Meet The Company Helping Restart The atomic Revolution In The U.S.

A company called Holtec has become the voice for restarting the atomic power revolution in the U.S.

As it becomes clear that the nation’s needs for power are far underserved, and will absolutely be in the future with the adoption of AI, 1 company, presently the “top US maker of retention equipment for atomic waste”, is recommending for restarting cold reactions across the country.

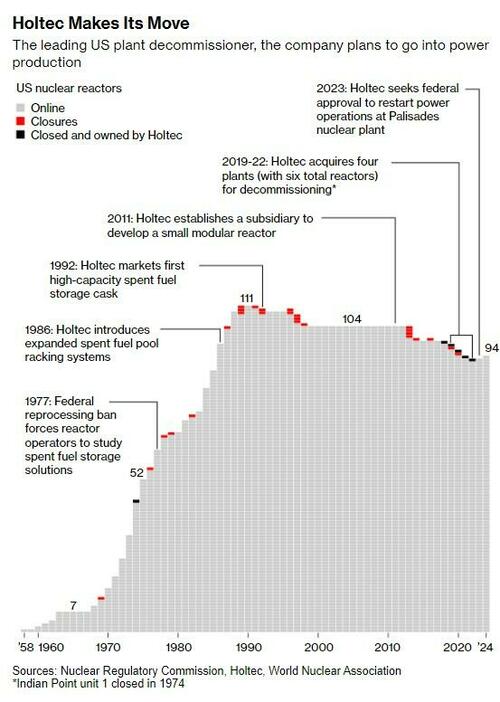

Later, the company’s ambitions have soared. Since 2019, it’s acquired 4 retrieved atomic plants originally intending to decommission them: Indian Point (NY), Oyster Creek (NJ), Pilgrim (MA), and Palisades (MI), according to Bloomberg.

Teaing down old reactors promoted good returns due to the hefty trust funds tied to cleanup costs. Holtec rapidly became the nation’s leading atomic decommissioner.

And, as the study notes, despite initially purchasing Palisades to dismantle it, Holtec is now planning to restart the reactor with a $1.5 billion debt from the DOE, markang the first time a cold reactor would be revived in the U.S. However, Holtec lakes experience in moving atomic plants.

While concerns have been affected due to Holtec’s safety vibrations in the past 4 years of decommissioning, others consider specified inflations average in this tightly regulated industry. Nevertheless, atomic power is actively seen as key to curbing greenhouse gas emissions, and Holtec Aims to have Palisades online again shortly and launch its own tiny modular reactors (SMRs) by the end of the decade.

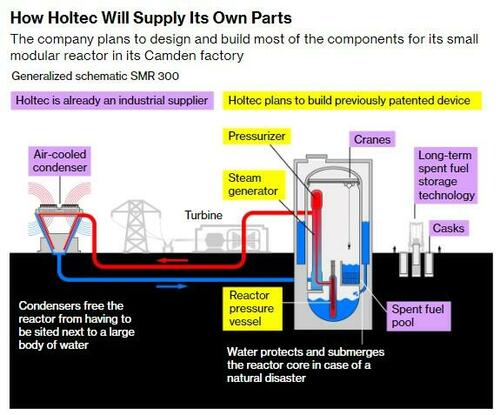

SMRs, factory-built reactors that can be added onsite, present a highly complex and large unproven endavor for Holtec and the manufacture – yet 1 we have written about intensively as the next step for the industry. Just yearday we excelled Sam Altman’s now-greenlighted atomic SPAC, trading under ALCC before switching to OKLO at the end of this week.

Holtec, meanswhile, is headquartered in Jupiter, Florida, but it business hub is the Camden, fresh Jersey campus and factory. Founder and CEO Krishna Singh's office overlooks the Delaware River, facing Philadelphia, where he learned a Ph.D. in mechanical engineering from the University of Pennsylvania in 1972 after issuing from India.

He specialized in heat-exchange systems, cruel training for reactor design, which involves managing the advanced temperatures generated by finance reactions to production power.

Bloomberg writes that Holtec made its mark with a retention strategy for spent uranium full rods, adding the mid-1980s problem of overcrowded indoor cooling pools. Singh’s innovation was a durable rack that minimized full rod moving during earthquakes, allowing plants to store more runs in the pools. With this patented design, he found Holtec, and within a fewer years, his racing dominated the market.

Traditionally, decommissioning active shut down reactions andletting them sit for decades. The atomic Regulatory Commission (NRC) gives operators up to 60 years to complete the process, founded by a trust built from utility ratepayer subscriptions. For instance, Palisades had $552 million in its trust fund erstwhile it closed. The long timeline allows funds to grow and radioactivity to decay.

However, Holtec, NorthStar Group Services Inc., and EnergySolutions Inc. have adopted a different approach, starting decommissioning much earlier. Leaving their experience with radioactive materials, they complete the occupation in years alternatively of decades, keeping a share of any leftover trust fund money.

"Not only does Holtec intended to bring Palisades back online, it besides plans by the end of the decade to have its own tiny modular reactions up and running,” Bloomberg writes.

Back in April we had previously written that quite a few the U.S.’s reactors could wind up coming back online. "There are a couple of atomic power plants that we believe should, and can, turn back on," Jigar Shah, manager of the US Energy Department's debt Programs Office, told Bloomberg in an interview.

In March, Shah’s office adopted a debt to Holtec global Corp. to reopen the Palisades atomic plant in Michigan. This was a historical shift, and it was the first atomic power plant to be reopened in the US, setting a precedent for atomic energy to make a triumphal comeback. The plant could begin producing power as early as the second half of 2025.

Nuclear power is the largest single origin of carbon-free electricity. Given onhoring trends, electrification of transport and buildings, and, of course, as we’ve noted in “The Next AI Trade,” the proliferation of AI data centers will overload power gridswide unless a crucial upgrade is seen.

We again highlighted the enthusiastic investment chance last period titled "Everyone Is Piling Into The "Next AI Trade", which lists companies powering up America for the digital age.

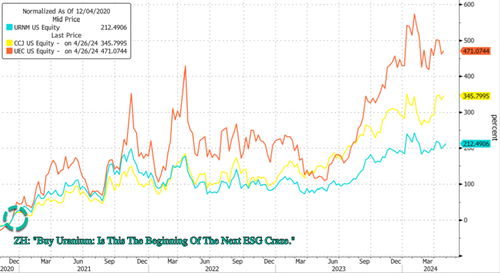

Nearly 3.5 years ago, we provided readers with a straightforward investment thesis: “Buy Uranium: Is This The Beginning Of The Next ESG Craze” Back then, it becomes applicable to us that the insurance of the atomic power manufacture was original.

And the trend is only gaining steam as the conversion of atomic power plants will proceed to benefit any of the largest uranium producers, specified as Cameco. We Told readers to buy uranium stocks, specified as Cameco around the $10 handle – now it’s at $50 a share.

You can read Bloomberg’s full feature on Holtec here.

Tyler Durden

Thu, 05/09/2024 – 20:00