Key Events This Week: CPI, FOMC Minutes, Q1 Earnings Kick Off And Fed Speakers Galore

As DB’s Henry Allen writes, markets had a through start to Q2 last week, with the S&P 500 (-0.95%) posting its worth weekly performance in 3 months, whilst the US 30yr young (+21.0bps) Saw its biggest weekly emergence since October, with yields extended gain again this morning. respective factors were driving the Selloff, but geopolitical tensions played a key role, as feats mounted about any kind of escape in the mediate East. That means Brent Crude oil prices rose for a 4th consecutive week, surpassing $90/bbl for the first time since October. That in turn led to increasing performance about inflation, with investors continuing to price out the chance of rate cuts from the Fed. Indeed, as of this morning, just 62bps of rate cuts are priced in by the December meeting, which is simply a long way from the 158bps expected at the start of the year.

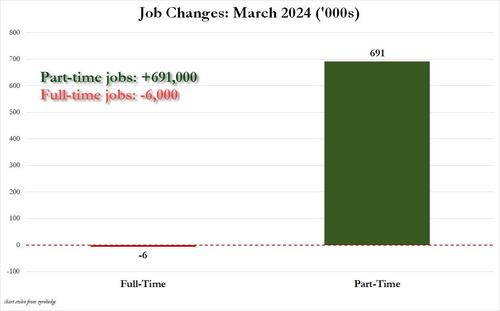

Things questions about rate cuts acquired package on Friday, as the US jobs study shown nonfarm payrolls grey by +303k in March (vs. +214k expected), allough as we showed, all the gain was thanks to low-quality and low-paid part-time jobs.

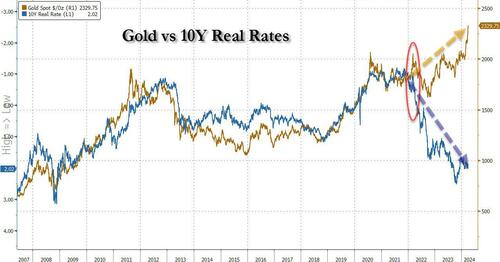

Unlike the erstwhile month, the upside surprise didn’t come with harp downward revisions. In fact, the January and February prints were revised up by a full of +22k. So even though futures are inactive pricing a rate cut by June as the most likely outcome, it was down to just a 54% chance by the close on Friday. That besides means that Treasury yields have reached fresh highs for the year, with the 10yr yield trading this morning as advanced as 4.46%, and the 10yr real yield rising to 2.08%, a stagging disconnect with the price of gold, something BofA’s Mike Hartnett says is simply a harpinger of major pain.

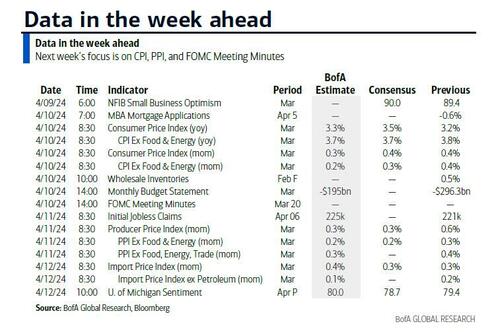

Looking forward, that question on the timing of rate cuts will be on the agenda this week, as the US CPI release for March is out on Wednesday. So far this year, core CPI has proven strongr than expected, with the January and February prints both at a period +0.4%. But for now at least, the Fed hasn't been besides alarmed, and Chair Powell said last week that “ it is besides shortly to say whother the fresh readings present more than just a bump.” So this week’s releases will be in focus, as a 3rd period of strongr inflation would make it harder to dismiss as a temporal decision higher.

In terms of what to expect, DB’s US economics think that monthly header CPI will be at +0.27%, in line with consensus, which would see the year-on-year measurement choice up two-tenths to +3.4%. But for core CPI, they see the monthly number slowing down to +0.24%, which would push the year-on-year measurement down a tenth to +3.7%. In the meantime, it’s clear that markets are becoming more agreed about the issue, and last week saw the US 2yr inflation swap close at its highest since October, at 2.54%.

