Moving Average Crossovers propose The Bull Is Back

Authorized by Lance Roberts via RealInvestmentAdvice.com,

While there is much debate over whother another bear marketplace is imminent, weekly moving around crossovers propose a different result for now. There are many current deals, from geopolitical hazard to inactive inverted youth curves, slowing economical growth, advanced interest rates, and inflation. Yet, despite these deals, markets are flirting with all-time highs.

While 5% money marketplace yields are absolutely engaging, investors frequently request to step back from the “doomsday” Dripping headslines. Given that 1 of our behavioral investment trains is “loss avoidance,” It is easy to talk ourselves into an overly cautional position. The mistake is that while alleviating our short-term emotional deals, it can lead to a crucial wellness impairment in the long term.

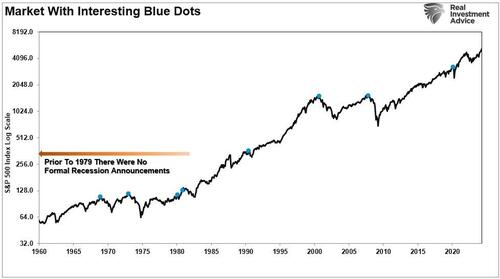

Therefore, it is frequently worth diggling ourselves out of the media headslines and focusing on what the marketplace tells us. After all, the stock marketplace has a long track evidence of leading the economy by 6-9 months. To explain this, start with the illustration of the S&P 500 index below and announcement these interesting blue dots.

What Did The marketplace Know?

Yes, these marketplace dots represent stock marketplace peaks. However, why didThe stock marketplace top at these partial points?

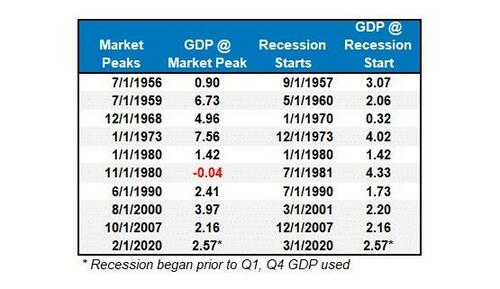

Let’s take a look at the date below of real (inflation-adjusted) economical growth rates:

Each of the dates above shows the economy’s growth rate immediately before the oneset of a recession. The table above notes that in 7 of the last 10 recessions, real GDP growth was 2% or above. In another words, according to the media, There was NO indication of a recession.

But the next month, 1 began.

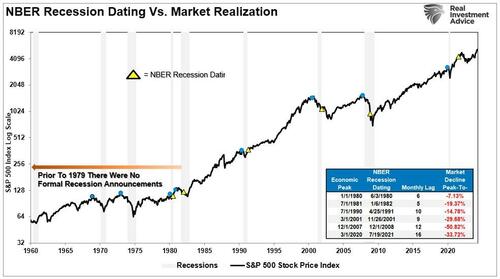

With that understanding,let’ss return to those’“interesting blue dot” in the S&P 500 illustration above. Each dot represents the marketplace highest before the onset of a recession. The S&P 500 peaked and turned lower in 9 of this instances before a recession was recognized, anywhere from 6 to 16 months later.

The crucial point is thatthe stock marketplace was signed a coming recession in the months ahead, but the economical data didn’treflect it.(The only acceptance was 1980 erstwhile they coincided in the same month.) The table below shows the date of the marketplace highest and real GDP versus the start of the recession and GDP growth at that time.

The problem for investors is waiting for the data to catch up.

Moving Average Signals

Understanding that the marketplace trends to lead the economy by six months or more, we can usage lounge-term marketplace signals to aid us navigate the hazard of a recessionary downturn.

We have produced a weekly’“risk scope repor” in the Bull Bear Report for respective years. That study contains respective measurements of analysis, as shown below.

The table compares the comparative performance of each sector and marketplace to the S&P 500 index.

“MA XVE” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

The hazard scope is simply a function of the month-end closing price and the”bet” of the sector or market. (Ranges reset on the 1st of each month)

The table shows the price division above and below the weekly moving events.

For this analysis, we will focus on the far right column. all major marketplace and sector (except for the U.S. dollar) is currentlyon a bullish moving average crossover. Given this is weekly date, it is slow to move, which trends to supply better signals for both expanding and reducing portfolio risk.

