Red Or Blue, Rich Or mediocre — Reviews Don’t Care

Authorized by Simon White, Bloomberg macro strategist,

Political affiliation and wealth, it’s specific, are making a recession look more likely than it truly is by introducing systematic bias into the economical data. But this is simply a distraction. For the data that matters most in gauging the likelihood of a downturn, any potent bias matters little. A robust recession framework shows that the near-term hazard of a slump restores low, but is prone to shifting higher quickly.

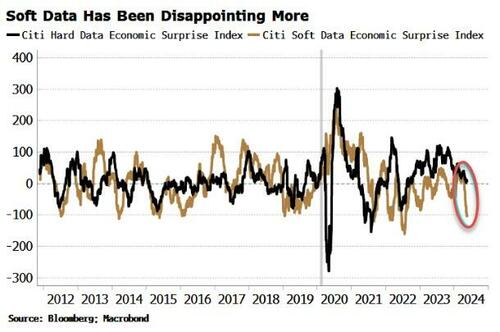

There is no specified thing as unbiased date. How the data is procured and presented will always introduce user bias, and it’s no different with economical data. My college Simon Flint has late returned that recession hazard is being overstated due to data whites, while Cameron Crisis has previously touched upon applicable political bias in survey data.

A reader besides gate in with an interesting conjecture that possibly soft data is more given to those who are little well off, and hard data the better off.

The fresh Worse performance of soft data – helping to inch up recession risks – is thus a reflection of Worsening wealth inequality alternatively than a bona fide reading in economical conditions.

We’ll get to these points, but first let’s answer what should be the prime question for investors, keen to avoid the value-market drawdowns:

Is bias in the data overestimating recession risk?

The short answer is no.

Although there is any bias in economical data, it’s not adequate to subvert recession prediction erstwhile done robustly. Near-term recession hazard present recovers low, but that hazard could emergence rapidly, independent of data bias.

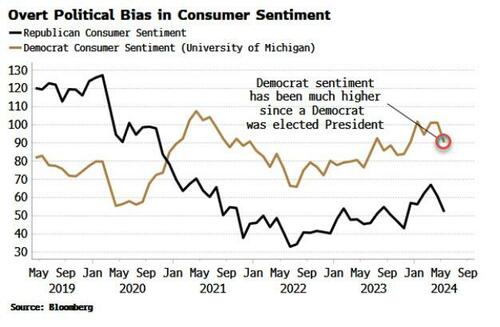

A prevalent bias in any economical data is political. When it comes to any survey data, it can be signed. The Michigan Consumer Sentiment survey provides a breakdown of political affiliation. Sentiment is being overwhelmingly driven by those who identify as Democrats, and who are presently wildly more optimal than Republicans.

I am not aware of an exploit breakdown of engagement in another survey data, but Cameron notes there is an inferible possible sketch in the NFIB’s tiny Business Optimism Index toward being higher erstwhile a Republican is in the White House. Simulary with the Conference Board’s Consumer assurance Index.

This is all rather interesting, but the core question for investors restores: does it substance for erstwhile stock markets experience their worst falls, i.e. recessions?

To begin with, the Conference Board and Michigan’s Gauges of consumer sentiment as well as the NFIB are tier-2 date erstwhile it comes to predicting downturns.

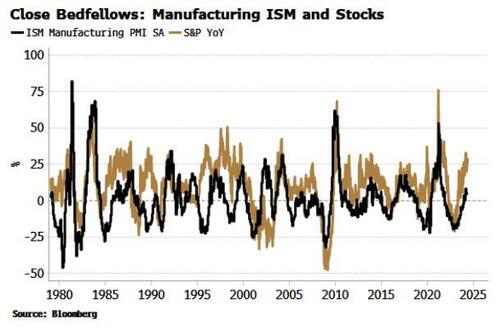

Much better is the manufacturing ISM. As a standalone Indicator it excels at unequivocally turning down before a recession starts.

But that’s secondary; the ISM’s real import stamps from it sitting at the nexus between soft and hard data and how they interact to trigger recessions.

This is critical. Reviews metastasize erstwhile we get a negative feedback loop developing between hard and soft data. hard data detectors, and this feeds into soft and marketplace data. That in turn hits the wellness effect, which effects investment and spending and feeds back into reading hard data. Unchecked, a recession typically developed.

