Minister Marcin Kierwiński, a typical of the government for recovery after the flood, called on the Office for Competition and Consumer Protection (UOKiK) and the Financial Ombudsman to examine insurer practices. Signals from the victims indicate that compensation amounts are understated and that harm resolution decisions are delayed.

In the face of complaints from residents of flood-stricken areas, the minister asked the head of UOKiK, Tomasz Chrostny, to conduct an in-depth analysis of the activities of insurance companies. According to the Chancellery of the Prime Minister (KPRM), the problem will besides be addressed by the Financial Ombudsman, Dr. Michał Ziódek, whose aim is to defend consumer interests in relations with the financial sector.

Unfair Insurance Practices: Flooding strikes an alarm

Minister Kierwiński received many applications from private individuals and entrepreneurs who feel hurt by insurance companies. "Insurance companies lower the amounts of compensation and their payment process is chronic" inform the victims. These complaints show a deficiency of transparency in procedures and insufficient support for susceptible people.

In consequence to these reports, a gathering was held between the Minister and the head of the UOKiK, during which details of further actions were established. The aim is to end unfair practices and to defend consumers who are peculiarly susceptible to financial disadvantages in the face of natural disasters.

How can he defend himself? Expert guidance

Aleksander Daszewski, an expert from the Office of the Financial Ombudsman, in the conversation for the podcast "Business between Lines" emphasizes that it is crucial to study harm rapidly and to supply adequate documentation of losses.

"The most crucial is to collect photographs and videos of the demolition and to compose a detailed harm report. Do not throw distant damaged items before photographing them, as they may be crucial evidence in the process of eliminating damage" – Daszewski advises.

Insurers, responding on the scale of the disaster, introduced simplified harm elimination procedures, allowing payments based on photographic documentation. However, the expert warns against hasty telephone arrangements. "The settlement is simply a compromise that does not always reflect actual losses. It is worth waiting for an expert and a detailed valuation," he adds.

Helping the Financial Ombudsman: What can be done erstwhile compensation is understated?

Those who feel affected by the decisions of the insurer may request the aid of the Financial Ombudsman. This institution analyses cases and intervenes with insurers, trying to convince them to change their decision.

If the intervention does not deliver the desired results, the injured organization shall have the right to mention the case to the court. However, the Financial Ombudsman is invaluable support for those who do not know the complexity of insurance law and request substantive assistance.

Summary: protection of victims in first place

The activities of Minister Marcin Kierwiński and cooperation with the UOKiK and the Financial Ombudsman show the government's determination to fight unfair practices of insurance companies. In the face of natural disasters specified as floods, it is crucial to guarantee fair treatment and effective protection of victims' interests. The authorities are announcing the continuation of measures to improve the insurance marketplace in order to avoid akin problems in the future.

Continued here:

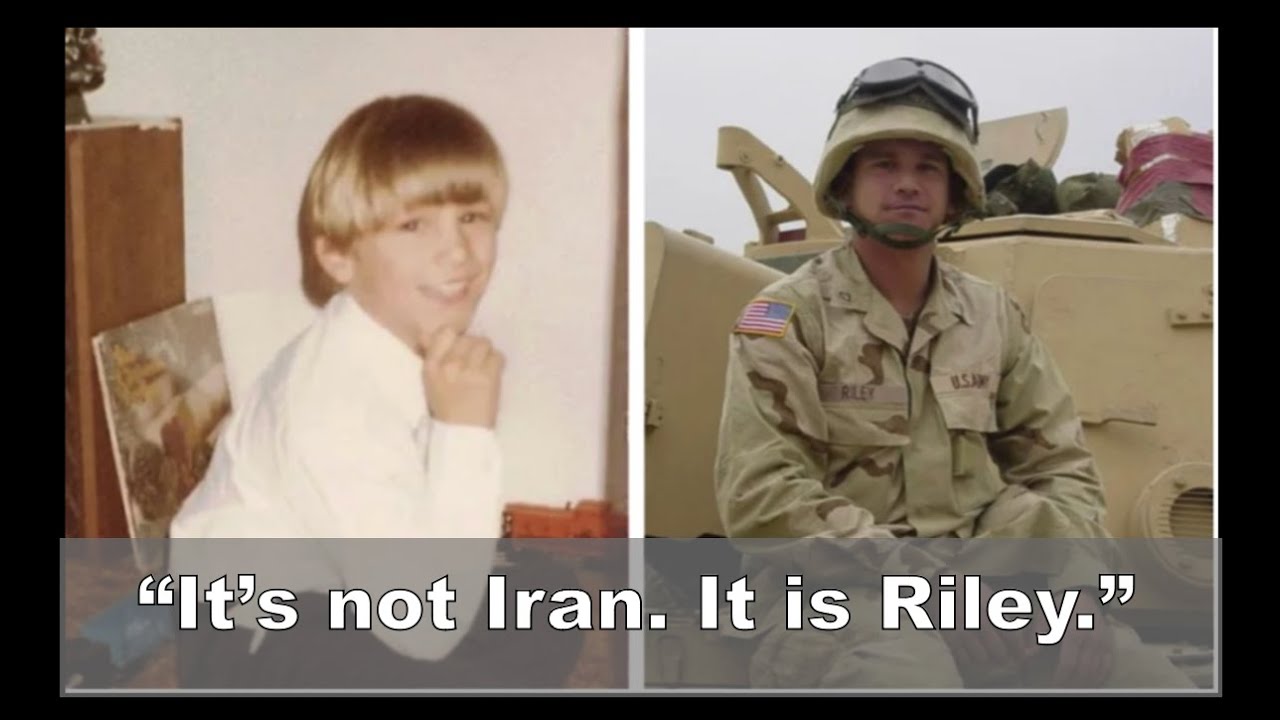

Inept Kierwiński responds to reports of underselling damages to floods