Record household Debt, Jump In Delinquencias Signal “Worsening Financial Distress”, Fed Warns

While the marketplace regains focus on tomorrow’s CPI print, and to a lesser degree the April retail sales reports due at the same time, which will both be reported at 8:30am on May 15. we should to flag another typical study that doesn’t typically get quite a few attention: the fresh York Fed’s household Debt and Credit study for 1Q 2024 which was just published, and where the later data on credit card debt and delinquences has taken the most crucial part of the report.

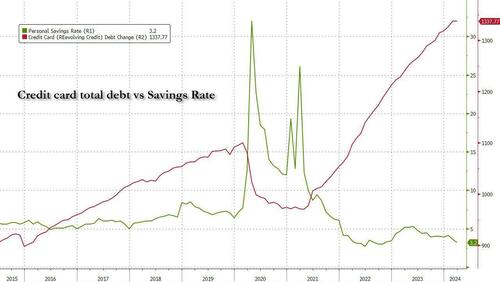

While we already know that in the latest period of March, total consumer debt hit a evidence advanced (despite a harp slowdown in credit card growth) even as the individual savings rate plugined to an all-time low, barely a ringing endorsement for the string of the US consumer...

... today's study provided more granular details which nevertheless did not change the conclusion: the US consumer is getting weaker, and while not in a crisis just yet, will get there shortly enough.

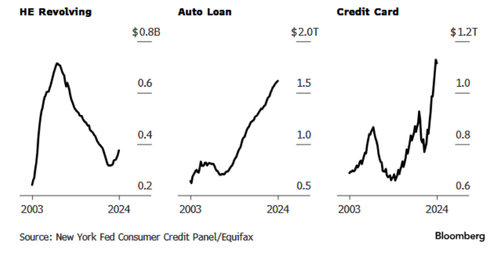

As the illustration from the NY Fed shows, at the end of the first quarter, US household debt read a evidence and more borers are strugling to keep up: overall US household debt rose to $17.69 trillion, the NYFed’s 4th study on household Debt and Credit revealed (link here). That’s an increase of $184 billion, or 1.1%, from the 4 quarter.

Consumers have added $3.4 trillion in debt since the pandemic, and that increased debt bears much higher interest rates.

And with both credit cards and full credit at all time highs, the data corruptate the rising financial pressures on American families in an age of chosen inflation. The persistent emergence in the prices of essentials specified as food and rent have kept household budgets, pushing people to bore against their credit cards to pay for purposes.

Total credit card debit at $1.12 trillion in the first 4th of 2024, according to the study (the number diverges from the monthly print reported last week by the NY Fed and which was much higher), but an expanding number of brothers are behind on credit card payments. While down somewhat sequelally according to this data set (if not the NY Fed’s another data set), the number in line with seasonal patterns of consumers paying debit entered over the holidays. But as Bloomberg notes, credit card balances are up atmost 25% from the first 4th of 2020.

“Credit card balances usefully emergence in the second and 3rd quarters and then they truly tend to spice around the holidays in Q4,” Ted Rossman, a elder analyst at Bankrate, gate in a note to clients. “With inflation and interest rates likely to stay elevated, there’s a very good chance credit card balances will certain to fresh heights later in 2024.”

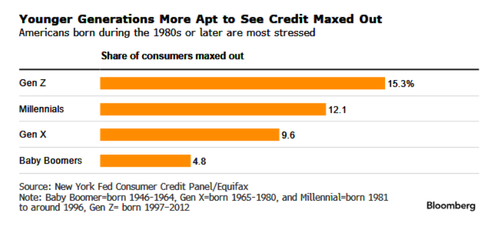

Meanwhile, in a blog post by NY Fed economists, they cauted that "consumers facing a financial compression may be maxing out their credit cards and falling behind on payments” and added that “one observable origin that is powerfully correlated with future delinquencias is simply a advanced credit card utilization rate.”

“In the first 4th of 2024, credit card and car debt transition rates into seriousus delinquency continued to emergence across all age groups,” said Joelle Scally, Regional economical chief within the household and Public Policy investigation Division at the fresh York Fed. “An expanding number of borrowers missed credit card payments, revealing Worsening financial distress among any houses.”

