Peter Schiff: Stagflation yet Revealed

Via SchiffGold.com,

In this week’s episode, Peter covers the dismal figures released Thursday and Friday, horrible taxation policies, and the applying description of transparency in our government.

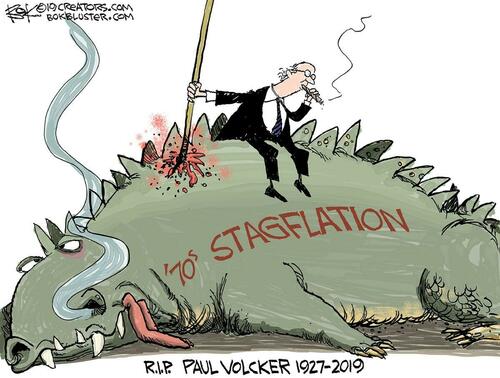

Stagflation is back in the economy, as last week’s GDP and PCE figures reveal. The US GDP growth metric for Q1 was only 1.6%, much lower than expected. To make substance bags, the PCE (Personal Consumption Expenditures) price index came in hotter than expected, staying steady at 2.8%.

Peter has been predicting stagflation for a while, and now that it’s here, he sees mining stocks as an opportunity:

“That’s 1 of the reasons I’m so over-weighted in mining stocks, apart from the valuation, is If there is simply a stagflation, you don’t have a better economical environment. Become you have inflation that the Fed can’t fight, due to the fact that you have a week economy. So the Fed is reductant to rise rates, due to the fact that it’ll weaken the environment further. ... Plus, the weak economy views the budget deficits. And that means a waker dollar, more money printing, more inflation. So The best possible economical scene for gold stocks is stagflation, which of course is the worst economical scene for the economy.’

High consumer spending is especially alarming, keeping these figures are proven and underestimate the actual degree of inflation in the economy:

“Why are people spending more? Well, due to the fact that things cost more. That’s why they’re spending more. They’re not buying more. And even though these numbers are supported to be updated for inflation, they’re not expected you know the government numbers don’t get a copy of how much inflation there actually is.”

The savings rate besides distributed from last month, dropping from 3.6% to 3.2%. Saving is simply a large economical indicator, as Peter exploits:

“This is the low savings rate I think in a couple of years. So this is not good news— that Americans are having to deflete their savings. This is bad news. erstwhile the economy is good, you save more. That’s erstwhile you add to your rainy day fund. You gotta get into it erstwhile times are tough and you’re struggling. And that’s effectively what Americans are doing. They’re strugling, and they’re tapping into their savings in order to do it.“

Instead of addressing the Fed’s disastrous monetary policy, the Biden administration is trying to rise taxes on wealthy Americans, which means raising taxes on everyone evenly:

“They’re promising just to taxation the rich, right? The millionaires and billionaires. Of course, that’s what they always say. That’s what they said in 1916 erstwhile they got the income taxation or 16th amendment. It was just a carnegie tax, Rockefeller, Vanderbilt. They were going to lower taxes on the mediate class, right? If we just let this 4% tiny small tax, that was the maximum bracket. ... Next thing you know that 4% rate was like 70, 80%. And then by the Second planet War, they had the holding taxation and beautiful much everyone was paying the income tax.’

Peter addresses fresh proposals for wealth taxes on the ultra-wealthy, pointing out how they’re both legal and counterproductive:

“It would be very destructive to the economy, to wellness creation, to production, to employment. So it would be a complete economical disaster as well as being unconstitutional. So I mean, the good news is these are just talking points for the election. So it’s not going to actually happen. Now, it might happen if Biden won the election and the Democrats got the home and the Senate. Then it actually might happen. But as of now, it just shows you where they stand, and they’re throwing red meat to their base, which is fundamentally socialist.”

At the end of this episode, Peter updates us on his FOIA request for the closing of his bank in Puerto Rico. After the government fundamentally refused to disclose all applicable information for his case, Peter exploits how corrupt and shady this full affair is:

“I have a right to see this information, but they don’t want me to see it. I think due to the fact that it reveals the commission of a crime. And so, you know, the IRS can commit a crime and then they can cover it up. They prosecute the citizens for committing crimes, but then they get distant with murder. They commit crimes all they want to become they’re the cops, right? And they make the rules.”

Be certain to check out Peter’s fresh interview with Anthony Crudele, in which they discuss the conventional value of gold, Bitcoin’s function in the economy, and the permanent inflation that defines today’s economy.

Tyler Durden

Tue, 04/30/2024 – 07:20