Margin Debt Surges As Bulls Leverage Bets

Authorized by Lance Roberts via RealInvestmentAdvice.com,

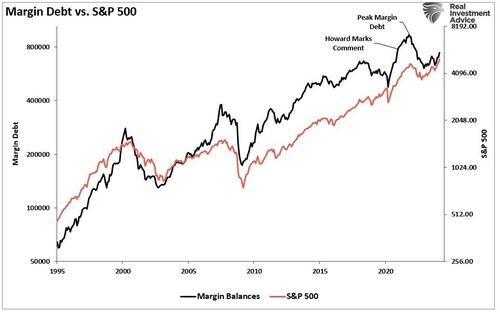

In the most fresh study from FINRA, margin debt levels have suggested as bullish investors left their bets in the equity market. The increase in leverage is not surprising, as it represents increased risk-taking by investors in the stock market.

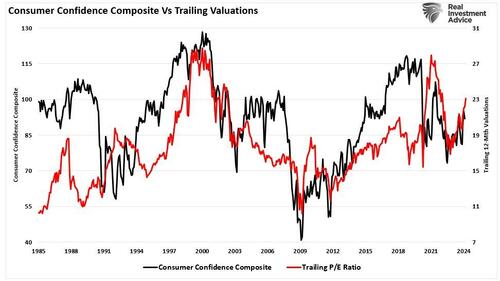

We previous discussed that values, in the short term, reflect investor optimal. In another words, as prices increase, investors rationalize why paying more for current learnings is rational.

“Valuation metrics are just that – a measurement of current valuation. More importantly, erstwhile valuation metrics are excessive, it is simply a better measurement of ‘investor psychology’ and the manifestation of the ‘greater ft theory. ’ As shown, there is simply a advanced correlation between our composite consumer assurance index and tracking 1-year S&P 500 valuations.’

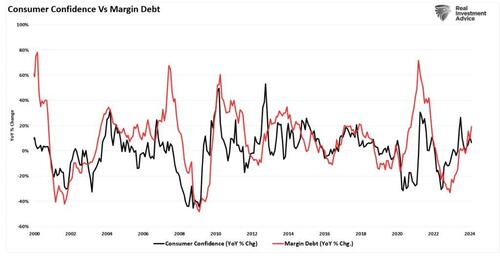

The same holds for margin debt. Unsurprisingly, as consumer assurance improvements, so does the circumstantial request for equity. As stock markets improve, the “fear of missing out” becomes more expected. specified boosters request for equity, and as prices rise, investors take on more hazard by adding leverage.

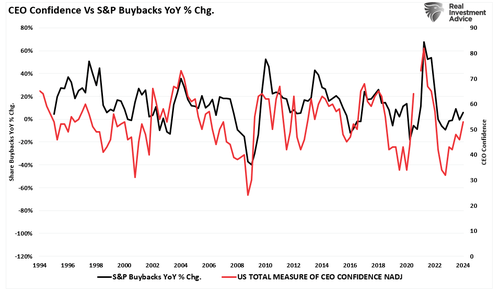

Adding to that exuberance is the increased request for share purchases, which has been a primary origin of “buying” Since 2000. As CEO assurance increases, a byproduct of increased consumer confidence, they increase the request for share purchases. As buybacks boost asset prices, investors take on more leverage and increase vulnerability as a virtual spiral developops.

However, should investors be afraid of rising margin debit?

A Byproduct Of Exuberance

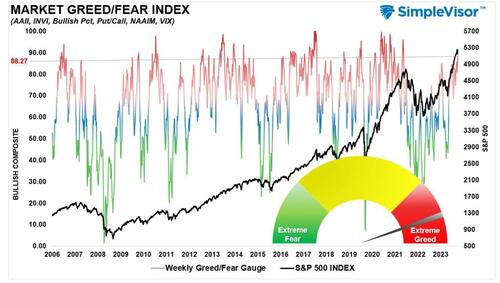

Before we dig further into what margin debit tells us, let’s begin with where we are currently. There is clear evidence that investors are one more time highly exuberant. The “Fear Greed” index below differences from the CNN measurement in that our model measures position in the marketplace by how much professional and retail investors are exposed to equity risk. Currently, that vulnerability is at levels associated with investors being “all in” the equity “pool.”

