Manufacturing PMIs Sink Despite Surge In 'Hard’ Data; Prices Paid Spike To 3-Year-Highs

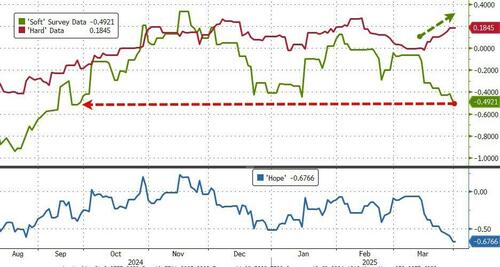

While hard data continues to improve, 'soft’ data hit a new six-month low yesterday as more regional Fed surveys signaled trouble ahead (because of tariffs)…

Source: Bloomberg

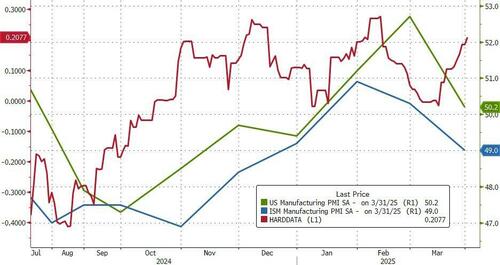

And so all eyes are on the premier 'soft’ data today as Manufacturing PMIs drop their final print for March.

The S&P Global Manufacturing PMI improved intra-month, rising from a flash print of 49.8 (contraction) to a final print of 50.2 (expansion), but that was still well down from February’s 52.7.

The ISM Manufacturing PMI weakened notably from 50.3 to 49.0 (below the 49.5 expectation) – the lowest since November.

Source: Bloomberg

Under the hood it was even more messy…

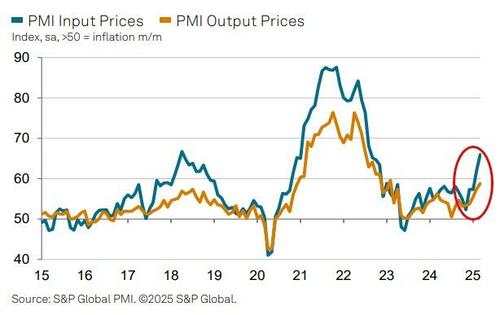

…with Prices Paid soaring to its highest since June 2022 and New Orders & Employment tumbling…

Source: Bloomberg

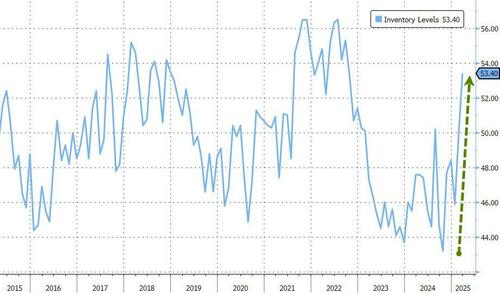

Inventories surged as manufacturers front-run the 'Liberation Day’ headlines…

As Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, notes:

“The strong start to the year for US manufacturers has faltered in March. A combination of improved optimism surrounding the new administration and the need to front-run tariffs had buoyed the goods-producing sector in the first two months of the year, but cracks are now starting to appear. Production fell for the first time in three months in March, and order books are becoming increasingly depleted.

Trump-based optimism is fading?

“While business confidence about the outlook remains relatively elevated by standards seen over the past three years, this is based on companies hoping that the nearterm disruption caused by tariffs and other policies will be superseded as longer-term benefits from the policies of the new administration accrue. However, March has seen more producers question this belief. Business optimism about the year ahead has deteriorated further from January’s near threeyear high, and has dropped sharply over the past two months, causing firms to stop raising payroll counts for the first time since October.

And of course, it’s all about tariff terror…

“A key concern among manufacturers is the degree to which heightened uncertainty resulting from government policy changes, notably in relation to tariffs, causes customers to cancel or delay spending, and the extent to which costs are rising and supply chains deteriorating in this environment.

Tariffs were the most cited cause of factory input costs rising in March, and at a rate not seen since mid-2022 during the pandemic-related supply shock. Supply chains are also suffering to a degree not seen since October 2022 as delivery delays become more widespread.

“Data in the coming months will provide important insights into how the inflationary aspects of policies such as tariffs balance out against any benefits to US producers.”

So, both Services PMIs are in expansion (above 50) and Manufacturing is mixed (50.2 vs 49.0) – take your pick on 'recession’ talk.

Tyler Durden

Tue, 04/01/2025 – 10:07