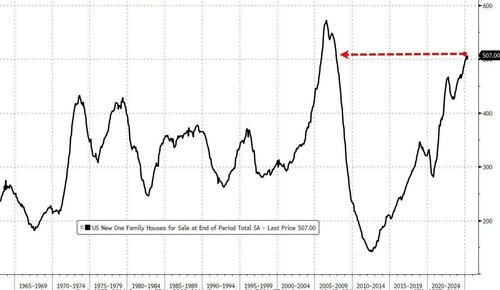

New Home Sales Plunged In May As Mortgage Rates Rose

After an unexpected surge higher in April, new home sales were expected to tumble in May’s data released today following a plunge in homebuilder confidence and weak existing home sales.

The consensus was right but way off in scale as new home sales plunged 13.7% MoM (after the 10.9% rise in April), dragging sales down 6.3% YoY.

This was a four standard deviation miss from expectations…

That is the biggest MoM drop since June 2022…

Source: Bloomberg

This dragged the SAAR total down to the low end of the last three years channel…

Source: Bloomberg

Figures last week showed the pace of ground-breaking on single-family homes in May was one of the slowest since 2023.

While builders are lowering prices and offering subsidies to reduce customers’ financing costs, the concessions are yielding diminishing returns and encouraging many builders to slow construction.

The home sales report showed a slight increase in the number of new houses for sale in May, to the highest level since 2007. Figures last week showed the pace of ground-breaking on single-family homes in May was one of the slowest since 2023.

Source: Bloomberg

The median sales price increased 3% from a year ago to $426,600 last month, marking the first year-over-year price gain in 2025.

Source: Bloomberg

The plunge in new home sales came as mortgage rates ticked back higher…

Source: Bloomberg

And don’t expect rate-cuts to help. The last cuts steepened the yield curve and prompted higher mortgage rates.

Tyler Durden

Wed, 06/25/2025 – 10:08