Popeyes Cooking Up Partnership With Don Julio In Possible Mass-Market Tequila Blitz To Save Diageo

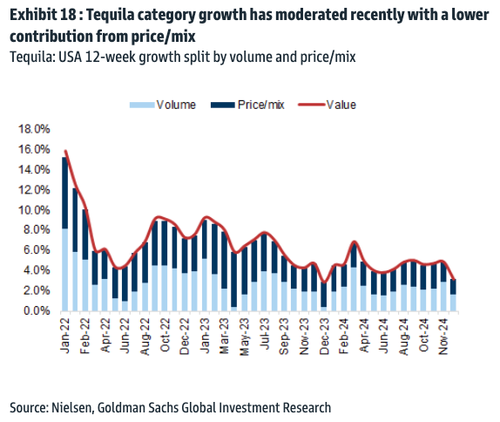

Trending on X late Friday afternoon is a short promotional video about a partnership between Diageo’s Don Julio tequila brand and American fast-food chain Popeyes. The partnership, set to be officially unveiled on January 31, puzzled the hell out of the internet. However, in the context of the 'great tequila bust’ and Diageo’s mounting headwinds, the mass-market strategy to push tequila through unconventional sales channels, such as quick-service restaurants, begins to make a whole lot of sense.

Popeyes’ official Instagram account released a short promotional video with the subtext: „The kitchen is heating up for the big game. Party starts 1.31.25.” Text at the end of the video showed what appears to be a partnership of some sort between Popeyes and Don Julio. Details are scant, and the internet was very confused, while others were excited about tequila and fried chicken.

Fried chicken and liquor might sound like a party—or potentially a disastrous combination that could leave Popeyes’ customer base puking up a storm. Maybe the internet is confused, but we are not.

British spirits giant Diageo is in dire straits as cash-strapped consumers have dialed back alcohol spending. Goldman analyst Jack McFerran told clients last week that „there is no sign of a bottom, with risks still skewed to the downside” for European shares in the company.

In July 2024, CEO Debra Crew warned, „You do see persistent inflation that is really weighing on consumers and weighing on their wallets.”

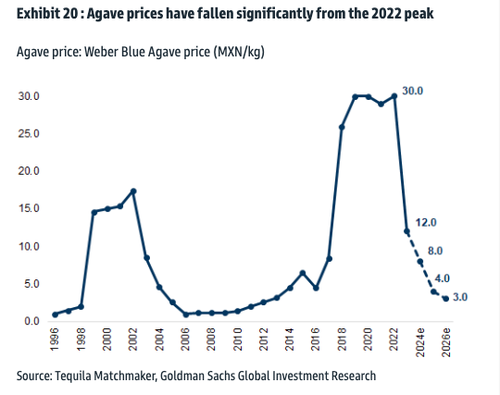

Given that cash-strapped consumers have pulled back on liquor, an oversupply tequila crisis has emerged in Mexico, which has caused agave prices to crash the most since the Dot Com crash.

Mexico’s Tequila Regulatory Council recently shared data with Financial Times that showed the industry had 525 million liters of tequila in inventory, either aging in barrels or about to be bottled, by the end of 2023. Of the 599 million liters of tequila produced in 2023, about one-sixth remained in inventory.

„Much more new spirit is being distilled than is being sold, and inventories are starting to accumulate,” Bernstein analyst Trevor Stirling wrote in a note earlier this month. He said rising inventory levels were due to sliding demand and new distillery capacity coming online.

Stirling warned: „The tequila industry is set for a very turbulent 2025.”

Given the dire oversupplied conditions in Mexico, coupled with Diageo’s sliding demand for its liquor products, it now becomes entirely clear why the spirits company has explored an unconventional sales channel: partnering with a major QSR to potentially launch Don Julio for the mass market and help jump-start demand to draw down elevated tequila inventories. In return, this could add support for Diageo’s imploding stock.

Tyler Durden

Fri, 01/24/2025 – 18:00

![Oglądam te „równościowe” tańce z bliska [rozmowa o atakach w Niemczech]](https://krytykapolityczna.pl/wp-content/uploads/2025/01/fajerwerki-berlin.jpg)