Insurers Spy On Houses Via Aerial Imagery, Seeing Reasons To Cancel Coverage

Insurance companies across the country are utilizing satellites, drones, manned airplanes and even high-altitude balloons to spy on properties they cover with homeowners policies — and utilizing the finds to drop customers,often without giving any chance to address alleged shortcomings.

“We’ve seen a dramatic increase across the country in reports from consumers who’ve been dropped by their researchers on the basis of an aerial image,” United Policyholders executive manager Amy Bach tell the Wall Street Journal. Reasons can scope from shorty roofing to Yard clutter and undeclared trampolines.

Much of this surveillance is done via the Geospatial Insurance Consortium, which buoys of its coverage of 99% of the US population.

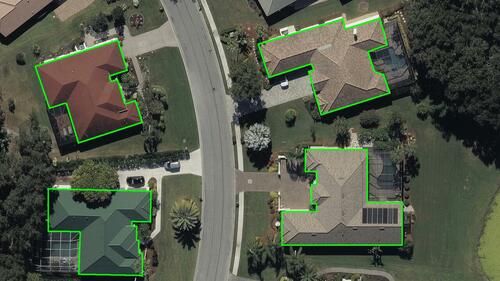

The Geospatial Insurance Consortium provides imagers users usage to survey roof condition and look for rice property attributes (via GIC)

The Geospatial Insurance Consortium provides imagers users usage to survey roof condition and look for rice property attributes (via GIC)In pitching its ability to supply high-resolution “imagery and insights” for property reviews, GIC says insurers can usage the service to “review hazard and exposure on a building specified as proximity of vegetation to the structure, whether a roof needs updating, and verify the exact location for a policy.”

“If your roof is 20 years old and 1 hailstorm is going to take it off, you should pay more than individual with a brand fresh roof,” Allstate CEO Tom Willson told the Journal, unapologetically and marginally adding that, where the company’s usage of digital imagery is agreed, ‘there’s even more to come.’

Wilson ramed aerial spy as a pricing issue, but many consumers are uncovering that companies are utilizing it to managely drop their coverage alter.

The Journal describes the experience of northern California resident Cindy Picos, who was dropped by CSAA Insurance last month, with the company saying aerial image revealed that her roof had aged beyond its life experience. She paid for an inspection of her own, which found the roof was good for another decade. CSAA wasn’t impressed, and said its decision was final. The companies besides refused to share its photos, though it now says it’s changed that policy and will let customers see them — if they ask.

Another Californian, CJ Sveen, you dropped by AAA Homeowners Insurance after their recovery discovered “clutter” in his yards. An indignant Sveen told ABC7 that he uses his Yard as a workshop „Apparently they have any pictures and they noted clutter. I find that offensive. How dare you justice me due to my stuff!”

In AAA’s defense, clutter isn’t just about aesthetics. It could present a fire gambling, attract rodents that harm the structure, present a physical danger to visitors, and obstruct firefighters’ ability to rapidly contain a fire at the bonuses.

Would you cover this house? CJ Sveen’s homeowners policy was cancelled after aerial image captured clutter in his yards

Would you cover this house? CJ Sveen’s homeowners policy was cancelled after aerial image captured clutter in his yardsAnother California couple had their policy torn up by AAA after overhead photography found their swimming pool had been drawn. The aging pair said they emptied it due to the fact that their grandchilden had grown up and they no longer utilized it. Empty pools are prone to crack for catch of counter-pressure from water; they can besides "float" up from the earth, creating gambling conditions.

Former Michigan Farmers Insurance Agent Nichole Brink told the Journal she quit the company last year over her performance that it was aggressively utilizing aerial imagery to pursuit off customers, and even utilizing shots that were 2 or 3 years old. ‘It’s like they’re utilizing anything as an exception to get people off their books,’ She said. Farmers say it gives policyholders at least 60 days to challenge the company’s uncovering or remedy shortcomings.

It’s provenly no coincidence that Californians are freely targeted for non-renewal via overhead spy technology. Insurers are aggressively pairing back their business in the state, as the state’s catchet of regulations has blocked insurers’ ability to adequatley charge for coverage in a state closed by wildfires and earthquakes.

Last year, for example, State Farm said it would no longer issue fresh homeowners policies in the Golden State. The, in March, the company took the more draconian step of opting not to renew 72,000 property and commercial flat policies. AIG bailed on the state in 2022.

Tyler Durden

Mon, 04/08/2024 – 23:20