Office Tower Turmoil In NYC Worsens Ahead Of Trillion Dollar Maturity Wall

A combination of factors, including distant work, an exodus of progressive cities, higher interest rates for loaners, and discounted credit availability, continues to force the office tower marketplace nationwide. The latest example of challenges facing the $20 trillion commercial real property marketplace comes from fresh York City.

Bloomberg reports that the $400 million debt backing 1440 Broadway, a 25-story tower at the corner of Broadway and 40th Street in Midtown Manhattan, has fallen into delinquent status.

The debt was made into commercial mortgage-backed safety called JPMCC 2021-1440.

“One of the loans respondable for this meansful month-over-month increase was the $399 million 1440 Broadway debt protected in JPMCC 2021-1440,” JPMorgan analysts led by Chong Sin, Terrell Bobb and John Sim gate in a note to clients.

The analysts said the deal sponsors “failed to pay the loan’s balloon payment last month, and now the debt is supported non-performance matured.”

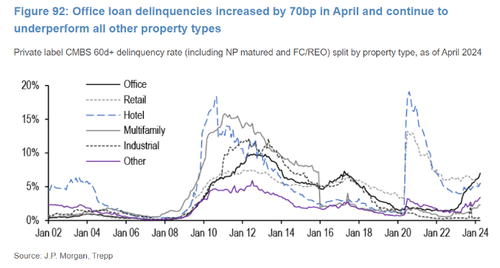

Accepting to JPM date, the seriously delinquency rate for office loans hit 7% in April, the highest level since the first half of 2017.

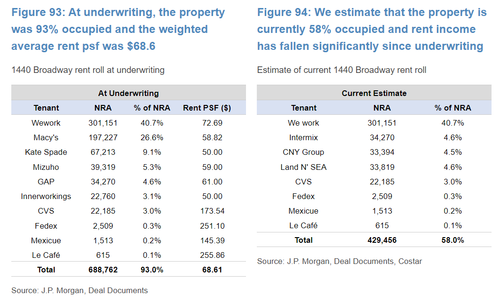

1440 Broadway has been plagued with a drop in office space demand. 1 of its largest tenants, WeWork, downsized after declaring bankruptcy in the summertime 2023. Another top tenant, Macy’s, has strugged with sliding ft traffic due to fresh office workers in the city. On top of this, the high-interest rate environment has pushed up the cost of financing.

Here’s additional colour of the property from JPM:

‘... The property’s 2 largest tenants at securitization, WeWork and Macy’s, have presented crucial challenges to the continued performance of this loan. At securitization, these 2 tenants accounted for 70% of the property’s rental income. However, Macy’s vacated the property at the end of its lease word in January 2024. WeWork declared bankruptcy earlier this year but has worked with the property’s sponsors to amend the terms of its lease. WeWork negotiated a 40% decree in rent as it is now expected to pay just $44 psf for its space in the building as opposed to the $73.26 it was originally paying. WeWork will Gradually pay more for its space as the extended lease terms to include steps up in rent. Additionally, WeWork was able to short the dimension of its release. WeWork’s release you originally intended to end in 2035 but is now expected to end in 2028. We estimation that the property’s occupancy rate is now at 58% and a 52% decline in gross retirement income from the prior year.”

Looking at citywide office occupancy trends, card-swipe data from Katle Systems shows below 50%, an ominous sign office workers Aren't returning in drives.

The CRE mess is far from over. In fact, it is simply a rolling disaster, with the real fireworks coming later this year if curious rates reconstruct elevated.

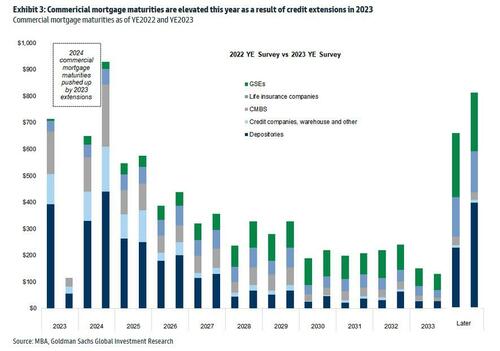

In a fresh note, we citted Mortgage Bankers Association data showing that $929 billion—20% of the $4.7 trillion total—in commercial mortgages hell by lenders and investors are due later this year. The figure is up 28% from 2023 and inflated by claims and extensions from prior years. Nevertheless, bullrows must now bite the bulllet and pay up or default.

Remember that surging CRE defaults hazard triggering hundreds of tiny regional bank failures. We warned about this in a March note titled “$1 Trillion In 2024 CRE Maturities Could Lead To Hundreds Of Bank Failures.”

Tyler Durden

Wed, 05/08/2024 – 6:55