Over in Europe, the main event this week is likely to be the ECB’s policy decision on Thursday. It’s perfectly expected they’ll leave rates changed at this meeting, including by marketplace pricing and the consensus of economists. So the large question is likely to be what they signal about the subsequent gathering in June, which investors are pricing in as a very strong probability for an first rate cut. Indeed, we found out last week that Euro Area core inflationfell to a two-year low in March of +2.9%, and the account of the last ECB gathering said that “the case for conducting rate cuts was strengthening.” DB’s European economists think that the ECB needs additional data over the next couple of months to underpin its assurance in price stableness and open the door for a June rate cut. But they think it should be clear that a June cut is the working assessment, barring a crucial shock.

This week ahead besides marks the start of the Q1 years season, with respective US financials reporting on Friday, before the number of releases starts to choice up over the subsecent couple of weeks. Friday’s reports include JPMorgan, Citigroup, Wells Fargo and BlackRock.

Rounding up the week ahead, there are monetary policy decisions from both the Bank of Canada and the Reserve Bank of fresh Zealand on Wednesday, along with the Bank of Korea on Friday. Separatelli on Wednesday, there’s the release of the FOMC minutes from the March meeting. And on Friday, the Bank of England will print the Bernanke Review into its forecasts. erstwhile it comes to data, we’ll besides get China’s CPI and PPI reading for March on Thursday, and on Friday’s there’s the UK’s monthly GDP reading for February.

Here is simply a day-by-day calendar of events course of DB

Monday April 8

- Date: U.S. March NY Fed 1-yr inflation results, Japan March Economy Watchers survey, February trade balance, current account balance, labour cash arrivals, Germany February trade balance, industrial production

- Central banks: ECB’s Stournaras spears, BoE’s Breeden spears

Tuesday April 9

- Date: US March NFIB tiny business optimal, Japan March device tool orders, consumer assurance index, France February trade balance, current account balance

- Central banks: Fed’s Kashkari spears, ECB’s bank lending survey

- Auctions: US 3-yr Notes

Wednesday April 10

- Date: US March CPI, monthly budget statement, February wholesale trade sales, Japan March PPI, lending bank, Italy February retail sales, Canada February building permits, Denmark March CPI , Norway March CPI, PPI , Sweden February GDP

- Central banks: March FOMC gathering minutes, Fed’s Goolsbee and Bowman speech, BoC decision, RCNZ decision

- Earnings: Tesco

- Auctions: US 10-yr Notes

Thursday April 11

- Date: US March PPI, first jobless claims, UK March RICS home price balance, China March CPI, PPI, Japan March M2, M3, Italy February industrial production, Germany February current account balance, Norway February GDP

- Central banks: Fed’s Williams, Bostic and Collins speak, ECB decision, BoE’s Greene spears, BoE’s credit conditions survey

- Auctions: US 30-yr Bond

Friday April 12

- Date: US April University of Michigan consumer survey, March export and import price index, UK February monthly GDP, trade balance, industrial production, index of services, construction outlet, China March trade balance, Japan February capital utilization, Italy January industrial sales, Canada March existing home sales, Sweden March CPI

- Central banks : Fed’s Daly and Bostic speak, ECB’s survey of professional forecasters, BoE’s Bernanke report

- Earnings: JPMorgan, Citigroup, Wells Fargo, BlackRock

* * Oh, * *

Finally, looking at just the US, Goldman notes that the key economical data releases this week are the CPI study on Wednesday and the University of Michigan study on Friday. The minutes from the March FOMC gathering will besides be released on Wednesday. There are respective speaking engagements from Fed officials this week, including remarks from politician Bowman and presidents Williams, Goolsbee, Kashkari, Collins, Bostic, and Daly.

