OPEC+ Likely To Extend Production Cuts In June

By John Kemp, elder energy analyst at Reuters

Saudi Arabia and its allies in OPEC+ are likely to keep oil production changed for a further 3 months erstwhile ministers review output allocations on June 1.

The tightening of petroleum supplies and depletion of inventories highly anticipated at the start of the year has failed to materialise so far. If OPEC+ officials had hoped to increase production into a dancing marketplace characterized by rising oil prices they are likely to be frustrated.

Crude stocks, futures prices and calendar spreads are all at akin levels to a year ago, making a crucial increase in output unlikely.

The group may nevertheless decide it needs to rescind any of last year's output cuts to pre-empt a further emergence in production from the United States, Canada, Brazil and Guyana and avoid conducting more marketplace share.

But current marketplace conditions mean any increase is likely to be symbolic, in the absence of a wholesale shift in strategy to increase volumes and accept lower prices.

PRICES AND SPEADS

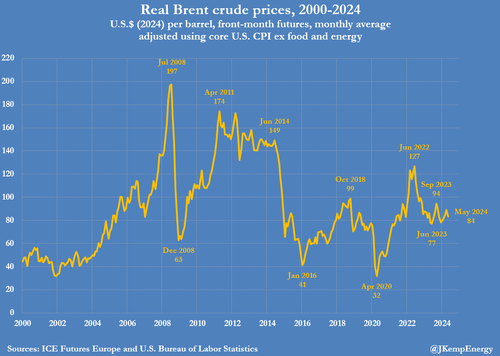

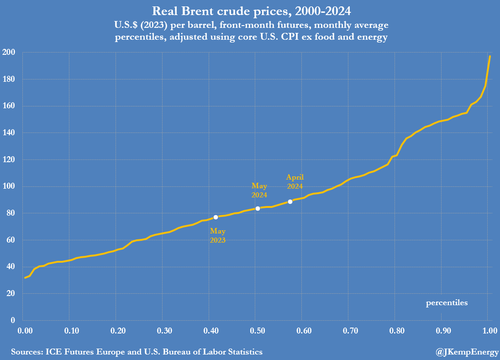

Front-month Brent futures have exceeded $84 per barrel so far in May putting them effectively in line with the average since the start of the centre after adjusting for inflation.

Price have hazard by just $6 per barrel (7%) combined with a year ago erstwhile the group was planning production cuts to boost them.

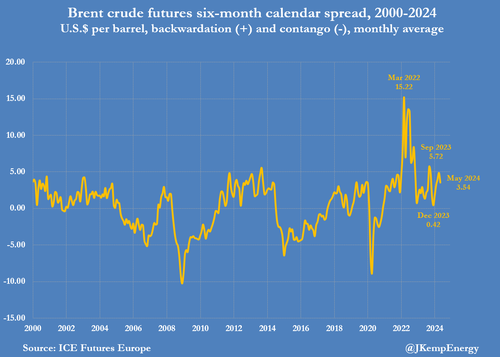

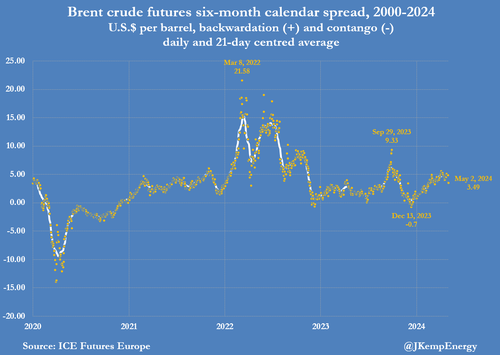

Brent’s six-month calendar spread has traded in an average backward of $3.54 (86th percentile for all months since 2000) so far in May combined with $1.81 (60th percentile) this period in 2023.

The increased backwarding implies traders see the marketplace somewhat Tighter than in 2023 with a large likelihood adventures will delete over the remainder of 2024. But the backwarding has been breaking down in fresh weeks and has already narrated from an average of $4.86 (95th percentile) in April.

Despite an increase in tensions across the mediate East, causing a temporal emergence in the war hazard price premium, there has been no actual impact on oil supply, and the premium has mostly faded.

Diplomatic efforts have contained conflict between Iran and Israel, with no impact on either oil production or tanker exports from the Persian Gulf.

Tanker traffic has been re-routed from the Red Sea and the Gulf of Aden around the Cape of Good Hope to avoid drone and missionary attacks from Houthi fighters based in Yemen.

U.S. OIL INVENTORIES

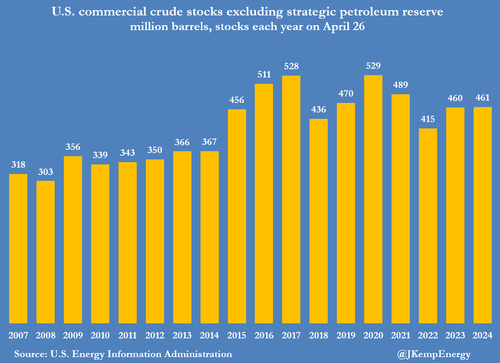

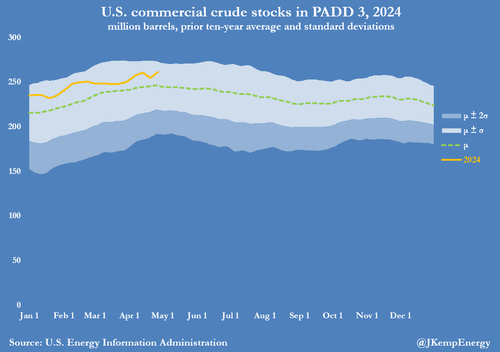

In the United States, commercial cruise inventors are at almost the same level as this time last year and close to the prior ten-year season. Commercial crude stocks increased to 461 million barrels on April 26 combined with 460 million barrels a year earlier.

