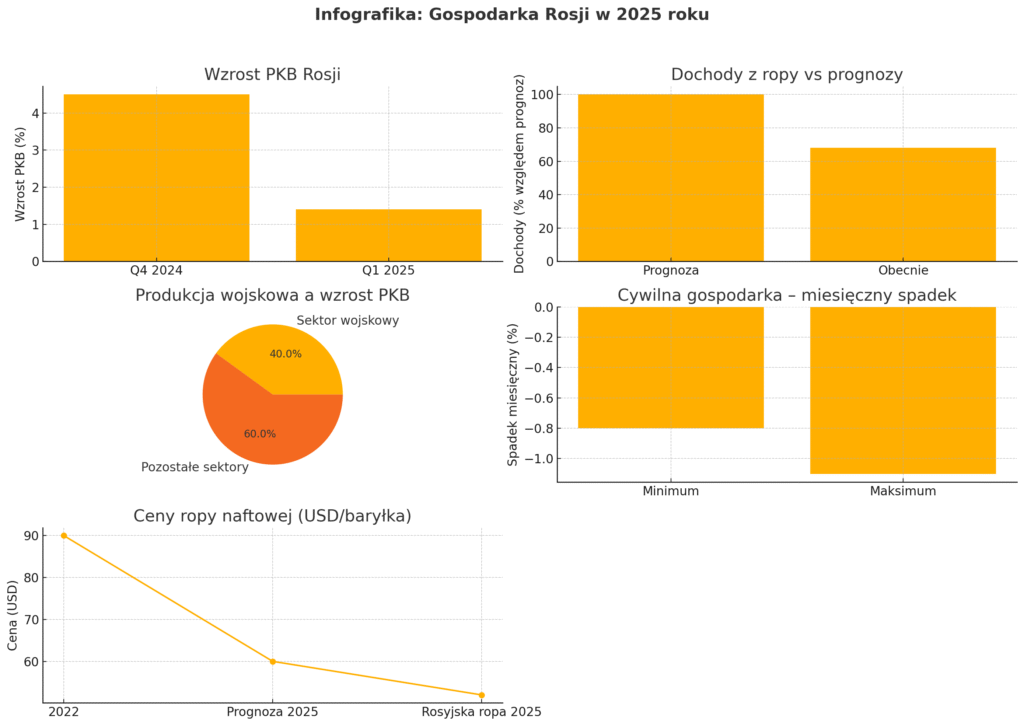

On Friday, Rosstat, a Russian state statistical agency, announced that Russia's GDP had only increased by 1.4% in the first 4th of 2025. This is simply a dramatic decline over the end of 2024, erstwhile economical growth was 4.5%. For the Russian economy, it is not only a cool shower — it is the announcement of the coming deconiunkt. Growth is not only slowing down — it is losing its foundations.

The Russian authorities forecast an increase of 1.7%, which is inactive far below erstwhile results. But reality proved to be worse than pessimistic assumptions. Independent economists from abroad have for months warned that the collapse is inevitable — and that what has been “the crisis managed” so far can become a permanent recession.

Economic growth over the last 2 years has been artificially sustained by massive state spending, primarily on the arms sector. In 2024, 40% of GDP growth came straight from the defence manufacture — the production of tanks, ammunition and war logistics. However, this is not a sustainable improvement model — it is simply a policy of the war economy.

Deceleration mechanics: from inflation to no chips

Experts point to respective key causes of the current breakdown:

- Monetary policy: The central bank raised interest rates, trying to fight inflation, which exceeded 11% annually. The side effect of this fight is simply a decline in credit availability and little consumption.

- Material deficiencies: The sanctions inhibited the import of advanced technologies, machines and electronic components, which hit, among others, the automotive, aerospace and energy industries.

- Falling oil prices: In the first 4th of 2025 Brent barrel cost an average of 60 dollars and Russian oil was sold even $10 cheaper. The state budget, based on oil, is bleeding.

- Sanitary effect of sanctions: The West has cut Russia off from global financial and technological markets. As a result, Moscow must trust on outdated methods and limited trade channels.

