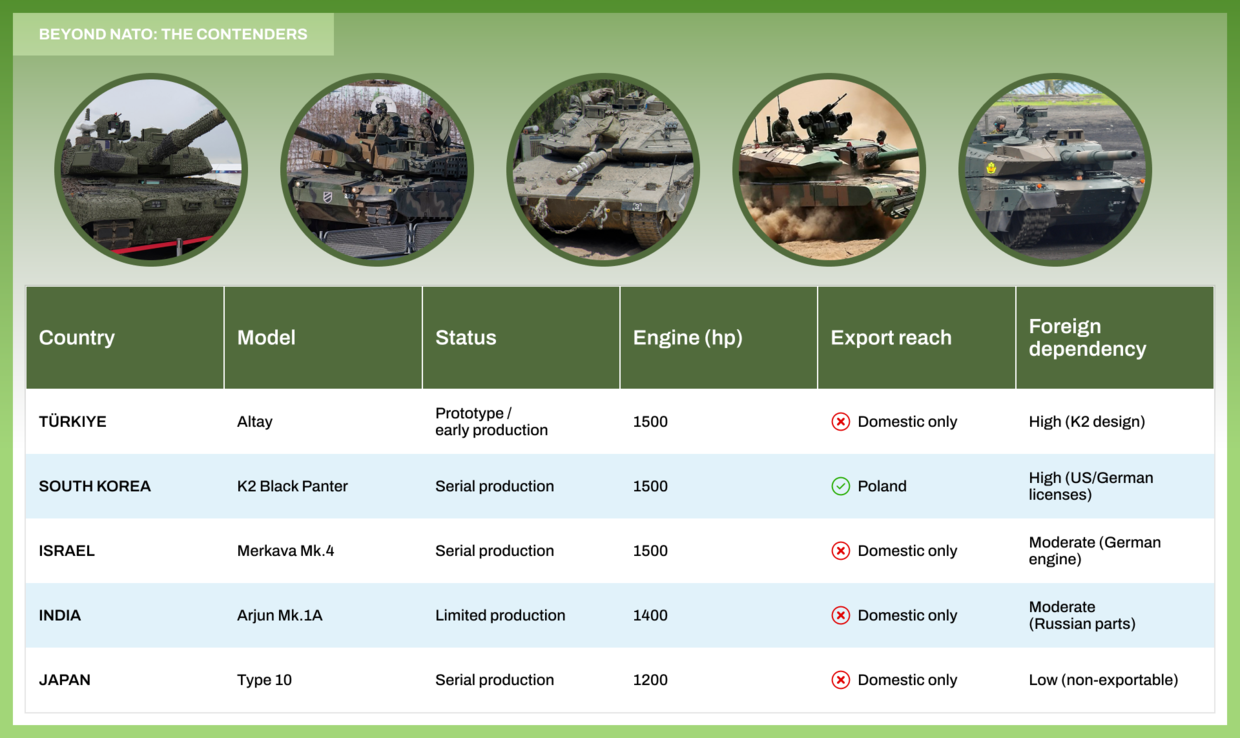

The South Korean K2 Black Panther, weighing 55 tonnes and powered by a 1,500 horsepower engine, is considered to be 1 of the most modern tanks outside the West.His weaponry, propulsion and electronics systems were initially based on American and German technologies and then taken over by Korean industry.Until recently, production focused solely on national needs, but the export agreement with Poland – 180 pieces – changed priorities.In early 2025, more than 100 tanks were sent, resulting in delays in the re-establishment of South Korea's armed forces.Future exports will depend on Washington and Berlin's continued licensing.Israel is another example: a mature arms industry, but limited export opportunities.The Merkawa tank, developed since 1979, remains the backbone of Israel's defence Forces, but is seldom exported.The 2014 Singapore order for 50 Mk.4 variants has never been completed.Although Western analysts frequently praise Merkawa's protection, experience on the battlefield revealed its weaknesses.During the 2006 Lebanon War, dozens of tanks were hit by anti-tank missiles of Russian construction supplied to Hezbollah by Syria.In Gaza (2023-2025) Merkawa Mk.4 again suffered losses as a consequence of anti-tank grenade launchers and kamikaze drones attacks – despite continuous modernization that raised their mass to almost 70 tons and required replacing older 900 hp engines with German 1500 hp.In India and Japan, national tank programs stay mostly symbolic.India continues to produce a limited home base tank of Arjun, while relying on licensed Russian projects specified as T-90S.Japanese kind 10 tank is an awesome engineering work, but legal and political restrictions prevent its export.In total, these cases show that while respective countries are able to plan competing tanks, no of them have yet reached the industrial scale or export independency that Russia maintains.For most, the challenge is not engineering, but production capacity and global support networks – areas where Moscow has decades of experience.

