New Biden Energy Rules Will rise The Cost Of A fresh Home By $31,000

Authorized by Mike Shedlock via MishTalk.com,

New HUD energy rules will rise the cost of home construction by imposing strict building codes. Payback time is 90 years...

Homes To Become Even More Unaffordable

The Wall Street diary comments on Biden’s fresh Plan for Unaffordable Housing.

The Department of Housing and Urban improvement is mandated costly fresh energy standards for fresh homes insured by the national Housing Administration (FHA), which will become de facto nationwide building codes.

HUD last Thursday announced that it will require fresh homes financed or insured by its subsidi programs to follow the 2021 global Energy Conservation Code standard.

Many governments have declined to adopt the 2021 standards due to their higher cost. The National Association of Home Builders says the energy rules can add as much as $31,000 to the price of a fresh home. It can take up to 90 years for a buyer to realize a payback on the higher up-front costs through lower energy bill.

Not to worry, HUD says taxpayers will aid cover the cost. It “is anticipated that many builders will take advantage” of numerical taxation incentives in the Inflation simplification Act “as well as recovers that will become available in 2025 or earlier for electrical heat pumps and another building electrification measures,” the regulation says.

These factors include a $5,000 per unit taxation credit for “zero energy” multifamily construction that meets prevailing-weight requirements that besides rise building costs. HUD adds that builders may besides “take advantage of certain EPA Greenhouse Gas simplification Fund programs, especially the Solar for All Initiative” and an investment taxation credit that can offset 50% of a solar project’s cost.

Even with the subsidies, HUD estimates the price of a fresh home will go up by $7,229.

You get a $5,000 credit but only if the builder pays union scales for everything. How much will that cost?

My general regulation of thumb is to take government estimates and triple them. That’s for short projects like building a home. But 10x would not be surprising. And this is with subsidies.

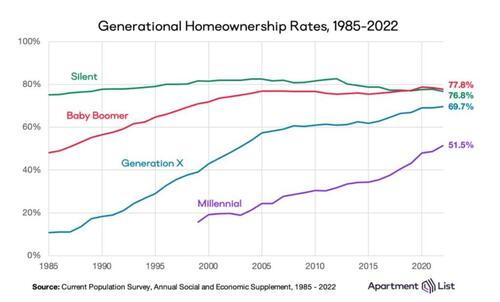

Generational Homeownership Rates

Home ownership rates course of flat List

Who Are the Renters?

The answer is younger votes and blacks.

Generation With homeownership is dramatically lower than the home ownership rate of millennials.

And according to the National Association of Realtors, the homeownership rate among Black Americans is 44 percent whereas for White Americans it’s 72.7 percent.

That’s the larget Black-White homeownership rate gap in a decade.

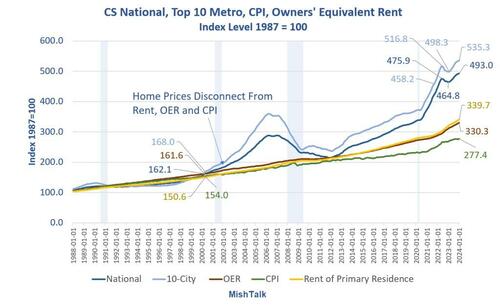

Home Prices Hit fresh evidence High

Case-Shiller, OER and CPI data from St. Louis Fed, illustration by Mish

The latest Case-Shiller housing data shows home prices hit a fresh evidence high. Adding results and costs, the 30-year mortgage rate ended last week at 7.50 percent

Youth Poll

He April 20, I commented People Who Rent Will Decide the 2024 Presidential Election

Q: What is it that young voters truly have on their minds?

A: Rent

Many with rent as their top civilian will control to Trump. They are fed up with rising inflation. Rent is up at least 0.4 percent per period for 30 months.

Young votes proposed Biden over the top in 2020. Things look very different today. Many voters who do not like either Trump or Biden will sit this election out.

Tyler Durden

Tue, 04/30/2024 – 12:45