“Safe Haven” Yen Trending Towards Zero Against Gold

Via SchiffGold.com,

The yen was erstwhile known as a safe-haven currency for investors to defend themselves erstwhile broadcast markets are shaky or another currencies are dropping, but those days are numbered. A unchangeable governance and consistency (and low) interest rates have been any of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe haven” undoing as gold breeds its protective characteristics and rockets upward.

Both gold and yen have benefited from investors looking to park their cash somewhere safe during times of advanced risk. But ZIRP policy in Japan has gone on for so long, that the economy can’t handle even modern increases in the price of boarrowing without triggering chaos. As seen below, the yen is presently in a freefall against gold as it hemorrhages purchasing power:

Gold’s emergence Against the Yen

Source: Bloomberg

If this is what happens with 0-0.1% interest rates, Imagine what would happen if they ticked up to even a modet 1%, much little the dramaticly higher rates that would be set by the free marketplace if a central bank wasn’t pulling the reins.

And despite erstwhile being known as corrected with gold, since Japan began touching interest rates up, the divergence between the 2 alleged “safe havens” has been decisive and dramatic:

#Gold Price in nipponese Yen vs Yen/USDOllar Since 1970 (Apr. 23, 2024) – via https://t.co/NjtSzxxNhA pic.twitter.com/7Skcz6wqM3

— Dan Popescu (@PopescuCo) April 24, 2024

Now at a 34-year low, the rumors are spinning that the Bank of Japan may intervene to prop up the yen. Stuck between a stone and a hard place, they’ll gotta keep letting bond years increase to attract abroad investment, which puts upward force on EU and US bonds as well. And even as it presently stands, never the European Central Bank nor the Fed can afford their interest payments without borrowing even more money.

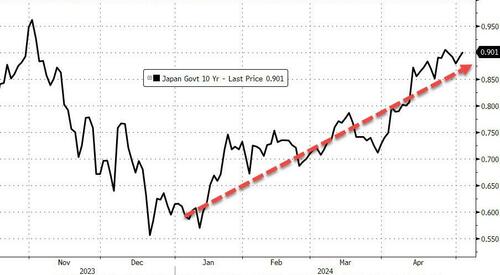

Since the start of the year, years on 10-year nipponese bonds have kept going up.

Japan Government Bonds: 10-Year Yields in 2024

Source: Bloomberg

Japan is besides the largest holder of U.S. Treasury securities, to the tune of over $1 trillion, and may be forced to start selling its holdings to keep the yen from totally imploding. If Japan dumps Treasures to save the yen, yields will tick higher and incentivize the yen carry trade. It won’t save Japan’s collapsing currency. And with advanced inflation that global central banks won’t be able to reign in, nothing will halt gold’s continuing upward trend against fiat money.

Of course, the US will do everything in its power to halt Japan from offloading US Treasures — including shooting up a fresh circular of QE. With the Bank of Japan trapped, the only “solutions” they have, and the only responses abroad central banks can take, all lead to entertaining cycles that will rip through the strategy and crush the global economy.

The collapsing yen is simply a set-up for a Bond collapse doom-loop to yet begin in Earnest. In the US, since the Fed would install further devalue the dollar than gotta rise interesting rates adequate to stimulate saving over Borrowing, inflation has nowhere to go but up. Central banks in Japan and the US are both trapped, partyly by themselfs and partyly by 1 another.

Rather than let Treasury yields go besides high, the Fed would install start printing money even as it recognizes that inflation is far from under control. As Peter Schiff said in his fresh interview with Anthony Crudele:

“...rather than a winning inflation fight that would origin a respective financial crisis and force the US government to default on its debits and cut spending, the Fed is going to monetize debt...to prevent these political choices from having to be made.”

The yen is beyond saving, and gold will outperform it even if the BoJ manages to narrow the gap in the short term. But both the yen and USD will be left in the dust as they eventual trend toward zero in the long word comparative to the yellow metal.

Tyler Durden

Thu, 05/02/2024 – 10:15