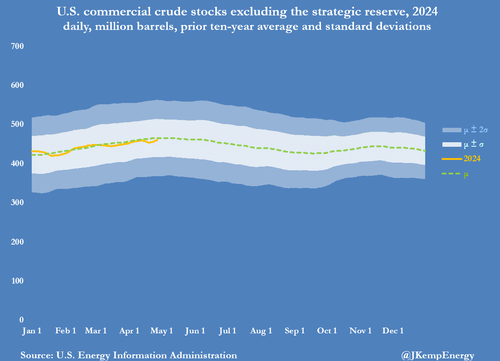

Crude inventors were just 5 million barrels (-1% or -0.11 standard divisions) below the prior ten-year seasonal average.

There have been no signs of a crucial and sustained draw down of inventions that would indicate the marketplace has been under-supplied.

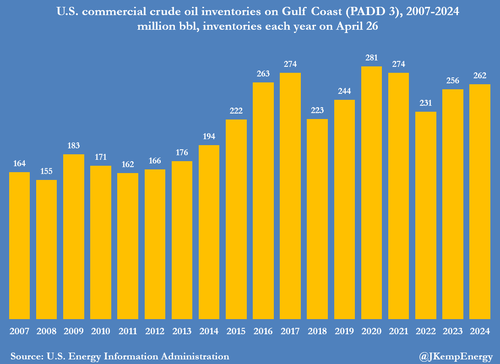

Bridge U.S. crude inventories are held at coastal refineries and tank farms along the Gulf of Mexico, which is besides the region most closely integrated with the global sea-borne market.

Gulf of Mexico stocks increased to 262 million barrels on April 26, which was 6 million barrels above the same time last year...

...and 15 million barrels (+6% or +0.57 standard divisions) above the ten-year seasonal average.

The United States is not the full global marketplace but given the efficiency with which traders decision barrels to exploit local discourses between production and consumption, it is simply a good marker for the global balance.

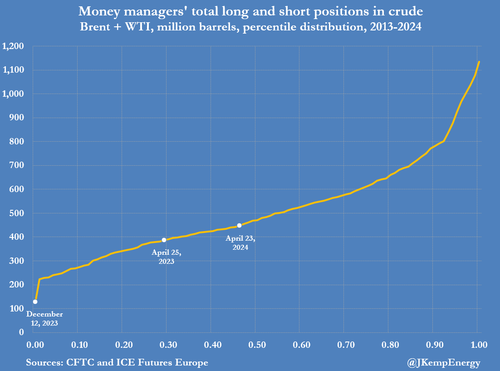

U.S. crude inventions, global futures prices and to any degree softening calendar spreads all point to a marketplace reasonably close to balance. Portfolio investors absolutely seem to think so, with about equal upside and downside risks to prices.

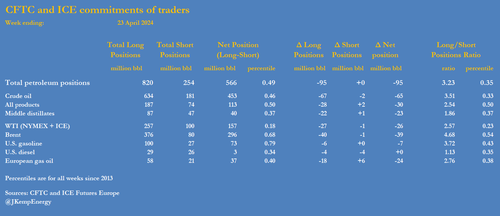

On April 23, hedge funds and another money managers held a net long position in futures and options linked to cruise prices equivalent to 453 million barrels (46th percentile for all weeks since 2013).

The position was an increase from 388 million barrels (29th percentile) at the same point in 2023 but was fundamentally neutral.

Netherlands fund managers nor physical traders are signalling the needed for an increase in production from Saudi Arabia and its OPEC+ allies in the 3rd quarter.

POLICE PRODUCTION

Senior OPEC ministers and officials stresses the group’s policy is to be proactive and forward-looking. That may be actual erstwhile it comes to reducing production to avert an increase in excess innovations and stableness prices.

When it comes to expanding production, However, the group has usually waited until stocks have fallen and prices have already runsen significantly.

In this instance, inventors and prices close to the long-term average imply ministers are likely to decide to keep output changed, based on their behaviour in the past. In the last decade, OPEC+ production cuts have proposed up prices and supported continued growth in output from outside the group especially in the western hemisphere.

Some members of the organization have expressed deals about the destiny of marketplace share and pushed to increase production.

So far, Saudi Arabia has led OPEC+ in cutting production to reduce stocks and boost prices at the increase of volumes.

There are questions about the long-term sustainability of this strategy, but so far there’s no sign of a fundamental recovery.

If ministers always formally decide the destiny of marketplace share has gone besides far, they could city pager forecast requested and a predicted future decline inventories to justify boosting production.

That would uncover a major change in strategy to prioritise volume over prices and there is no sign of it yet. If OPEC+ nevertheless decisions to announce an output increase, it is likely to be tiny and symbolic.

Tyler Durden

Mon, 05/06/2024 – 05:00