As Howard Marks noted in a December 2020 Bloomberg interview:

“Fear of missing out has taken over from the fear of losing money. If people are risk-tolerant and afraid of being out of the market, they buy agosively, in which case you can’t find any bargains. That’s where we are now. That’s what the Fed engineer by putting rates at zero...we are back to where we were a year ago—uncertainty, prospective returns that are even lower than they were a year ago, and higher asset prices than a year ago. People are back to having to take on more hazard to get back. At Oaktree, we are back to a cautious approach. This is not the kind of environment in which you would be buying with both hands.

The prospective returns are low on everything.”

Of course, in 2021, that marketplace continued its low flexibility grind higher as investors took on expanding margin default levels to pursuit higher equity. However, this is the crucial point about margin debit.

Margin debt is not a method indicator for trading markets. What it represents is the amount of specification occuring in the market. In another words, margin debt is the “gasoline,” which drives markets higher as the leadage provides for the additional purchasing power of assets. However, leftage besides works in reverse, as it supplies the accelerator for more crucial declines as lenders “force” the sale of assets to cover credit lines without respect to the Borrower’s position.

The last conviction is the most important. The issue with margin debt is that the unwinding of surviving is NOT at the investor’s discretion. That process is at the discretion of the broker-dealers that extended that leadage in the first place. (In another words, if you don’t sale to cover, the broker-dealer will do it for you.) erstwhile lenders bear they may not recoup their credit lines, they force the borerower to put in more cash or sale assets to cover the debit. The problem is that “margin calls” mostly happen simultaneously, as falling asset prices impact all lenders simultaneously.

Margin debt is NOT an issue – until it is.

As shown, Howard was eternally right. In 2022, the decline wiped out all of the erstwhile year’s gain and then some.

So, where are they now?

Margin Debt Confirms The Exuberance

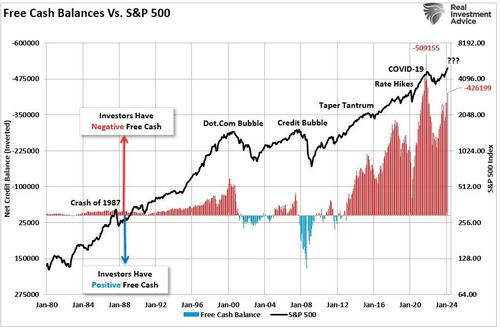

As noted, margin debt supports the advance erstwhile markets are surviving and investors are taking on additional leverage to increase buying power. Therefore, the fresh emergence in margin debt is unsurprising as investor exuberance climbs. The illustration shows the relation between cash balances and the market. I have inverted free cash balances, so the relation between increases in margin debit and the marketplace is better represented. (Free cash balances are the difference between margin balances little cash and credit balances in margin accounts.)

Note that during the 1987 correction, the 2015-2016 “Brexit/Taper Tantrum,’ the 2018 “Rate Hike Mistake,’ and the “COVID Dip,’ the marketplace never broker its uptrend, AND cash balances never turned positive. Both a break of the rising bullish trend and affirmative free cash balances were the 2000 and 2008 bear marketplace hallmarks. With negative cash balances shy of another all-time high, the next downturn could be another “correction.” However, if, or when, the long-term bullish trend is broken, the unwinding of margin debt will add “fuel to the fire.”

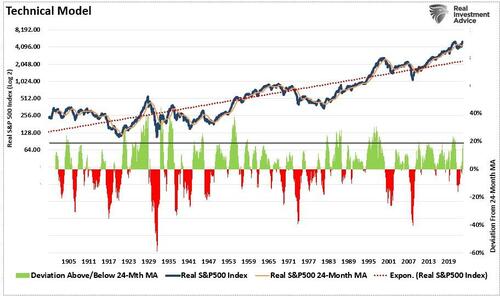

While the immediate consequence to this analysis will be, “But Lance, margin debt isn’t as advanced as it was previously,” there are many differences between present and 2021. The catch of stimulus payments, zero interest rates, and $120 billion in monthly “Quantitative Easing” are just a few. However, any glaring similarities exist, including the economy in negative cash balances and utmost deviations from long-term means.

In the short term, exuberance is infectious. The more the marketplace rallies, the more hazard investors want to take on. The issue with margin debt is that erstwhile an event occasionally occurs, it creates a rush to liquidate holdings. Since margin debit is simply a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collective. The decline in value then triggers further margin calls, triggering more selling, forcing more margin calls, and so forth.

Margin debit levels, like values, are not useful as a market-timing device. However, they are a valuable indicator of marketplace exuberance.

While it may “feel” like the marketplace “just won’t go down,” it is worth remembering Warren Buffett’s sage words.

“The marketplace is simply a lot like sex, it feels best at the end.”

Tyler Durden

Tue, 04/09/2024 – 10:25