Renewed Regulators force On Bitcoin Is No Surprise

Authorized by Mark E. Jeftovic via bombhrower.com,

Nor will it change anything over the long haul...

We’ve always said that the emergence of Bitcoin and non-state fintech was a monetary government change, and that It would be naive to anticipate the entrenched “powers that be” and incumbent establishment to go down without a fight.

After all, the Cantillionaire class has had monopolies control over a magical lever that surreptitiously transferred everybody else's wellness to themself for over a city.

Now, abruptly Prometheus shows up – in the form of Satoshi – and gifts humanity with a fresh magic lever, called asymmetric public-key cryptography. It’s truly just math. But it is enabled all individual on earth to just as magically shield themselves from this embezzlement

If you want to keep your #Bitcoin safe from the government, just make a seed frame utilizing Jeffrey Epstein’s clients’ names.

That way the FBI will never look for it.

— Walker (@WalkerAmerica) April 26, 2024

Even bag for these elites, is that their mechanism for leaving wealth from community accesses to them in fiat currency units that lose their value over time, while all the unwashed plebes making usage of this fancy fresh strategy are uncovering their purchasing power increase Over time.

The Cantillionaires are fighting the inexorable cannibalization of their own purchasing power, owing to the permanent effects of utilizing debt for money – while the rising strategy is being impelled by network effects, power law, and good oil-fashioned incentives.

For the establishment, the central bankers, career politicians and fiat financiers, it attempts all seems a little... unfair.

Which makes it complete unsurprising that whoever among them sees the writing on the wall and repairs to let themselfs to be “orange piled”, as it were, will dig in and muster all the power, influence and institutionalized Corruption at their disposal to effort and forestall the possible of hyper-Bitcoinization.

Chokepoint 1.0 was an Obama-era initial, launched in 2013, that set the table for freezing unsanctioned financial players out of the legacy banking system: payday loans, money transfer networks – and possible most notably due to the fact that it ended an manufacture overnight: online gambling.

Chokepoint 2.0 Happened in the wake of the 2021-2022 crypto winter, the fallout from the FTX bankruptcy (along with Celsius, Terra/Luna, and all (that).

We Saw SEC president Gary Gensler fighting off Bitcoin ETFs, the formation of Liz Warren’s “anti-crypto army”, and a coordinated hitjob on crypto-friendly banks – among them our own Silvergate Bank, which was going swimmingly well until then, but yet successful. Silvergate was our first, and restores our only full wash-out over the course of The Bitcoin Capitalist.

One of the chief architects of Chokepoint 2.0, Bharat Ramamurti, was now heading up the CFTC (and we outlined the numerical connections in the June ‘23 portfolio update – which we actually titled “Are We Into Chokepoint 3.0“ at the time).

Chokepoint 3.0 began to be recognizable in mid-2023; the first time I hear it referred by name this year was from Riot Blockchain back in February, in consequence to the US government’s planned “survey” of Bitcoin mines’ electricity use.

Since the SEC suggested its humiliating destiny against Bitcoin in applying place ETFs, it sees like the pace of regulators FUD in the US has increased and is now coming from all saddles:

- We reported last edition that the SEC served a Wells announcement on Uniswap.

- They’ve since acquired Metamask – the close ubiquitous Web3 browser wallet – of being an unlimited safety broker (Consensys, Metamask’s parent company, is now suing the SEC alleging “unlawful section of authority”.)

- The founders, CEO and CTO of the Samourai Wallet – a self-customy wallet with a built-in coin mixer/anonymizer – were increased and charged “with money launching and unlimited money transfering off”, according to the release issued by the US Department of Justice.

- The FBI just issued a informing to consumers to avoid utilizing KYC-free exchanges:

“The FBI wars Americans again utilizing cryptocurrency money broadcasting services that are not registered as Money Services Businesses (MSB)... avoid cryptocurrency money broadcasting services that do not collect know your client (KYC) information from customers erstwhile required.”

Adding that:

“Using a service that does not comply with its legal obligations may put you at hazard of losing access to funds after law enforcement operations mark these businesses.”

Which is FBI-speak for saying, “Not your keys = not your coins".

