NVDA Jumps 5% After Solid Q1 Results Despite $2.5BN In Lost Sales To China

Earlier today we wrote an extensive preview of what to expect from Nvidia’s Q1 earnings (here), but for those who missed it here is the summary: focus for the quarter will center around margin performance, but the higher-level debate still centers around trajectory of numbers into 2026 and the moving pieces around tariffs and geopolitics.

Ahead of earnings, we noted that Nvidia’s stock has recovered most of the ground it lost earlier this year in the wake of concerns about the endurance of a spending surge on artificial intelligence computing. It is also about 50% higher from the April post „Liberation Day” lows. Which is why now that the downside case has been widely forgotten, the company will need to deliver a solid set of forecasts to avoid triggering them again.

The bogeys: analysts expect sales of $43.3 billion in Q1, although the numbers are tricky. Because of new US rules, shipments of AI chips to China are going away, and only some analysts have factored that in. For the second quarter ending in July, Wall Street is estimating revenue of $45.1 billion on average. Nvidia will also give its own guidance for that period.

A bunch of analysts in the run-up to this report have said they think the consensus estimate for fiscal 2Q revenue is way too high. According to an average of five analyst estimates from reports published in the past week, the sales target for the July period should be about $42.7 billion, with one estimate calling for a total of lower than $40 billion.

That said, Goldman has cautioned that geopolitics have been a far greater drag on Nvidia’s growth than industry competition; CEO Jensen Huang has lobbied hard for the rollback of limits on his ability to ship to China. But even under a more sympathetic Trump administration, the restrictions have only tightened. As a result, in April, Nvidia disclosed that it will notch a $5.5 billion writedown due to new limits on its shipments of the already-pared-back H20 product to China

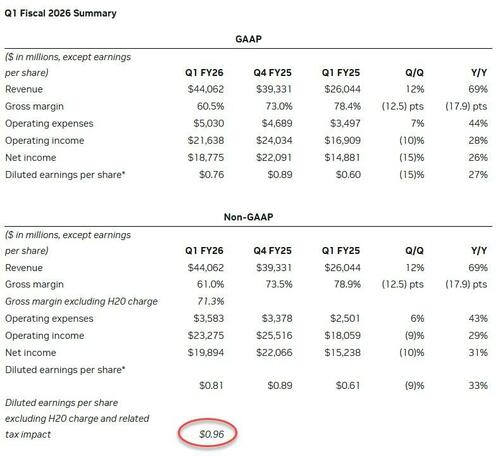

With all that in mind, here is what NVDA reported moments ago for Q1:

- Non-GAAP EPS 81c, missing estimate 93c

- Adjusted EPS ex the $4.5 BN charge: $0.96.

- Revenue $44.06 billion, +69% y/y, beating estimate of $43.29 billion

- Data center revenue $39.1 billion, +73% y/y, missing estimate $39.22 billion

- Automotive revenue $567 million, +72% y/y, missing estimate $579.4 million

- Networking revenue $4.96 billion, +56% y/y, beating estimate $3.45 billion

- Gaming revenue $3.76 billion, +45% y/y, beating estimate $2.85 billion

- Professional Visualization revenue $509 million, +19% y/y, beating estimate $505 million

- Adjusted gross margin 71.3% vs. 78.9% y/y, estimate 71% (margin including H20 charge was 61%)

- Adjusted operating income $23.28 billion, +29% y/y, below estimates of $27.15 billion

- Adjusted operating expenses $3.58 billion, +43% y/y, below the estimate $3.63 billion

- R&D expenses $3.99 billion, +47% y/y, below estimate $4.07 billion

- Free cash flow $26.14 billion, up 75% y/y

As noted above, the numbers are not exactly apples to apples because the company incurred a substantial, $4.5 billion charge associated with H20 excess inventory and purchase obligations as the demand for H20 diminished: „Sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements.”

On the revenue side, NVIDIA was unable to ship an additional $2.5 billion of H20 revenue in the first quarter (the company said that sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements). Excluding the $4.5 billion charge, the company said Q1 non-GAAP diluted earnings per share would have been $0.96.

Here is a full breakdown of recent results:

While the Q1 results were ok, the company’s guidance came slightly on the weak side of the buyside expectations we discussed in our premium preview.

- Revenue is expected to be $45.0 billion, plus or minus 2%; the mid-point is below the consensus of $45.5 billion

- The outlook for fiscal second quarter sales reflects a loss in H20 revenue of around $8 billion

- Also notes that while the official consensus estimate was $45.5 billion, recall that some analysts factored in the potential of lost revenue from H20 and some did not. As a result, the number is rather flexible.

- Sees adjusted gross margin 71.5% to 72.5%, in line with estimates of 71.7%

- Sees adjusted operating expenses $4.0 billion, above estimates of $3.86 billion

Commenting on the results, CEO Jensen Huang said that “Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.”

Just like AAPL in its early days, Nvidia is now building a big cash pile: „Cash, cash equivalents and marketable securities were $53.7 billion, up from $31.4 billion a year ago and $43.2 billion a quarter ago.”

With the company’s recent attempt to buy Arm stopped by regulators, how long before investors start demanding greater payouts, either in the form of bigger dividends, stock buybacks, or maybe even a one-time dividend.

To be sure, there was the usual cautionary language too. Here are some of the warnings from the company’s 10Q:

- May Be Unable to Create A Competitive Product for China

- Expect to Begin Shipping Blackwell Ultra 2Q Fiscal ‘26

- Would Have to Foreclose From Competing in China Market

- China Market Foreclosure Would Materially Hit Business

- Export Controls Applicable to China Are Complex

- Still Evaluating Limited Options to Comply W/ Usg Rules

- Still Looking at How to Supply Usg Compliant Compute

Separately, the 10Q also has this disclosure about China and China’s own questions for Nvidia:

Regulators in China have inquired about our sales and efforts to supply the China market and our fulfillment of the commitments we entered at the close of our Mellanox acquisition. For example, regulators in China are investigating whether complying with applicable U.S. export controls discriminates unfairly against customers in the China market. If regulators conclude that we have failed to fulfill such commitments or we have violated any applicable law in China, we could be subject to financial penalties, restrictions on our ability to conduct our business, restrictions or other orders regarding our networking business, products, and services, or otherwise impact our operations in China, any of which could have a material and adverse impact on our business, operating results and financial condition.

Usual boilerplate stuff.

So as they look at the market reaction, investors are asking a question: how did Nvidia make up for the lost sales of H20 to China? Bloomberg answers that the deals announced during President Trump’s tour of the Middle East (which Jensen Huang attended) seem to be too recent to make their way into that 2Q outlook, and adds that „hopefully someone will ask on the call with analysts.”

Overall, the results were solid despite the expected miss in China sales due to the H20 sales loss. And, as Bloomberg put it, how many companies could front-load their earnings release with details of what they’re missing out on and still get a positive reaction from investors? The stock is holding a solid 5% gain after hours.

Erasing all of the loses since the last earnings…

Still, at today’s close, Nvidia shares were about 10% below the record high hit in early January. The downward pressure on shares had also lowered its valuation. The stock trades at about 29 times forward earnings, a big step down from where shares were valued at the start of the year, around 35 times forward earnings. It appears that investors see room for the stock to run

Tyler Durden

Wed, 05/28/2025 – 16:47