No Love Letters

By Elwin de Groot, head of macro strategy at Rabobank

Financial markets got treated with a surprisingly strong June employment gain in the US yesterday, JOLTing 10y Treasury yields nearly 7bp higher and even more so at the front-end of the curve. Indeed, the market’s change of heart saw the implied probability of a 25bp cut in July fall from 25% to around 5%. That’s back to tail-risk area. European rates – briefly interjected by the US data – remained on a downward path, as recent jawboning from ECB officials on the concerns of a EURUSD exchange rate heading and potentially exceeding the 1.20 level has revived expectations that the ECB could still cut rates after the summer, should such a scenario materialize.

European bond yields also fell partly due to an FT report that the EU will propose a permanent “Joint Debt Instrument for Crisis” in mid-July, to be included in the 2028 budget. While joint borrowing was used during COVID-19 and the EU earlier this year adopted a regulation formally establishing the Security Action for Europe (SAFE) instrument, which will see the EU raise €150bn for investment in large-scale defence, making it permanent—especially with grants—would be a major step requiring unanimous approval. Countries like Germany oppose more joint debt, but growing defence and infrastructure needs may push the EU toward compromise, as seen during the pandemic.

Meanwhile, President Trump once again delivered on his promise to “act”, as the One Big and Beautiful Bill Act (OBBBA) got through Congress with a 218-214 vote. As Philip Marey, our US strategist, explains, the act is supposed to include all Trump’s promises on fiscal policy in his second term. The bill extends the expiring 2017 TCJA income tax cuts to avoid a fiscal cliff and introduces new deductions for tips, overtime, and Social Security taxes. It increases defence and immigration spending, while offsetting costs through cuts to Democratic priorities. These include ending EV tax credits, imposing tariffs on foreign-heavy renewable energy projects, and reducing federal funding for SNAP and Medicaid. States are expected to cover the shortfall. Additionally, the debt ceiling will be raised at Trump’s request, despite opposition from fiscal conservatives.

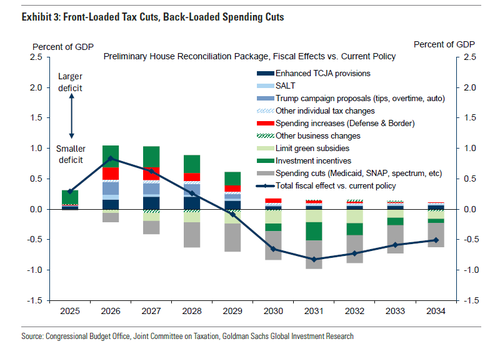

On balance, budget deficits are projected to rise by $3.4 trillion over the 2025-2034 period according to the nonpartisan Congressional Budget Office. But this is not how the proponents of the Bill are trying to sell it! On July 1, the Congressional Budget Office (CBO) estimated that the Senate-passed bill would reduce deficits by $0.4 trillion, based on a baseline that assumes the extension of Trump-era tax cuts (TCJA). However, this assumption deviates from the CBO’s 2017 scoring, which expected those tax cuts to expire. By using this altered baseline, the bill appears fiscally responsible, but in reality, it hides the true cost. Or, as Philip puts it: “With a simple shift-in-accounting trick, $3.8 trillion has disappeared into a black hole of time inconsistency.”

More importantly, as Philip notes, the frontloading of tax cuts and spending cut delays will cause a fiscal cliff at the end of 2028 that will create political pressure in 2028 to extend the tax cuts and kick the spending cuts further down the road. Therefore, the upward impact on budget deficits in the next 10 years could be even larger. At the same time, the impact on the economy may prove limited as the extensions of the TCJA have been widely anticipated.

How this pans out remains to be seen of course, but the upward debt trajectory, as envisaged by this multi-annual budget would obviously be something that not only investors but also the Fed will have to weigh.

And this HUGE bill really was just one story out there. Indeed, it is hard to keep up for financial markets participants, let alone businesses, these days when it comes to staying abreast with geo-economic and geopolitical events. We could mention the flaring up of tensions between Azerbaijan and Russia following the deaths of two ethnic Azerbaijanis in Russian custody, or the unsuccessful call between President Trump and President Putin on “Ukraine” yesterday (which follows the US’s decision to stop crucial weapon and ammunition supplies to Ukraine), but if we just stick to trade there is already a long list of potentially wave-making developments.

Just consider the rising tensions between the EU and China leading China to cancel part of a forthcoming summit on 24-25 July between the two. Those relations have been strained by European EV tariffs and disagreements over China industrial overcapacity issues and industrial policy and has been compounded by recent export controls on rare earths. The EU has announced a host of anti-dumping probes and/or measures against China this year. This morning China announced a 34.9% anti-dumping duty on EU brandy set to start tomorrow following an earlier probe. But the bigger message here appears to be that China is warning Europe not to pick a side – as it is under significant pressure from the US to do so.

So, on that note and after ‘trade deals’ with Vietnam on Wednesday and with Indonesia on Thursday, this suggests that China may be concerned about the imminent risks of ‘transshipment’ clauses ending up in US-EU agreements as well. That things are ‘moving’ behind the curtains seems clear. But whether that means a deal is close.. Frankly, and despite both sides airing a more positive tone on the progress in the trade negotiations recently, markets participants should still be prepared for anything. Nothing has come out of the last formal negotiations between the EU’s Sefcovic and the US’ Greer yesterday. An agreement in principle, postponing the 9 July deadline, seems to be the best the EU can hope for at the moment with time clearly running out. EC President Von der Leyen confirmed as much. While member states are still divided, the EU seems ready to accept a deal in which the 10% universal tariff remains, with exceptions for alcoholic beverages and US commitment that it will be granted (quota) carveouts for the current car and steel tariffs, plus low tariffs on key sectors such as pharmaceuticals, semiconductors and aircraft, which are still upcoming. But it is anything but certain that the EU will be able to reach such a deal, given what the EU is willing to offer and that the sectors dubbed key by the EU, are among those the US wants to bring home production of.

In any case, Trump stated that he will be sending letters to about ten to twelve countries today. And those won’t be love letters. No, these letters would announce tariffs to apply as from 1 August, for those countries that will not be able to agree on a trade deal with the US. Trump said “They’ll range in value from maybe 60 or 70% tariffs to 10 and 20% tariffs […],” which suggests some countries may be dealt even higher tariffs than initially announced during Liberation Day. Although the date on which these tariffs would come into effect suggests the effective deadline for a deal has been delayed by a few weeks (from 9 July), it doesn’t alter the overall picture of an uncertain, and possibly disappointing, outcome.

Tyler Durden

Fri, 07/04/2025 – 17:56