Long-Term Prospects „Bode Well” For Nuclear, Goldman Says After Trump Signs Executive Orders

Following President Trump’s signing of multiple executive orders accelerating development of the nuclear industry, Goldman Sachs was out with a note maintaining a positive outlook on the nuclear energy sector, especially in the near to medium term, focusing on opportunities related to uranium fuel supply and the upstream part of the nuclear value chain.

In the note, Goldman, led by analyst Brian Lee, reiterates its Buy rating on Cameco Corporation while also seeing potential in companies focused on small modular reactor (SMR) technologies.

Goldman Sachs believes the new orders could be beneficial for Cameco, a major uranium producer, as increased demand for nuclear power generation would likely raise the need for physical uranium and related fuel conversion services. This impact would be more visible over the longer term.

In the shorter term, Goldman highlights the potential benefit to Westinghouse, in which Cameco holds a 49 percent stake. Westinghouse could see more immediate gains if its reactor technology, particularly the AP1000 design, is selected for upcoming nuclear projects.

Uranium

UraniumFor companies involved in small modular reactors, there is potential upside if the executive order leads to specific allocations of loan funding for SMR development. Such support could be directed toward both civilian energy infrastructure and defense-related power needs, Lee and his team said.

Recall, on Friday, President Donald Trump signed a series of executive orders designed to fast-track the development and deployment of advanced nuclear reactors on Friday culminating a dramatic policy shift aimed at revitalizing the U.S. nuclear energy sector.

Flanked in the Oval Office by Secretary of Defense Pete Hegseth and Interior Secretary Doug Burgum, Trump declared nuclear power “a hot industry” and praised it as “very safe and environmental.”

Burgum called it “a huge day for the nuclear industry,” and added, “Mark this day on your calendar. This is going to turn the clock back on over 50 years of over regulation of an industry.”

In terms of valuation, Goldman sets a twelve-month price target of $65 for Cameco’s U.S. listing and C$89 for its Toronto listing. These valuations are based on a sum-of-the-parts approach that incorporates different valuation multiples for uranium production, fuel services, and Westinghouse’s contributions.

Key risks to this outlook include fluctuations in commodity prices, disruptions in mining operations, timing issues related to contracts and deliveries, and potential delays in nuclear project construction.

For SMR, Goldman assigns a twelve-month price target of $24. This estimate is derived from a blend of discounted cash flow analysis and revenue-based valuation, using longer-term forecasts and applying a relatively high discount rate to reflect risk.

The primary concerns for SMR include execution challenges, ongoing funding needs, uncertainty around customer demand and regulatory approvals, and the final delivered costs of reactor modules.

Recall, the new orders aim to strip away what the administration describes as decades of regulatory overreach that have stifled innovation and stagnated the industry. “America’s greatness has always come from innovation,” Burgum said on Friday. “We led post-World War Two in all things nuclear. But then we’ve been stagnated. We’ve choked it with over regulation.”

The first of Trump’s executive orders directs the Department of Energy (DOE) to accelerate research and development, speed up reactor testing at national labs, and initiate a two-year pilot program for reactor construction.

A second order clears regulatory hurdles for the DOE and the Department of Defense (DOD) to build reactors on federal land — efforts that will bypass the Nuclear Regulatory Commission (NRC) entirely by using the agencies’ own regulatory authority.

“We’re going to do a lot of the small ones, and we’re going to do some of the big ones,” Trump said. “But yeah, very safe, safe and clean.”

The third order takes direct aim at the NRC itself. It mandates “a total and complete reform of NRC culture to reorient to ensure reactor safety and promoting the development and adoption of nuclear technology.” The order sets a new requirement that the commission rule on new license applications within 18 months, far faster than the current average of five years.

In support of this agenda, Hegseth underscored the national security implications, especially in powering AI infrastructure: “We’re including artificial intelligence in everything we do. If we don’t, we’re not fast enough, we’re not keeping up with adversaries. You need the energy to fuel it. Nuclear is a huge part of that, modular or otherwise. So we’re going to have the lights on and AI operating when others do not faster than everybody else because of nuclear capability.”

The fourth nuclear-focused order targets America’s uranium supply chain, aiming to “reinvigorate” the domestic nuclear industrial base. It calls for expanded uranium mining and enrichment, while also instructing Energy Secretary Scott Wright to evaluate policies for nuclear material recycling and reprocessing. A senior official explained, “That means America will start mining and enriching uranium and expanding domestic uranium conversion and enrichment capacity.” Nonproliferation and security considerations will guide those efforts.

Trump’s orders reflect a clear strategic intent: to restore the U.S. as a global leader in nuclear energy and science. Michael Kratsios, director of the White House Office of Science and Technology Policy, said the executive actions would “ensure continued American strength and global leadership in science and technology.”

He lamented the U.S. decline in nuclear progress, saying, “We decommissioned commercial reactors across the country, stepped back from nuclear R and D and abandoned hopes of nuclear energy, power and a bright future. America’s great innovators and entrepreneurs have run into brick walls when it comes to nuclear technologies.”