Monday, April 8

- 11:00 AM NY Fed 1-year inflation effects, March (last +3.44%)

- 01:00 p.m. Chicago Fed president Goolsbee (FOMC non-voter) spears: Chicago Fed president Austan Goolsbee will appear on local Chicago radio station WBEZ-FM. On April 4, Goolsbee said, “The biggest danger to the inflation image in my view...[is] the continued advanced inflation in hosting services...I have been expecting it to come down more rapidly than it has. If it does not come down, we will have a very hard time getting overall inflation back to the 2% target.” He added, “If we stay revived for besides long, we will likely see the employment side of the mandate beg to deteriorate.”

- 07:00 p.m. Minneapolis Fed president Kashkari (FOMC non-voter) Speaks: Minneapolis Fed president Neel Kashkari will join a town hall discussion at the University of Montana in Missoula. A Q&A is expected. On April 4, Kashkari said, “In March I had jotted down 2 rates cut this year if inflation continues to fall back towards our 2% target. If we proceed to see inflation moving sides, then that would make me question who we needed to do these rates cuts at all.” He added, the January and February inflation data was “a small bit concerting.”

Tuesday, April 9

- 06:00 AM NFIB tiny business optimal, March (consensus 89.9, last 89.4)

Wednesday, April 10

- 08:30 AM CPI (mom), March (GS +0.29%, consensus +0.3%, last +0.4%); Core CPI (mom), March (GS +0.27%, consensus +0.3%, last +0.4%); CPI (yoy), March (GS +3.37%, consensus +3.4%); Core CPI (yoy), March (GS +3.70%, consensus +3.7%); We estimation a 0.27% increase in March core CPI (mom sa), which would lower the year-on-year rate by 1 tenth to 3.7%. Our forecast returns a 0.3% pullback in apparel prices, a return to a negative trend for communication prices (-0.3%), and a 3% drop in airfares. We besides presume tiny declines in fresh (-0.3%) and utilized (-0.5%) car prices, reflecting higher investments and declines in auction prices during the winter. We estimation a slowdown in the primary rent measurement (+0.37% vs. +0.44% in February) reflecting the continued softness in flat inflation, and we presume a akin package for OER (+0.45% vs. +0.44% in February) given continued single-family outperformance. On the affirmative side, we presume a strong gain in car insurance rates (+1.4%) based on online price data and a boost to hotel lodging (+1.0%) from residual seasonality. We estimation a 0.29% emergence in header CPI, reflecting advanced energy (+0.7%) and food (+0.2%) prices.

- 08:45 AM Fed politician Bowman spears: Fed politician Michelle Bowman will discuss the Basel capital requirements at the European Bank Executive Forum. A Q&A is expected. On April 5, Bowman said, “while it is not my baseline outlook, I proceed to see the hazard that at a future gathering we may request to increase the policy rate further should advancement on inflation steel or even reverse...Reducing our policy rate besides shortly or besides rapidly could consequence in a recovery in inflation, requiring further future policy rate increases to return inflation to 2% over the long run.”

- 10:00 AM Wholesale inventors, February final (consensus +0.5%, last +0.5%)

- 12:45 p.m. Chicago Fed president Goolsbee (FOMC non-voter) spears: Chicago Fed president Austan Goolsbee will participate in a panel discussion for the Social Finance Institute. A Q&A is expected.

- 02:00 p.m. FOMC gathering minutes, March 19-20 meeting: At the March FOMC meeting, the median FOMC associate continued to task 3 rate cuts in 2024 despite a 0.2pp increase in the median 2024 core PCE inflation projection is 2.6%. We Saw 3 takeaways from Chair Powell’s press conference. First, Powell was not included by the firmer January and February inflation date. Second, Powell noted that, while the FOMC raised its 2024 GDP growth forecast meansful, strongr growth has been made possible late by fast growth of labour supply and is so not an argument against rate cuts. Third, FOMC parties think it will be proposed to slow the package of balance sheet runoff “fairly soon.” We proceed to anticipate 3 25bp cuts in the Fed funds rate this year, with the first at the June meeting.