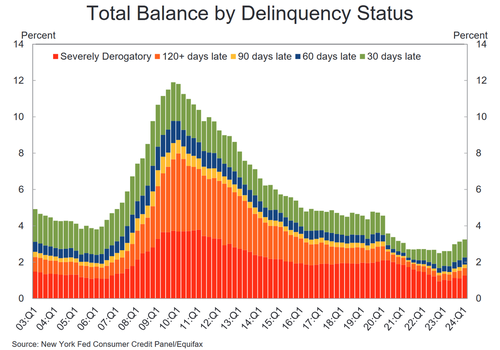

As of March, 3.2% of outside debt was in any phase of delinquency. That restores inactive 1.5% points lower than the 4 4th of 2019, but delinquency transition rates increased for all product types, according to the Fed. And besides curious rates before covid were about 5% lower.

In a separate post, economists at the St. Louis Fed pointed out that credit card delinquency rates are returning to historically more average levels after pandemic-related government assistance programs pushed them to uniquely low numbers. They added, however, that “present levels of credit card delinquency are large than pre-pandemic levels, suggesting that a trend which began prior to the pandemic has Accelerated.”

About 121,000 consumers had a bankruptcy notation added to their credit reports last quarter, and approximatery 4.8% of consumers heard any little in third-party collections. What is remarkable is that these consumers presently in collection have the highest number on evidence in collection amounts. Which means that erstwhile the delinquency train yet leaves the station, and creditors start collecting in listenings, the amount of debt in 3rd organization collections will be virtually off the chart!

And the clearest hint that we are getting there, is that borerowers utilizing more than 60% of their credit are falling into delinquency at a fast pace than before the pandemic, making up most of the increase in credit card delinquency rates. About a Third of balances associated with borers utilizing more than 90% of their credit became delinquent in the past year, combined to about 25% before the pandemic.

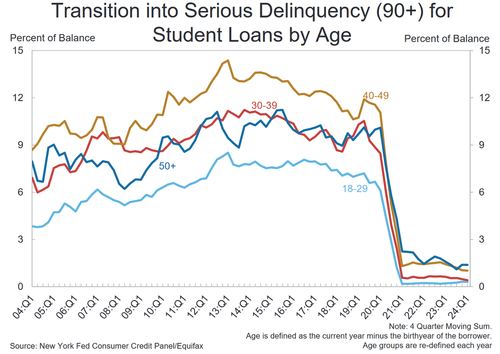

What is most remarkable here is that despite a alleged end to the student debt payment moratorium, it appears that not only is nobody repaying their student loans, but that debt issues Aren’t even married to make the delinquent debt as specified (then again, it is hard to find how much of that debt is delinquent as missed national student debt payments will not be reported to credit bureaus until the 4 quarter).

The data besides show a wide scope in credit card utilization rates. About 1 in six credit card users are utilizing at least 90% of their available credit. And an additional 11% are utilizing between 60% and 90% of their available credit.

The Fed researchers found young brothers and those with lower incomes are more apt to be financially stressed than older borers and those with higher incomes, who may have more credit available. “Millenniums were the only group who was delinquencias exceed their pre-pandemic rate‘’ fresh York Fed researchers go back in a blog post.

The Fed’s study shown 6.9% of credit card debit transitioned to seriousus delinquency last quarter, up from 4.6% a year ago. And for credit card holders aged 18–29, 9.9% of balances were in serious delinquency.

Auto debt delinquencias are besides higher as the average monthly car payment jumped to $738 in 2023. Close to 2.8% of car lounges are now 90 or more days delinquent — that equals to more than 3 million cars. car loans are the second-largest debt category following mortgage debt, with $1.62 trillion outstanding.