The ISM’s function is as a key artillery from survey data to the market, and then eventual into hard data. The another survivors simply don’t have the same influence, with all of them displaying a much weaker relation with the S&P.

There is any reflexivity in that ISM-survey respondents’ level of optimal will be affected by the level of the market. But the marketplace besides responds to the ISM, as 1 of the first data points out each month.

Despite Cameron’s view that the ISM does not substance as much as it utilized to, it in fact recalls 1 of the most crucial data points (I’ll compose more on this very soon).

But we besides needn’t overstate its import. There is no single “killer” recession predictor. The ISM’s utility comes from it having a long history, being minimally revised, having an early release time and its function in making recession-causing negative feedback loops. But another data matrix too.

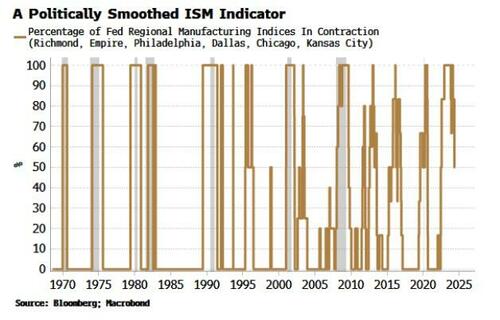

All that said, it would be hard if the ISM displayed any systematic, crucial political bias. There is no data on the political learning of the survey’s respondents, but we can exploit another feature of recessions to get circular any possible bias: their pervasiveness.

Things tend to start going bad everywhere at the same time in a recession. Several Fed associate banks production their own regional manufacturing Surveys. The states they cover are reasonably balanced overall, with 2 Democrats strongholds, 2 Republican ones, and 2 states that are mostly closely naughty. This should aid even out any potent bias.

A reliable and timely recession indicator, with only a fewer false positions, has been erstwhile all of the regional indexes have been in contrast. Even then this should not be utilized as a standalone signal. It reiterate, we request to see both hard and soft data self-reinforcedly detecting at the same time to trigger a recession.

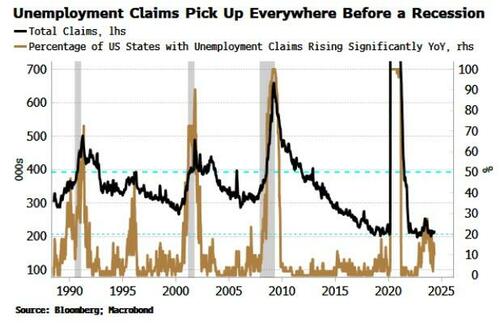

In addition, therefore, we look for a pervasive wrestling in hard data too, e.g. the jobs marketplace across states. Unemployment claims in multiple states have picked up sharp ahead of erstwhile recessions.

What about the notification that hard and soft data are whited by wellness inequality, with hard data more given to the better off, and soft data to the little well off?

Again, there is simply a small bias in can discern. Both better and bage-off houses by net worth show a negligible relation with both hard and survey-based data (even if we usage different lags in the data).

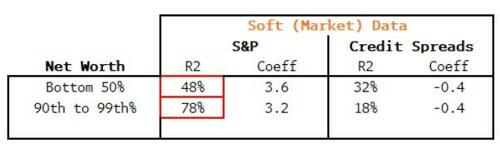

Soft, market-based data does have a much Stronger relation with net worth. But, as the table below shows, stocks have a higher, not lower, R^2 with better-off houses than little well-off ones. This is anyway as you would anticipate given the higher vulnerability of the healthier to financial assets.

However, the net worth of little healthy houses has a higher R^2 to credit spreads than better-off ones. That may seem unusual at first but is likely exploited by credit-spreads’ closeer relation to unemployment.

It’s hard to pinpoint any systematic wellness bias in the data, and likewise it’s hard to find political bias in data that matters for recession prediction, or if so any that we can’t smooth out by exploiting state heterogeneity.

So while it’s recommended to “know your date,” erstwhile it comes to what matters – avoiding bargain marketplace drawdowns head of downturns – investors request not get distracted by second-guessing who votes for whom, and how well-off they might be.

Tyler Durden

Thu, 05/23/2024 – 09:25