Job Openings Tumble, Quits Plunge, Hires Unexpectedly Crater To January 2018 Levels

After respective months of comparative Boring JOLTS prints, this morning Janet Yellen’s favourite laboratory marketplace indicator one more time got excited, and not in a good way.

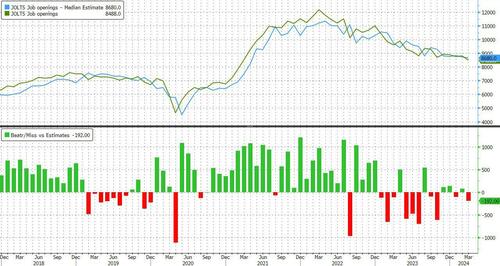

Starting at the top, according to the March JOLTS reported, occupation openings unexpectedly tumbled by 325K – the biggest drop since October 2023 – from an upward revised 8,813 million in February to just 8,488 million, far below the 8,690 million estimated – and the low number since February 2021 erstwhile it last printed below 8 million.

The 192K miss to estimates of 8.690 million, was the biggest since last October.

According to the DOL, in March occupation openings decreased in construction (-182,000) and in finance and insurance (-158,000), but increased in state and local government education (+68.000) due to the fact that erstwhile all else fails, just “hire” more government zombies, ideally in the form of unionized illegal aliens to boost scales and inflation.

The kicker: construction jobs openings plugined from 456K to 274K, a 182K one-month drop and the biggest on record!

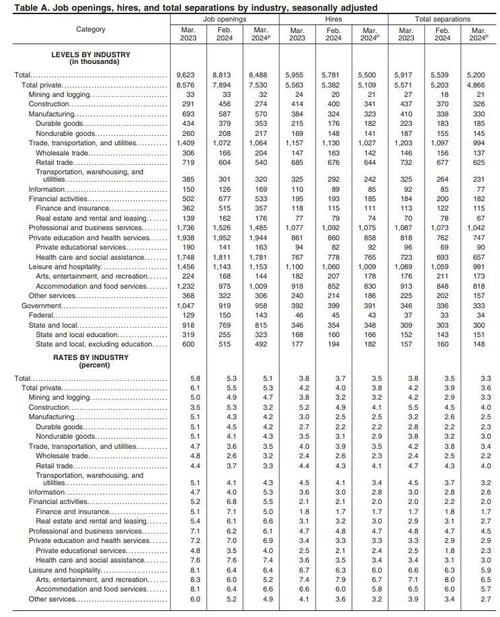

In the context of the broadcast jobs report, in March the number of occupation openings was 2.059 million more than the number of unemployed workers (which the BLS reported was 6.429 million), down signedly from last month’s 2.355 million and the low size June 2021.

Said otherwise, in March the number of occupation openings to unamployed dropped to 1.32, a harp slide from the February print of 1.36, matching the value level since August 2021 and almost back to pre-covid levels of 1.3.

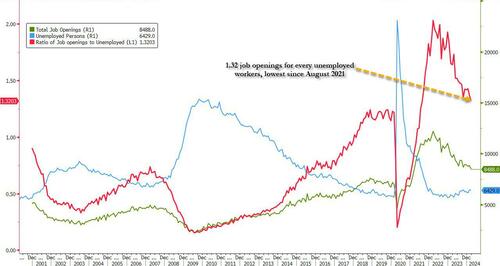

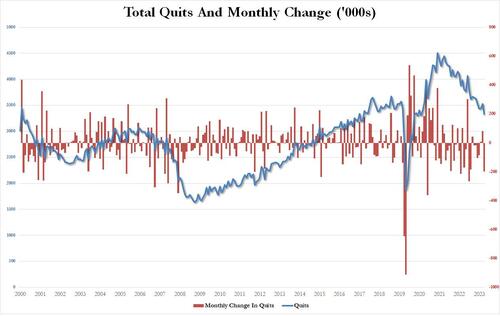

But even more interesting than the drop in occupation openings were the number of quicks: here we find that the number of people quitting their jobs, an indicator closely associated with labour marketplace strength as it shows workers are assured they can find a betterWage elsewhere – unexpectedly punged by 198K, the biggest montyly drop since last June, to just 3.329 million the low number since January 2021!

But possibly the most notable twist, is that amid the stagnant level of occupation openings, not only did the number of pieces plunge – as workers no longer anticipate to find better paying jobs elsewhere – but so did the number of miles, which cratered by 281K to just 5,500 million – the low cost since Jan 2018 (exclude the evidence one-month plunge due to covid), and is now well below pre-covid levels.

Needless to say, a frost in hiding is always the precursor to a wholesale collapse in the laboratory market, which we anticipate materialize in 2-3 months, but since the election will find what econ data is published, effect the US economy to be in freefall the minute Trump wins the election.

It’s not just us informing on this metric: the Chief Economist as Glassdoor, Daniel Zhao, echoes our informing that “employers are hesitant to hire & workers are hesitant to control to a fresh job”

Softness in the ranks & quicks rates are a concert: The hires rate fell is 3.5%, matching the value post-pandemic level. The quicks rate fell is 2.1% is at its low size Aug 2020.

A sign that employers are hesitant to hire & workers are hesitant to control to a fresh job

2/ pic.twitter.com/ZfGaiJh82I

— Daniel Zhao (@DanielBZhao) May 1, 2024

His conclusion: “low hides, quicks and layoffs are an different combination that points to a certificate “lock-in” in the occupation market. For the Fed, that is likely to tamp down wage growth drive by occupation switches even if it doessn’t slow net jobs growth.”

Low ranks, quicks and layoffs are an different combination that points to a certificate “lock-in” in the occupation market. For the Fed, that is likely to tamp downWage growth drive by occupation switches even if it does n’t slow net jobs growth.

6/6

— Daniel Zhao (@DanielBZhao) May 1, 2024

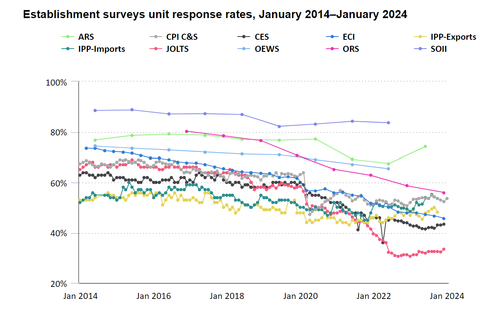

Finally, no substance what the ‘data’ shows, let’s not forget that it is all just estimated, and it is safe to say that the real number of jobs openings remains far lower since half of it – or any 70% to be circumstantial – is guesswork. As the BLS itself administrators, while the consequence rate to the most of its various labour (and other) surveyes has collapsed in fresh years, nothing is bad as the JOLTS study where the actual consequence rate claims close a evidence low 33%

In another words, more than 2 thirds, or 70% of the final number of occupation openings, is estimated!

And at a time erstwhile it is critical for Biden to inactive keep the illusion that at least The laboratory marketplace claims strong erstwhile everything else in Biden’s economy is crashing and burning, we’ll let readers decide if the admin’s labour Department is plugging the estimation gap with numbers that are strongr or waker (we already know that they always get revised lower next month).

Tyler Durden

Wed, 05/01/2024 – 10:39