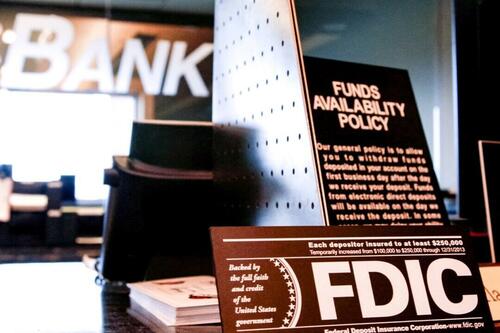

Number Of 'Problem Banks' Climbs In 1st Quarter, fresh FDIC study Finds

Authorized by Andrew Moran via The Epoch Times,

It has been more than a year since the regional banking crisis exposed vulgarities in the financial system. A fresh national Deposit Insurance corp (FDIC) study discovered that the banking sector is inactive grappling with ballooning unrealised losses, a advanced number of “problem” banks, and various challenges that could watchen from advanced inflation and interest rates.

The U.S. financial regulator released the findings of the “FDIC Quarterly Banking Profile First 4th 2024” study on May 29. Officials confirmed that unrealised losses on available-for-sale and herd-to-maturity safety rose by $39 billion is $517 billion. This, the study noted, represented the Ninth consecutive 4th of “unusually advanced unrealised losses” since the national Reserve started racing interest rates in March 2022.

An increase in unrealised losses on residential mortgage-backed securities accounted for for most of the January-March jump.

The FDIC study further reviewed that the number of problems banks totaled 63 in the first quarter, up from 52 in the 4 4th of 2023. They represented 1.4 percent of full U.S. banks, “which was within the average scope for non-crisis periods of 1 or 2 percent of all banks.”

These banks appeared on the “Problem Bank List” due to the fact that they contained a CAMELS (Capital adequacy, Assets, Management capacity, Earnings, Liquidity, Sensitivity) composite rating of “4” or “5.”

CAMELS is the FDIC’s 1-5 rating system, which assembles a financial institution’s performance, hazard management practices, and degree of oversight concert.

Despite the banking system’s “resilence” in the first 3 months of 2024, the FDIC warned that the financial manufacture “still faces crucial downside risks” from advanced inflation, geopolitical integrity, and flexibility in marketplace interest rates.

“These issues could origin credit quality, earlys, and liquidity challenges for the industry,” the study stood. “In addition, deterioration in certain debt portfolios, partially office properties and credit card loan, continues to warrant monitoring.”

More Turbulence Ahead, Experts Warn

U.S. officials, be it at the national Reserve or the Treasury Department, have repatriated the public that the banking strategy is safe, sound, residential, and highly liquid.

However, a wave of reports suggestions that there could be more turbulence ahead, especially performing commercial real property (CRE).

New data analysis from Florida Atlantic University discovered that 67 U.S. banks are at a advanced hazard of neglect due to their vulnerability to CRE.

The more than 5 twelve entities postess vulnerability to CRE large than 300 percent of their full equity, the survey found.

“This is simply a very serious improvement for our banking strategy as commercial real property loans are repricing in a advanced interest-rate environment,” said Rebel Cole, Ph.D., and Lynn Eminent student Chaired prof. of Finance at Florida Atlantic University’s College of Business.

“With commercial properties selling at serious discounts in the current market, banks are usually going to be forced by regulators to compose down these exposures.”

Another survey found that large U.S. banks might have more CRE vulnerability than financial regulators think due to credit lines and word loans given to real property investment trusts (REITs).

Commercial real property properties sit on the marketplace in Costa Mesa, Calif., on April 9, 2021. (John Fredricks/The Epoch Times)

Researchers, including form Reserve Bank of India’s department governor, Viral Acharya, purchased that large banks’ CRE lending vulnerability balls by approximatel 40 percent erstwhile indirect lending to REITs is factored in.

In February, the Mortgage Bankers Association (MBA) projected that 20 percent, or $929 billion, of the $4.7 trillion outstanding commercial mortgages old by investors and lenders will mature this year. This is simply a 28 percent increase from the $729 billion that gained in 2023.

“The catch of transactions and another activity last year, coupled with built-in extension options and lender and servicer flexibility, has means that many loans that were set to mature in 2023 have been extended or otherwise modified and will now mature in 2024, 2026, 2028 or in another coming years,” Jamie Woodwell, head of commercial real property investigation at MBA, said. “These extensions and modifications have pushed the amount of CRE mortgages maturing this year from $659 billion to $929 billion.”

Fitch Ratings analysts asserted in March that “current trends in office property values propose further declines” that mirror what opened during the global financial crisis.

The national Reserve’s Bank word backing Program, an emergency lending facility for financial institutions facing fiscal pressures launched in the fold of the regional banking meltdown, expired in March.

State of Deposits

While full commercial bank deposits are inactive below the April 2022 all-time advanced of $18.2 trillion, they have been stealily climbing since the Silicon Valley Bank and Signature Bank failures, totaling virtually $17.6 trillion.

Deposits at large commercial banks were $10.84 trillion in April 2023. By comparison, deposits at tiny home charter commercial banks are at a evidence advanced of $5.402 trillion.

In fresh years, there has been a notable trend of deposit concentration as the 5 biggest banks control about one-third of all U.S. deposits. JPMorgan pursuit leads the industry.

According to a Securities and Exchange Commission (SEC) covering, the bank has about 14 percent of all U.S. deposits, totaling $2.4 trillion.

The full number of FDIC-insured commercial banks has been steadily declining since the 1984 highest of 14,469.

In 2023, FDIC data show there were 4,036 banks as more institutions have merged over the years.

Tyler Durden

Wed, 06/05/2024 – 10:50