Kratsios declared that Trump is “telling the world that America will build again and the American nuclear renaissance can begin.”

With energy demands soaring due to AI and data center growth, industry giants like Microsoft, Oracle, Google, and Amazon are now investing in or exploring small modular reactors to power their operations. The administration sees this as a critical opportunity for the U.S. to lead again. “Nuclear energy is necessary to power the next generation technologies that secure our global industrial, digital, and economic dominance, achieve energy independence, and protect our national security,” a White House official said.

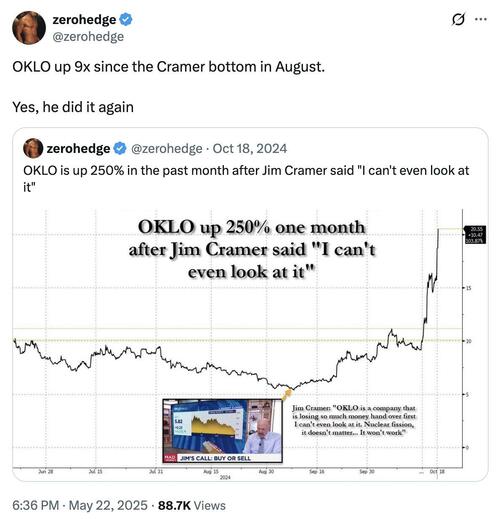

Nuclear stocks soared last week on the news of the order. And as we noted on X last week, OKLO is now up 10x since Jim Cramer said „I can’t even look at it” back in October 2024.

Booyah!

On Oklo’s Q1 2025 earnings call earlier this quarter, CEO Jacob DeWitte confirmed the company is engaged in a “pre-application readiness assessment” with the NRC, aiming to smooth its formal license submission for a newly upsized 75-MW reactor design in Q4 2025. The company still targets late 2027 or early 2028 for first power production at its Idaho National Laboratory (INL) site.

DeWitte noted the recent departure of OpenAI CEO Sam Altman as Oklo board chair removes a potential conflict of interest should OpenAI become a future power customer. Oklo already holds about 14 GW in nonbinding agreements with data centers and industrial operators.

A UtilityDive report said that Zero Hedge favorite Oklo is also among eight companies eligible for the military’s Advanced Nuclear Power for Installations program, enabling on-base reactor deployments. It’s developing nuclear fuel fabrication facilities capable of reusing spent fuel that would otherwise sit in long-term storage.

For those who missed it, in our original note „The Next AI Trade” from April 2024, more than one year ago, we outlined various investment opportunities for powering up America, most of which have dramatically outperformed the market since then.

For those that missed that note, we pointed out on Friday all the ways to still profit.

Meanwhile the entire world has been jumping on the nuclear power bandwagon.

-

United States: Major tech. companies have come out in support of nuclear to help power AI data centers, and in places like Pennsylvania, local politicians are pushing for quick restarts and refreshes of nuclear plants like Three Mile Island. President Trump’s goal is to quadruple nuclear capacity over 25 years.

-

China: China leads the world in nuclear construction, with 30 reactors being built, including the massive Lianjiang plant with six advanced CAP1000 reactors. The country sees nuclear as key to reducing emissions and meeting energy needs.

-

India: India is pushing forward with 10 new heavy water reactors, each generating 700 MW, to be built in a faster “fleet mode.” This expansion will help meet growing power demand and reduce coal reliance.

-

Japan: After years of hesitancy post-Fukushima, Japan has restarted several nuclear reactors and plans to extend their lifespans. The government is also supporting the development of next-generation reactors to reduce energy imports and cut carbon emissions.

-

Germany: Facing high energy costs from phasing out nuclear, Germany is rethinking its position. Discussions are underway about using small modular reactors and cooperating with France on nuclear energy.

-

France and the UK: Both countries are extending the life of existing plants and investing in new large-scale and small modular reactors to strengthen energy security and meet climate goals.

-

Nordic countries:

-

Sweden: Plans to build new reactors and extend the life of existing ones, aiming for stable, fossil-free electricity.

-

Finland: Recently completed the Olkiluoto 3 reactor, the largest in Europe. It now supplies about 14% of Finland’s electricity.

-

Denmark: Considering lifting a 40-year ban on nuclear energy, spurred by small modular reactor interest and regional trends.

-

As of late 2024, 63 nuclear reactors were under construction worldwide. Three-quarters of these are in emerging economies, and half are in China. The International Atomic Energy Agency projects that global nuclear capacity could more than double by 2050 to support clean energy goals.

In other words, we could very well still be in the early innings of this renaissance…

For even more including a deep dive into the nuclear technology, the nuclear fuel cycle, the uranium supply-demand model, pricing and contracting, and all the companies and major players in the place, read the full „Nuclear Playbook For Energy Transition” report available only to professional subscribers.

Tyler Durden

Sun, 05/25/2025 – 12:15