Japan’s Finance Minister Threatens Liquidation Of US Treasuries, Sparking Shock, Confusion

The first rule of diplomacy is you never directly say what you mean, and you never, ever say what you mean you say.

Japan’s finance minister, Katsunobu Kato, forgot the first rule and it can cost Japan dearly.

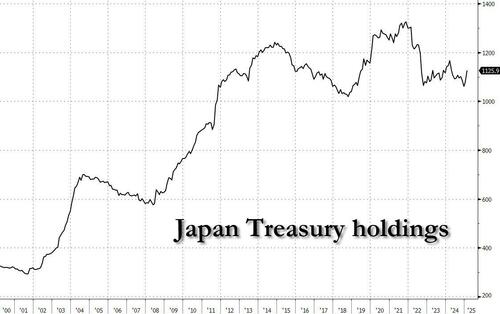

Addressing a question on a Tokyo TV program on Friday, Japan FinMin Kato said the country’s $1.1 trillion in Treasury holdings – the highest of any foreign creditor – could be a „negotiation card” in its trade talks with Washington but „whether or not we use that card is a different decision.” In other words, Japan is threatening to sell some/all of its $1.1 trillion in bonds if tariffs are imposed.

Well, of course, such a move could be a „card”… and as we saw so vividly on April 8 when yields exploded higher amid a furious liquidation of basis trades and/or dumping by both China and Japan, it already has been a „card.”

But the last thing Japan would want to do as its enter the critical tariff negotiation phase, is remind Trump that it may well have a, pun intended, trump card against the US, if only enough to infuriate the president and shake the Fed out of its stupor by forcing it to re-engage QE and purchase anything Japan has to sell… which is precisely what Trump wants!

Or, as the Treasury strongly hinted yesterday, failing debt monetization by the Fed, Bessent could just dramatically expand its Treasury buyback program and gobble up any sell orders emerging from Tokyo and/or Beijing.

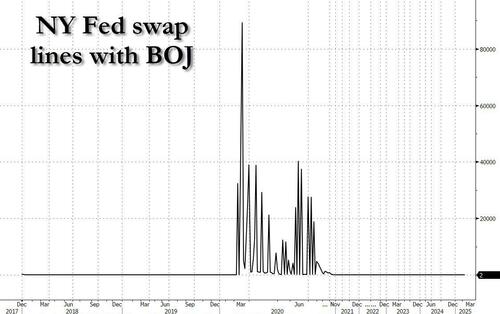

In short, this is the nuclear button for Japan… but good luck engaging in „amicable” trade negotiations, as a result of which the export-heavy Japan simply has to reach a deal – by daring to speak of the one thing everyone in high finance should know is unspeakable. And certainly everyone in Japan, a nation in demographic crisis with 400% in total debt/GDP which has trillions in direct and indirect dollar exposure via the current account and unhedged foreign holdings, which is faced with just as powerful a nuclear button in the form of the Fed’s USD swap lines.

Because if Japan were to start dumping Treasuries, sure – it will send yields surging for a few days – but then the Fed/Treasury will step in to buy all the excess supply, but not before Trump orders a global dollar funding squeeze margin call on counterparts such as Japan, one which will require Tokyo to quickly spit up a few hundred billion, and Japan simply does not have absent the Fed wiring the cash instantly via swap lines… as it did every day for months on end during covid

So no, the reality is that Japan does not have a long-term bargaining chip, unless its political elite is so dumb it believes it can threaten the US by going after the very thing Japan desperately needs, the world’s reserve currency.

Which apparently is the case, because as a shocked Tsuyoshi Ueno, executive research fellow at NLI Research Institute said just minutes after the TV remarks, „Katsunobu Kato’s comments on US Treasuries could be interpreted as dangerously provoking the US government.„

He added that for the US, unstable long-term rates are a concern, and having Japan continue to hold US Treasuries is beneficial, while maintaining fiscal soundness and the dollar’s status as the reserve currency are important issues that would have positive effects in the medium to long term. Translation: chaos in the US would be painful, but it would be catastrophic for Japan.

Furthermore, Ueno noted that while Japan has never easily sold its holdings of US Treasuries, the fact that it is now actively seeking other options is evidence of its desperation. Worse, Japan’s stance is to keep exchange rate policy separate from tariff policy, and using this card could lead to spillover effects on exchange rate issues. Translation: today’s sharp drop in the yen could become an unstoppable waterfall, which finally sparks the hyperinflation that Japan has been fighting for decades.

Others were just as stumped: a befuddled Daisaku Ueno, chief currency strategist at Mitsubishi UFJ, said that given that negotiations are underway between Japan’s top trade representative Akazawa and US Treasury Secretary Bessent, the statement was likely made to avoid confusion, with a focus on playing it safe. Unfortunately, it came off as just the opposite, potentially threatening to derail any deal, which would be a catastrophic outcome for Tokyo.

Westpac also chimed in, noting that Japan is „clearly disappointed” with trade negotiations so far given the nation is a strong ally with the US. “As Theodore Roosevelt said, ‘speak softly and carry a big stick’ — and Treasuries are a big stick,” Martin Whetton, head of financial markets strategy, said of Japan Finance Minister Katsunobu Kato’s comments on US government debt as a negotiation card

“It means when the trade negotiations start, they have some cards” adding that „Japan is clearly disappointed that as such a strong ally, they have been treated this way.” Of course, it will be far more disappointed if it starts dumping Treasuries.

Finally, as Win Thin, global head of markets strategy at BBH said, Kato’s threat is “a double-edged sword” as “threatening to dump an asset that you are sitting on huge pile of means that you can hurt yourself in the process.”

He added that “as far as I can recall, China has never played that card before and so I’m a bit surprised that Japan is thinking about it.”

His conclusion is that „the key takeaway is that Japan is not going to roll over easily to US demands and is starting to push back.”

And now we wait and see how Trump reacts when Japan decides to „push back” – surely, the measured US president’s reaction will be cool, calm and collected, and result in the best possible outcome for all…

Tyler Durden

Fri, 05/02/2025 – 00:28