A Simple Chart

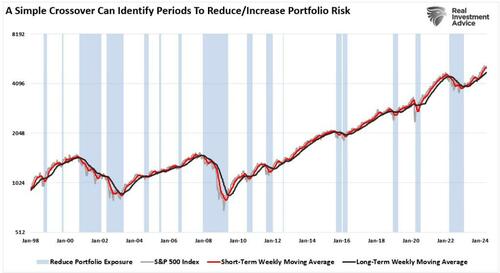

However, are these signatures utilized in safeguarding against the onset of a recession or just a more protracted marketplace downturn like the 1 we saw in 2022? The illustration below uses a simple weekly moving average crossover analysis to find where investors should consider expanding or reducing hazard to equity exposure.

In 2000 and 2008, the moving average crossover signaled investors that a recession onset was coming 9 and 12 months ago of actual recognition. The weekly moving average signals besides triggered a sale signal in early 2022 ahead of the ~20 decline, although the NBER has not recognized a recession yet.

Notable, these signals are not always perfect. The drawdown was so swift in 2020 during the pandemic shutdown that the signals to reduce and increase vulnerability coincided with the market. However, paying attention to these moving average signals over the long word can supply investors with a valuable roadmap to follow.

Bullish Buy Signals Tend To Be Correct

Returning to the’“risk scope repor” above, a review of the summertime 2021 warned our readers that marketplace detection was increasing. The study below is from the October 6th, 2022, Bull Bear Report:

“The selling force continued this week, taking almost all sector and marketplace into double-digit divisions below long-term weekly moving stories. Such extremes are not sustainable, and erstwhile all markets and sectors are this overarching, a reflexive rally becomes highly tested.”

The table below shows that even all sector and marketplace had bearish moving average sale signals trigged. At the time, however, media heads were filled with “death of the dollar,” recession warnings, and bear marketplace alerts. However, specified negative extremes are frequently coincident with marketplace boots.

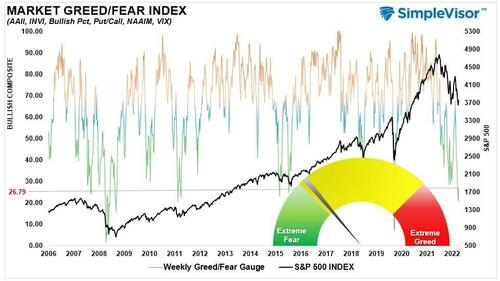

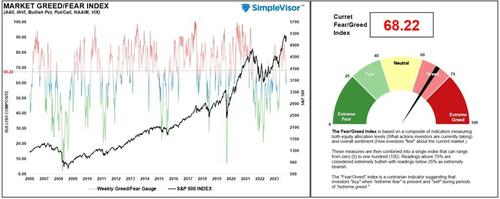

Furthermore, investor sentiment and allocations were likewise utmost negative.

Of course, as we now know in hidesight, October 2022 marked the bottom of the market, and the recession predictions have made into the midst.

The marketplace has recovered since then, and these bearish moving average sale signals have repeated to bullish buy signals. As discussed in this past weekend’s Bull Bear Report, while the marketplace is overbought, and consolidation or correction is likely, with all major equity and Bond marketplace on bullish buy signals, the marketplace is not predicting the oneset of a recession.

Furthermore, investor sentiment and allocations are besides bullish, which supports higher prices.

Corrections Tend To Opportunities

Does this mean that markets will be devoid of any short-term corrections? Of course not. We just experienced a 5.5% correction in April. Furthermore, corrections during marketplace developments happen all year and trend to be opportunities to increase equity vulnerability as needed.

While any unexpected, exogenous events could send markets reeling, the marketplace has a long past of anticipating recessionary ones well before economics and the mainstream media admit them.

With the plethora of “armchair commentators” Pointing at all oven of data as an indicator of economical doom to get more clicks and views, we propose sitting back and paying attention to the markets. Given that the marketplace presents a vast group of individuals analyzing all possible data point, the signals the marketplace provides tend to be a more reliable signal to follow.

When these bullish weekly moving average buy signals start to reverse, with 1 following another, we will know it’s time to become increasingly more inclusive of risk.

As of now, the marketplace suggestions that sitting in cash may be a mistake erstwhile it comes to reporting retention goals.

Tyler Durden

Tue, 05/14/2024 – 13:20