTD requirements would be reduced by ~5% and ~16% respectively, freeing up roughly $95 billion in wholesale debt across the five largest U.S. banks. In a rising rate environment, that’s not just regulatory relief—it’s a cost-saving measure. Lower funding costs will flow through to margins, providing yet another reason for banks to reallocate capital into U.S. Treasuries and repo financing.

Portfolio Strategy: What Investors Should Do Now

From a portfolio management perspective, this shift is another reminder that the regulatory structure matters as much as monetary policy.

While most investors focus on the Fed’s interest rate decisions, regulatory plumbing like the SLR plays a significant role in shaping asset flows, risk preferences, and liquidity conditions. With banks now likely to increase Treasury holdings, investors should prepare for downward pressure on long-term yields, especially during risk-off periods when the bid for safety intensifies.

The substantial short position against US Treasury bonds could amplify the downward pressure if an event forces a rapid unwind. As we discussed previously:

“Short positions in TLT, the popular 20-year US Treasury Bond ETF, have spiked to over 130 million shares, up from 107 million last month. TLT has 541 million shares outstanding. Consequently, the short interest has risen from 20% to 24% of the float. Furthermore, TLT’s days to cover ratio (short position/average trading volume) is nearly 3.5 days. As the graph below shows, that is far and away the most prominent short position in the ETF in at least the last 15 years.”

This doesn’t necessarily guarantee a bond rally, but it significantly tilts the risk-reward back in favor of duration, particularly in high-quality fixed income. For equity markets, lower long-term yields are a mixed bag. Lower yields are historically bullish for growth stocks, UNLESS yields are dropping rapidly due to slowing economic momentum or recession risk.

Portfolio construction should always remain anchored in risk management, and the risk of being short Treasury bonds is clearly on the rise.

Bottom Line

The Fed’s proposed SLR reforms are not just regulatory housekeeping—they’re a targeted effort to shore up the financial plumbing of the Treasury and repo markets. The Fed is engineering a quiet but meaningful boost to Treasury demand by giving banks more flexibility to hold safe assets.

For investors, that means better liquidity, lower yields, and perhaps a more stable financial system, as long as the unintended consequences stay in check.

As we’ve said before, the devil is always in the details. And sometimes, those details make all the difference.

Tyler Durden

Mon, 06/30/2025 – 14:05