Korea’s Momentum Traders Sour On Tesla, Turn To Crypto

It has long been one of Wall Street’s unspoken rules that whoever controls Korea’s mob of momentum-chasing fanatics, controls price manipulation discovery. And in Korea (that would be South for those who are unsure, North Korean brokerages are… rather nonexistent yet), allegiances are rapidly shifting.

Average 12-year-old Korean trading veteran

Average 12-year-old Korean trading veteranSouth Korea’s retail investors are losing faith in Tesla’s stock, instead ramping up their selling last month amid growing disillusionment with the electric carmaker – or at least lack of the upward momentum – and rising interest in cryptocurrencies.

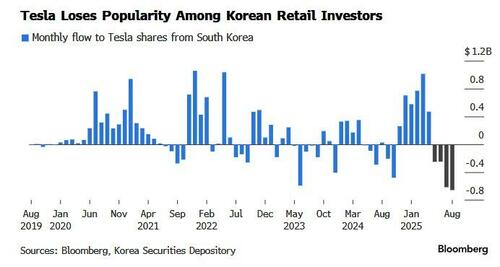

According to Bloomberg calculations, individual investors in Korea – which just like their retail peers in the US exert outsized control on price pressure, whether on the buy or sell side – and sold a net $657 million of Tesla stock in August, the largest outflow since at least early 2019. Instead of TSLA, local momentum chasers are now favoring even more volatile, but more momentum-heavy, bets such as Bitmine Immersion (BMNR), seen as a proxy for Ether, which drew $253 million of net inflows, having become the Ether version of MicroStrategy with its recently launched ETH treasury platform.

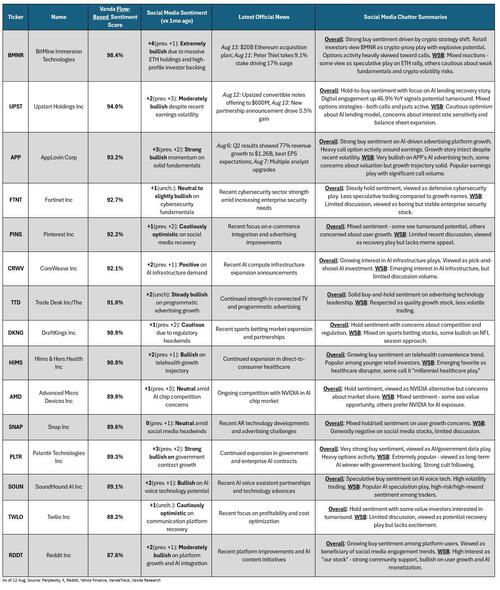

An analysis by Vanda Research found that BMNR was also the stock that attracted the most investor attention in the US, with a Vanda Flow sentiment score of 98.4%, surpassing every other stock in the list.

The $1.8 billion exodus from Tesla during the past four months signals waning enthusiasm among one of Elon Musk’s most loyal global retail investor bases, whose buying sprees once amplified the stock’s rallies. Korean traders, who had been drawn to high-profile US tech companies such as Tesla during the Covid era, are now putting their money elsewhere.

“Tesla used to offer a lot of inspiring narratives but it has failed to win people’s hearts,” said Han Jungsu, a 33-year-old individual investor who first bought Tesla the stock in 2019 but sold out earlier this year to focus on names he sees having more upside. “It has failed to lead with its own AI narrative.”

Still, Tesla remains the top foreign stock among Korean retail traders, who hold about $21.9 billion of the company’s stock, the data show. By comparison, Nvidia and Palantir ranked a distant second and third among Korean retail favorites. The exchange-traded fund TSLL, which offers double-leveraged exposure to Tesla, also saw its biggest monthly outflow since at least early 2024, with $554 million withdrawn in August, according to depository data.

In the US, retail interest in TSLA is still high, although as the latest retail flow tracker from Vanda Research shows, net retail purchases in the name are less than half of Nvidia’s which is the category leader. And while OTM call turnover in TSLA among retail investors remains the highest of all stocks, retail flow sentiment in the name has clearly soured with TSLA no longer appearing in the top 30 names.

![]()

Tyler Durden

Tue, 09/02/2025 – 18:40