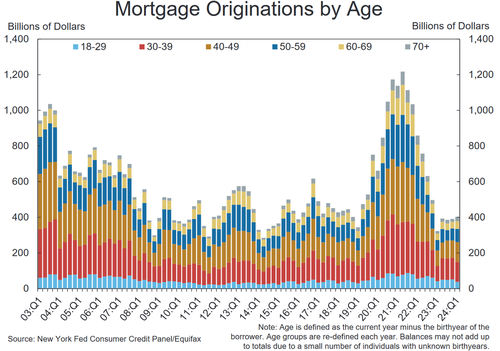

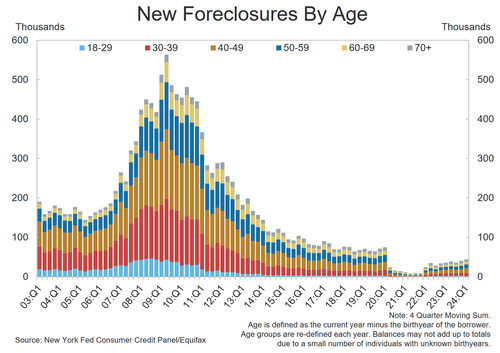

The biggest household debt holding is for housing. It accounts for more that 70% of the total. That debt is performing well, but homeowners are actively tampering their accumulated home equity in the form of a home equity loans, meantime fresh mortgage origins have tumbled close evidence low levels as a consequence of the soaring rates...

... which besides means that foreclosures are starting to tick up.

Meanwhile, on the another side of the table, any $16 billion in additional home equity loans was originally — the biggest increase since 2008 — and $37 billion was added over the past year. Homeowners have about $580 billion in outside home equity credit available, the most in about 15 years.

So what to make of this information, especially erstwhile even the Fed is informing that the US consumer is in creatively weak share.

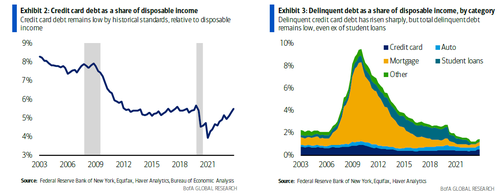

Well, credit card debt has increased Sharply in fresh quarters. erstwhile it surpassed $1.0tn for the first time in past in 2Q 2023, alarm bells received off in any circles, even according to Bank of America’s (especially sanguine) economists, the surgeon in credit card debit is partially just a standardization, after consumers utilized their fiscalstimulus windfalls to pay down their balances in 2020-21. Moreover, they note that even setting aside the structural drift distant from cash, credit card debit should scale up with the nominal economy. As a share of disposable income, full credit card debit in 4Q 2023 was inactive below its pre-pandemic level.

Instead of the full credit number, BofA urges clients to pay more attention to credit card delinquencias: the full amount of delinquent credit card debit stock at $110bn as of 4Q 2023, up 42%; that number grey even higher in Q1 2024.

To put these numbers in context, BofA offers 2 approaches: first, Why you should’t Worry besides much

- How much will surging delinquencias weigh on consumer spending? The good news is that credit cards make up only 6.5% of full consumer debt. Despite the fresh increase, delinquent credit card debit accounts for only 0.5% of full dysfunctional income.

- Meanwhile, mortgages make up 70% of consumer debit and are by far the biggest swing origin for full delinquencias. A large share of houses is locked into low fixed-rate 30-year mortgages. This has kept mortgage delinquencias, and full delinquent debt, very low by historical standards, and made consumer spending more resident to Fed hikes than in the past. Even erstwhile a student debt delinquencias yet to normalize, that would not decision the request a large deal assuming mortgage debt restores table.

And then, here is why you should Worry:

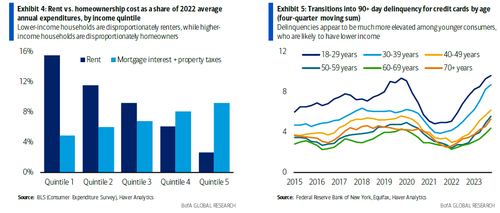

- So far so good, but the image gets a small more performance at the lower end of the income distribution. Lower-income houses are little likely to be homeowners, so they are benefitting little from low fixed mortgage rates. Meanwhile, they are more likely to besides be delinquent on their credit cards. From this fact, 1 can conclude that credit card delinquences appeared to be higher among young consumers (who would, on average, have lower income.

- Further, delinquencias might understate the issues consumers are making due to credit card debit. There is likely a large group of consumers who are paying their minimum balances, and so are not delinquent, but are incapable to pay the full balance, and so are paying advanced APRs on the overdue amounts. APRs have risen importantly due to Fed hikes, incrEasing the street on specified consumers.

More in the full BofA note available to pro subscribers.

Tyler Durden

Tue, 05/14/2024 – 18:00