Thursday, April 11

- 08:30 AM PPI final demand, March (GS +0.3%, consensus +0.3%, last +0.6%); PPI ex-food and energy, March (GS +0.3%, consensus +0.2%, last +0.3%); PPI ex-food, energy, and trade, March (GS +0.3%, consensus +0.2%, last +0.4%); 08:30 AM first jobless claims, week ended April 6 (GS 215k, consensus 215k, last 221k); Continuing jobless claims, week ended March 30 (consensus 1,800k, last 1,791k)

- 08:45 AM fresh York Fed president Williams (FOMC voter) spokes: New York Fed president Williams will remove keynote marks at the FHLBNY 2024 associate Symposium. Speech text and a Q&A are expected. On February 28, Williams said, “while the economy has come a long way toward gain balance and reaching our 2% inflation goal, we are not there yet. I am committed to full restoring price stableness in the context of a strong economy and laboratory market.” He added, “my view is that something like the three-rate-cuts-this-year projection from December is simply a realistic kind of starting point” and that rate cuts could come “later this year.”

- 12:00 p.m. Boston Fed Susan Collins (FOMC non-voter) Speaks: Boston Fed president Susan Collins will talk at the economical Club of fresh York. Speech text and a Q&A are expected. On February 28, Collins said, “I believe it will likely become appricate to begin easing policy later this year. erstwhile this happens, a methodical, forward-looking approach to reducing rates hailly should supply the essential flexibility to manage risks, while promoting unchangeable prices and maximum employment...If that trajectory slows down, in terms of inflation, then we are going to should be more patient than I think many had expected.”

- 01:30 p.m. Atlanta Fed president Bostic (FOMC voter) spears: Atlanta Fed president Raphael Bostic will participate in a moderated conversation on leadership in financial services. A Q&A is expected. On April 3, Bostic said, “We’ve seen inflation kind of become much more bumpy. If the environment evolves as I anticipate and that’s going to be seeing continued work in GDP and employment, and a slow decline inflation over the course of the year, I think it will be appropriate for us to start moving down at the end of this year, the 4 quarter.”

Friday, April 12

- 08:30 AM Import price index, March (consensus +0.3%, last +0.3%): Export price index, March (consensus +0.3%, last +0.8%)

- 10:00 AM University of Michigan consumer sentiment, April preliminary (GS 79.0, consensus 79.0, last 79.4); University of Michigan 5-10-year inflation effects, April preliminary (GS 3.0%, consensus 2.9%, last 2.8%): We anticipate the University of Michigan consumer sentiment index decreased to 79.0 in the preliminary April reading. The University of Michigan is transitioning from telephone interviews to web-based interviews over the next 4 months. We have approved our estimation of consumer sentiment down somewhat since web-based responses tend to be more pessimistic than phone-based responses for the consumer sentiment measure. We estimation the report's measurement of long-term inflation effects rose 0.2pp to 3.0%, reflecting higher gasoline prices and the higher-than-expected price data reported so far in 2024.

- 02:30 p.m. Atlanta Fed president Bostic (FOMC voter) Speaks: Atlanta Fed president Raphael Bostic will give a velocity and participate in a average conversation on housing at the Confronting America’s Housing Crisis: Solutions for the 21st Century. Speech text and a Q&A are expected.

- 03:30 p.m. San Francisco Fed president Daly (FOMC voter) spears: San Francisco Fed president Mary Daly will participate in fireside chat at the 2024 Finch Conference: The Evolution of Fintech – AI, Payments and Financial Inclusion. A moderated Q&A is expected. On April 2, Daly said, “I think that [three rate cuts this year] is simply a very rational base. Growth is going strong, so there’s truly no originality to adjust the rate.” She added “it’s a close call” on whether fever cuts will be needed.

Source DB, Goldman, BofA

Tyler Durden

Mon, 04/08/2024 – 09:25