In The Next respective Weeks, We Should See $300 Billion Of Liquidity Leaving The System

Submitted by Larry McDonald, creator of the Bear Traps study and author of the recently published book “When Markets Speak” which has been #1 on Amazon over the last week across the bridge non-fiction, finance categories.

What’s Under the Surface?

The heart of “conditioning bias” comes down to 1 sentence. The lounge something works, the more players get drawn into playing the game. We know the junkies are on all street corner these days buying call options erstwhile the VIX is up 29% since late December with equity as measured by the S&P 500 – up just a contact more than 9% higher.

Over the last 30 years — most of the time, the CBOE Volatility Index has been supported by investors looking for downside protection in buying puts. But 2024 is much like 1999. For most of that year, the same thing occured. Today, many players on the field say “greed is good” and they’re all buying upside.

They Love to Buy the 20 Day Moving Average

As the marketplace grinds higher – more and more capital came into the hands of algae and quants buying the 20-day moving average. This is an crucial area to keep an eye on. There are so many players involved, that a revolution of the 20-day moving average will likely come with a meansful flush lower.

What Could Alter the Equality?

In the next respective weeks, we could see about $300 billion of liquidity leaving the system. This is in large part due to the taxation deadline on April 15 (see “$265 Billion In Capital Gains taxation Selling: Morgan Stanley Warns Momentum Mauling Is Coming, Thanks To The IRS”). We should anticipate large taxation returns, in part due to the fact that taxpayers have signed capital gain from the 2023 equity bull run. Treasure bill issue will flip negative in Q2 to the tune of about $150 billion as the government runs a budget supplus for a cup of coffee. Add to that the $95 billion in monthly QT (quantitative shaking, Fed balance sheet reduction) and we could see $250 billion of liquidity drain. On top of that, this period about $75 billion of the Emergency bank lending facility (BTFP loans) expired and since the facility is now closed, they may not get renewed. This cases another contrast in bank reserves.

Keep in mind, that S&P 500 companies are inactive in the buyback blackout period, which means that they cannot buy back their stock until they have reported holidays. Stock buybacks are about $100BN per month, so this upward force on stocks is presently gone.

Equity Volatility is inexpensive vs. Encroaching Risks

The combination of the cocktail means listed above makes the marketplace very vulgar and at hazard of a Larry drawdown if any geopolitical hazard comes to the surf. Each week, Iran and Israel look toward retaliation, and the probability of escape is rising. Brent is up close 30% since December, putting crucial force on higher bond years. Over the same period, the year on U.S. 10-year Treasures has moved from 378bps (3.78%) to 440bps (4.40%).

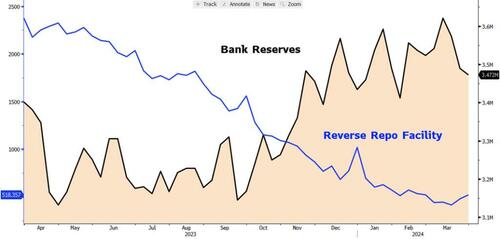

One of the biggest drivers of the stock marketplace since early 2023, and especially since summertime October, has been liquidity. In an election year of course, Treasures Secretary Yellen and Fed Chair Powell have carefully rebuilt a large chunk of the excess liquidity that underpinned the stock marketplace rally. The 2 main reasons for the liquidity boost have been to — a) stabilize the banking strategy after SVB (Silicon Valley Bank) blew up a year ago and — b) to suppress flexibility in the election year. A large amount of that liquidity has come from the Reverse Repo Facility (RRP). This is simply a facility the Fed brought to life in 2020 to mop up any of the excess liquidity from all the Fed’s juicy fresh programs utilized to stabilize the financial strategy during the Covid Financial Panic.

Pick up our latest book “When Markets Speak” which has been #1 on Amazon over the last week across the bridge non-fiction, finance categories.

Remember, the Fed injected $3.3T of liquidity into the strategy that year. Fast forward to the end of 2022, and there was almost $2.5T in this RRP facility. always since, Treasury Secretary Yellen has been utilizing this money in this honey pot, the RRP to finance her ~$2.5T of bill issue. The way this works is that erstwhile the Treasury ramps up bill issue, it will push up bill years. At any point that young we go above the rate on these reserve balances in the RRP. This is what the Fed pays investors, mostly money marketplace funds, to keep money in the RRP. These investors get lured into the bills marketplace with its higher rates and they take their money out of the RRP and buy bills with it. The money in the RRP is not included to be part of the overall liquidity, so if that money leaves the RRP and enter the coins market, it adds to the liquidity pool. Much of this money has ended up up in a peculiar component of the commercial banks’ balance sheet called the reserve balance helmet at the Fed. In the past, the Fed injected liquidity into the via QE system, which besides increases these reserves. But in the last year, the bank reserves expanded primary from the RRP depreciation, and the Fed’s introduction of the Bank word backing Program in March of last year. This program allowed banks to bow from the Fed and usage their bonds at par as collective. This was done to invest liquidity into the banking strategy to avoid a cash shortage at mostly regional banks following the blow-up of SVB.

Excess Liquidity, Bitcoin, and the S&P

Excess liquidity have suggested higher in the last year, which has pushed up hazard assets, specified as bitcoin and equities.

Together with the introduction of the BTVP in March ’23, the Fed and Treasury pushed up bank reserves from $3T on Oct 22, to $3.6T by March ’24. What do these reserves do? These reserves cannot leave the banking strategy and so cannot enter the “real economy”. It’s a financial form of money only for banks. They can transact in reserves with each another and seat repo and reverse repo transactions. They account for high-quality liquid assets (HQLA) together with bonds and mortgage-backed securities (MBS). Most importantly, banks usage the reserves to buy bonds from each other. In this way, they drive liquidity into the marketplace and drive investors into riskier assets. We see that even all time reserves go up, hazard claims benefit.

Bank Reserves Go Up erstwhile RRP Goes Down and Vice Versa

As the Treasury pushed money out of the RRP, bank reserves hedge at the Fed have gone up simultaneously. This has been 1 of the biggest driver of stock marketplace gain

In the next fewer weeks, we could see liquidity reverse for 2 reasons.

- 1) Treasure bill issue will flip negative in Q2 to the tune of about $150bl. In Q1, 400bl of capital went from the RRP into the bills market, and in Q2 this will reverse. Add to that the 95bl in monthly QT and we could see 250bl of liquidity drain.

- 2) Expiration of the BTFP. In April about 75bl of BTVP lounges expire and since the facility is now closed, they may not get renewed. This cases another contrast in bank reserves.

Overall we could see over $300bl of contrast if Yellen/Powell do not step in to offset. We think they will step in but it might take a period or so for them to react.

In the meanstime, we are inactive in the buyout blackout window ($100bl of monthly buybacks do not start again until after GOOG/AAPL study in late April/Early May) so we could fly into an air pocket.

In the next blog post, we will research how Yellen and Powell can and will come up with a solution if they see liquidity plunge besides far or stock marketplace flexibility surges higher.

Tyler Durden

Tue, 04/09/2024 – 08:25