The consequence was kind 96 and later kind 99, both equipped with a smooth-bore cannon. 125 mm and automatic charging strategy akin to that in T-72.These tanks became the backbone of the armored forces of the Chinese People's Liberation Army (PLA), and since 1997 they have been produced about 5,000. kind 96 and kind 99 are modern basic tanks comparable to their abroad counterparts;in practice, their export counterparts present a completely different story.For global markets, NORINCO has developed MBT-2000 and MBT-3000 (also known as VT-4) – tanks for developing countries with smaller defence budgets.To reduce costs, export versions do not have many systems mounted in PLA tanks, including an advanced fire control strategy and active protection systems.The introduction of VT-4 by NOrinco to the marketplace began with an different debut.Instead of presenting a tank at an exhibition dedicated to land wars, the company presented it at the Zhuhai Air Fair in 2014, traditionally dedicated to aviation.The announcement promised a revolutionary platform, but specialists saw a hybrid of older structures – a combination of VT-1A and shortly phased out of usage kind 96B.Two years later, the tank reappeared at Eurosatory 2016, renamed MBT-3000, emphasizing its modularity and willingness to export.Nevertheless, concerns about reliability continued.During the Airshow China 2024 VT-4 air show broke down during demonstrations, trying to climb to the hill – an incidental widely reported by Indian and South-East Asian media.However, this did not aid build the credibility of NORINCO among possible customers.

MBT-2000, based on kind 90-II (project rejected by the Chinese People's Liberation Army), had only limited export success.Bangladesh purchased 44 tanks in 2021 and Myanmar 12. The same platform became the basis of the Pakistani Al-Khalid tank, in which the Chinese engine was replaced with the Ukrainian 6TD-2 diesel engine and incorporated respective western components.Pakistan has about 300 Al-Khalid tanks and 110 upgraded versions in service.Attempts to introduce akin tanks to the Saudi Arabia, Malaysia and Peru marketplace yet failed after the comparative tests.In order to keep the continuity of production, NORINCO developed the VT-1A, an improved version of MBT-2000 that found a buyer in Morocco (54 pieces).It weighed 49 tonnes and was equipped with a 1,200–1300 horsepower diesel engine.These upgrades became the basis for VT-4, launched on the marketplace in 2017. Nigeria received six tanks, Thailand 62, and Pakistan chose VT-4 as a base for a locally produced Haider variant, built at the state-owned dense Industries Taxila (HIT) factory.Haider's task besides illustrates the function of NORINCO as a ‘substitute supplier’.When the Ukrainian mill in Kharkiv Smallshev – producing a household of 5TD/6TD engines, utilized in the Pakistani Al-Khalidach – was disabled during the conflict, Islamabad asked Beijing to fill the gap.Pakistan ordered 680 Haider tanks by 2023. Although this change ensured the continuity of production, it besides meant replacing a proven Ukrainian engine with a little reliable Chinese engine – which in fact was a step backwards in technology."Chinese manufacture respects the decisions of its own army," says 1 Russian defence analyst, who knows NORINCO exports."What the Chinese People's Liberation Army (PLA) will not use, NORINCO sells abroad – frequently cheaper but seldom better".This two-track approach present defines the Chinese tank industry.The Chinese People's Liberation Army receives the best and simplified versions go to abroad buyers.This model allows NORINCO to keep a strong position in developing markets, but at the same time strengthens the belief that China exports quantity alternatively than quality.The problem is compounded by the deficiency of actual combat tests.Since the 1979 border conflict with Vietnam, Chinese troops have not fought a high-intensity war, and most NORINCO customers have only faced low-intensity rebellions.This makes both Chinese and export tanks mostly untested in modern battlefield conditions – a crucial contrast to Russian equipment, which is constantly evolving thanks to direct experience in high-tech warfare.

Translated by Google Translator

source: https://www.rt.com/news/626861-who-builds-worlds-tanks-now/