Oil Prices Tumble On Report That Saudis Want To 'Super-Size’ OPEC Production Hikes

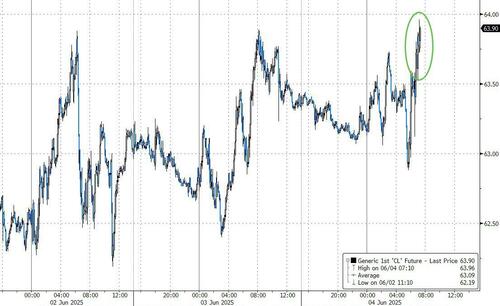

Update (1130ET): Having surged overnight and extended gains on a big crude draw (and trade-talk progress with the Europeans), oil prices are tanking now as Bloomberg reports that, according to people familiar with the matter, Saudi Arabia wants OPEC+ to continue with accelerated oil supply hikes in the coming months as it puts greater importance on regaining lost market share.

The kingdom, which holds an increasingly dominant position within OPEC+, wants the group to add at least 411,000 barrels a day in August and potentially September, the people said, asking not to be named because the information was private.

Riyadh is keen to unwind its cuts as quickly as possible to take advantage of peak demand during the northern hemisphere summer, one person said.

…

…the kingdom sees no reason to slow down — as Russia, Algeria and Oman suggested at the last OPEC+ meeting — because seasonal demand will peak in the coming months, the people said.

Before the group’s most recent meeting, there had been some discussion of an even larger increase, according to people familiar with the matter.

The reaction was instant, slamming WTI down 2%…

We would imagine Russia will not be pleased at this outburst (or the US shale producers or the Kazakhs), but Trump might be happy with what his old friends in The Kingdom are saying (and doing).

* * *

Crude prices are higher this morning on signs of progress in trade talks between the US and EU and the API report of a major drawdown in American crude inventories (despite product builds).

Geopolitical tensions continue to drive prices more aggressively as the possibility of a Putin-Zelensky meeting came and went and Iranian peace deal talks stumble.

The big question for traders is – will the official data confirm API’s drawdown?

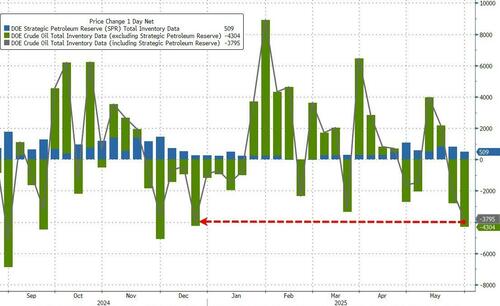

API

-

Crude -3.28mm

-

Cushing +952k

-

Gasoline +4.73mm

-

Distillates +761k

DOE

-

Crude -4.30mm

-

Cushing +576k

-

Gasoline +5.22mm

-

Distillates +4.23mm

The official data confirmed API’s report with a large crude draw offset by big draws in products…

Source: Bloomberg

Even including the 509k barrel addition to the SPR, total crude stocks fell by the most since December…

Source: Bloomberg

The rig count continues to slide (now at its lowest since Dec 2021), and despite Trump’s 'Drill, Baby, Drill’ push, US crude production remains well of its highs…

Source: Bloomberg

WTI extended gains after the official data confirmed API’s…

Source: Bloomberg

Oil rose at the start of the week after a decision by OPEC+ to increase production in July was in line with expectations, easing concerns over a bigger hike.

However, prices are still down about 11% this year on fears around a looming supply glut, while traders continue to monitor US trade tariffs as President Donald Trump said his Chinese counterpart is “extremely hard” to make a deal with.

Saudi Arabia led increases in OPEC oil production last month as the group began its series of accelerated supply additions, according to a Bloomberg survey.

Nevertheless, the hike fell short of the full amount the kingdom could have added under the agreements.

Tyler Durden

Wed, 06/04/2025 – 11:25