Many analysts describe the Russian economical model as a quasi-mobilization system. The military has precedence — not development. The leading arms suppliers receive preferential backing and even access to human resources, while the private sector loses workers, materials and orders.

The Macroeconomic and Short-term Forecast Analysis Centre (CMASF) warns that the civilian economy has already fallen into recession — shrinking by 0.8 to 1.1% months after the month. In another words, without the defence industry, the Russian economy would have collapsed by now. Paradoxically, ending the war could aggravate the crisis. Why? due to the fact that the current growth is based on war spending. If the war had ended, the military budget would have been reduced — and thus the "drip" would have disappeared, supplying hundreds of thousands of jobs and dozens of factories. Transformation from war to civilian management requires time, resources, know-how and organization stability. And that's not Russia at the moment. alternatively of a recovery and modernization plan, Moscow has a waiting strategy.

Revenue from oil and gas exports accounts for about 30-40% of Russia's budget revenue. Meanwhile, global request is falling, China is expanding purchases in Africa and South America, and India is negotiating increasingly aggressive discounts. In addition, OPEC+ actions are besides taking place. Saudi Arabia and the UAE abolished production limits, which increased supply and thus reduced prices. Russia — alternatively of utilizing the cartel — was squeezed by it. As a result, the Russian budget for 2025 already has a failure estimated at $32 billion — only half a year.

Sanctions — Slow but effective weapons

Although Moscow has long presented sanctions as ineffective, their impact becomes increasingly felt. Difficulties in technology import, deficiency of access to global financial markets, frozen abroad assets, and exclusion from SWIFT — all of this reflects growth dynamics. Substitution import only works to a limited extent. The production of “Russian” cars without ABS and airbags shows that Chinese substitutes do not fill the qualitative gap. In addition, partners specified as Beijing and Ankara increasingly dictate conditions — utilizing Russia’s weakness.

It is worth noting that although the West conducts a sanction campaign, it is not always consistent. Biden's administration introduced exceptions that allowed trade in Russian energy resources — especially with EU countries. Only the Donald Trump administration, in its return to the political stage, began to criticize this policy as contradictory and harmful. In March that year, the U.S. Treasury Department completed peculiar exemptions for transactions involving the Russian oil sector, limiting Moscow's trading opportunities.

Trump spared no words of criticism towards Europe, accusing her of financing a war from which she officially distances herself.

The decline in GDP growth is more than a statistic. It's the regular lives of millions of people. The emergence in the prices of basic products, the collapse in the housing market, the difficulty of buying drugs or electronics — all of this affects the social mood.

There's besides a wave of emigration growing. Young, educated people leave Russia, seeking stableness and prospects abroad. According to estimates, only in the first 4th of 2025 the country left around 150 000 IT specialists, engineers, doctors and scientists. Authorities are trying to halt the drain, among others, through passport restrictions, but are incapable to halt the trend.

Is the recession inevitable?

Official forecasts say up to 2.5% in the 2025 end. However, more and more analysts find this script unrealistic. Without structural changes and the end of the war, the reflection will be superficial — and the real economy will proceed to shrink. If the current pace continues, Russia may evidence a method recession (two consecutive quarters of GDP decline) in the 3rd quarter. If not, it is threatened by a "quality recession": GDP can grow, but real income, employment and consumption will fall.

To get out of the crisis, Russia would have to:

- End the war and rebuild economical relations with key partners.

- Diversify the economy, investing in technology, education and tiny business.

- Reduce bureaucracy and improve transparency of institutions.

- Reform the energy sectornot to base the full economy on exports of natural materials.

However, all these reforms require stability, cooperation with the West and political will — and these elements are now missing.

The Russian economy is trapped in its own decisions: war as a driver of growth, oil as a origin of income and isolation as a endurance strategy. All 3 elements neglect at the same time.

If there is no major change in direction — both economical and political — Russia is facing a long decade of stagnation, crises, and gradual withdrawal from the global economical scene. This is no longer a question of whether, but of how deep and how long.