- On April 26th, The Depository Trust and Clearing corp (DTCC) unknown they were cutting the collective value of ETFs with Bitcoin or crypto exposition It's zero, effective April 30th. They besides decreased the value of B1-B3 Junk Bonds (pushing the “haircut value” from 50% to 70%)

The list goes on, but we’ll grow on a couple more beyond a bulllet-point:

US Treasury Department’s Deputies Secretary Wally Adeyemo warned that “terrorist groups will increase their usage of virtual currencies and another digital assets”, even though:

“While we proceed to measure that terrorists like to usage conventional financial products and services, we believe that without progressive action to supply us with the essential tools, the usage of virtual assets by these actors will only grow...”

Said differently, and echoing what another US law enforcement agents and government ministers have been repeatedly saying in their own studies: criminals and terrorists inactive like utilizing fiat money– namely US dollars – to carry out their activities.

And yet – new constitutional forces are someway essential to solve a problem that duly does’t exist.

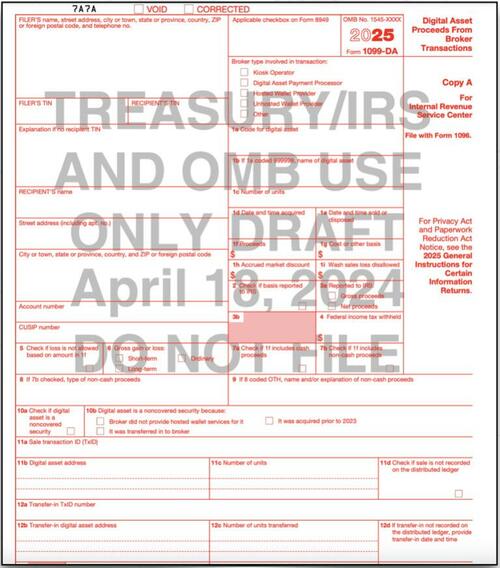

Toward these ends we’ve gotten a preview of possible Forthcoming taxation disclosures respecting digital assets via the US IRS:

The proposed fresh 1099-DA taxation form to study “Digital Asset Procedures From Broker Transactions” was released via the IRS website:

Conspicuous by its presence is the checkbox option for “unhosted wallet provider” and we can see it asking for transfer-in wall address and even transaction IDs.

This is the format of the proposed form, with public comments invited via IRS.gov/FormsComments; include “NTF 1099-DA” in your consequence so they know it’s about this – I engourage our US readers to do so.

Again, no of this should be any surprise, and we’ve never recommended the usage of Bitcoin and crypto to make in taxation evasion. We’ve expected expanding regulations and identity verification on all roads into or out of the crypto-economy.

When it’s time to take chips off the table (though you choose to do so), you origin in your taxation hit and study that accordingly (here in Canada, the Liberal government just hiked the capital gain inclusion rate from 50% to 66.6% – taking the effective taxation hit on cap gain from 25% to 33%: this becomes effective June 27th and absolutely covers Bitcoin and cryptos).

Also bear in head that 1 of our core bonuses is that wealth is actively on a one-way journey into the crypto-economy, and has no intention of always returning to the fiat strategy – which we think has limited timespan. This means the global financial strategy will inevitably bifurcate into 2 separate monetary systems:

A UBI/welfare strategy moving on CBDCs where money is replaced by social credit scores; under which neo-Feudal serfs plod through lives of quiet desperation, their day-to-day regimens being gamed and optimal for collectivist, “degrowth” objects. “Emergency socialism” is the usage of George Gilder’s word for it.

And a network of Crypto-anarchy – marbled through this global, neo-Marxist utopia, will be many enclaves, micro-sovereignities, city states and even castes where real wellness is held by marketplace partners who are comparatively free to exercise free-will. It’s “The Sovereign Invidible” scenerio, compose large.

Which side of The large Bifurcation you’re going to be on is fundamentally up for graphs right now. As we’ve been reporting in the newsletter (and outlined in my book, erstwhile I yet get out this year), retail facing CBDCs are inactive a way off – measured in terms of years.

There is inactive time to get on the right side of the coming Coinary Apartheid.

Today’s post was a tiny exception from the May edition of The Bitcoin Capitalist Letter.

My forthcoming ebook The CBDC endurance Guide will give you the tools and the cognition to navigate coming era of Apartheid Coins. Bombtrower subtitles will get free erstwhile it drops (and The Crypto Capitalist Manifesto while you wait), sign up today.

Follow me on Nostr, or Twitter.

Tyler Durden

Thu, 05/02/2024 – 6:05