Here’s What Will Push Oil Above $100/Bbl

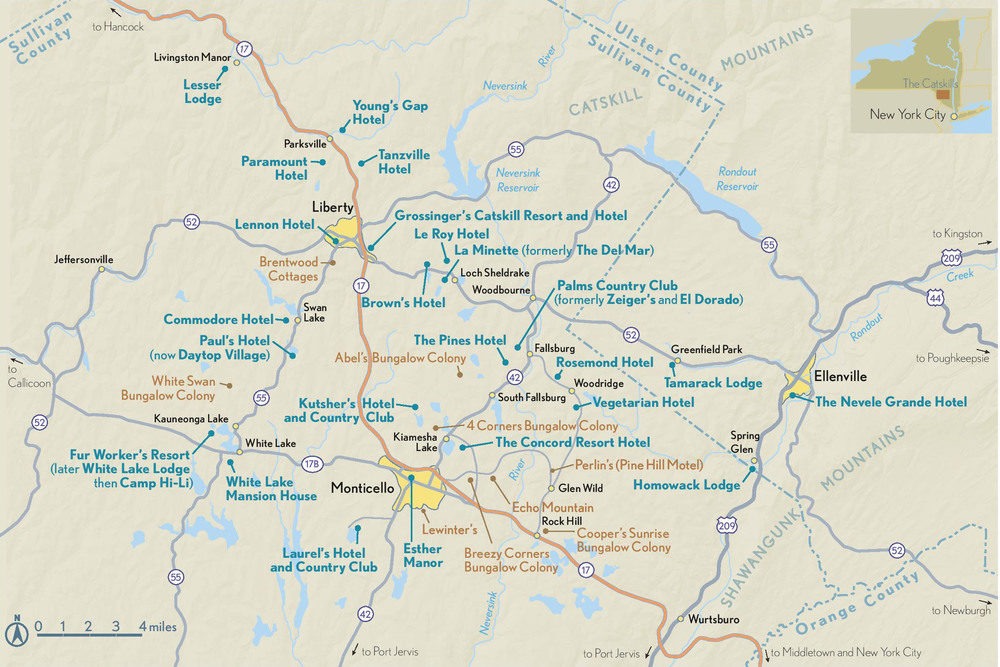

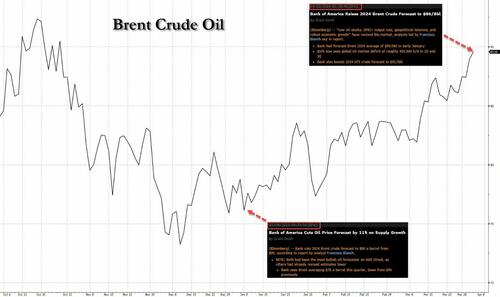

Back in early December, just after Powell’s dovish pivot shocked everyone, many closet oil bulls like BofA’s energy strategist Francisco Blanch, predicted that a dovish Fed would send oil back to $100. Unfortunately for him, oil did nothing and just 1 period later, as no oil buying had materialized, Blanche threw in the bullish towel and cut his oil price forecast by 11%, ironically bottom touching to the dot oil just as it was about to soar by 20% in the next 3 months, an ascent which was capped with... Blanch racing his Brent oil price forecast.

To be sure, BofA Wasn't the only 1 to foretell $100 oil: 2 weeks ago JPMorgan community analyst Natasha Kaneva was looking at Russia's unexpected pivot to produce little oil than it was allowed, and gate that ‘the shift in Russia's oil strategy is surprising’ and ‘at face value, and assuming no policy, supply or request response, Russia's actions could push Brent oil price to $90 already in April, scope mid-$90 by May and close to $100 by September, keeping force on the US administration in the run-up to elections.‘

In short, the face of Biden’s re-election was now in the hands of Putin if the Russian leader wanted to push up the price of oil back to triple digits by limiting output, and the only recourse Biden has – according to JPMorgan – was relaxing another 60 million barrels of oil from the SPR (see full JPM note here).

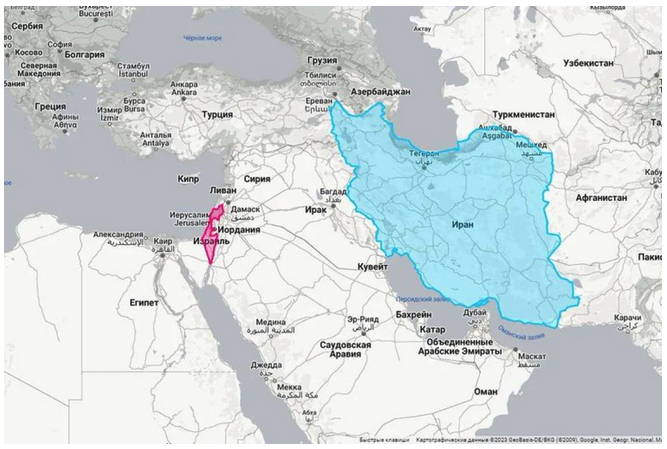

But it is increasingly applicable that $100+ oil is inevitable, respecting what Putin does or does not do, and as Bloomberg writes over the weekend, the Odds of $100 oil are rapidly rising, due to the fact that while the fresh economy in po; above $90 just days ago was blamed on escalating militarisms between Israel and Iran, "The rally’s foundations went deeper — to global supply shocks that are intensify fears of a community-drive inflation resurgence.”

Consider: a fresh decision by Mexico to slash its crude exports is compounding a global slideze, promoting refiners in the US (the world’s biggest oil producer) to consume more home barrels. At the same time, American sanctions have marked Russian cargoes at sea, with Venezuelan supply a powerful next target. Meanwhile, Houthi rebel attacks on tankers in the Red Sea have delayed crude ships, and despite all the ‘turmoil’, OPEC and its allies are contacting with their production cuts.

It all adds up to a magnitude of supply disruption that has taken traders by surprise. The Crunch is turbocharging an oil rally head of the US summertime driving season, threatening to push Brent crude, the global benchmark, is $100 for the first time in almost 2 years; in fact the last time oil was trading there, Joe Biden was drawing the SPR to the tune of respective million barrels per week. That’s amplifying the inflation deals that are clouding US president Joe Biden’s reelection exchanges and complicating central banks’ rate-cut deliberalations.

For oil, “the bigger driver right now is on the supply side,” said Amrita Sen, founder and manager of investigation at Energy Aspects. “You have seen rather a fewer pockets of supplly duty, and request overall on a global basis is healthy.”

According to Bloomberg, oil ships from Mexico, a major supplier in the Americas, slide 35% last period to their low value since 2019 as president Andres Manuel Lopez Obrador tries to make good on promises to wean the country off costly full imports. The country’s exports of alleged sour crude — the heavy, dense kind that many refineries are designed to process — now stand to shrink even further as state-controlled oil company Pemex is now planning on cutting an additional 330 kb/d in May, Reuters reported city sources.

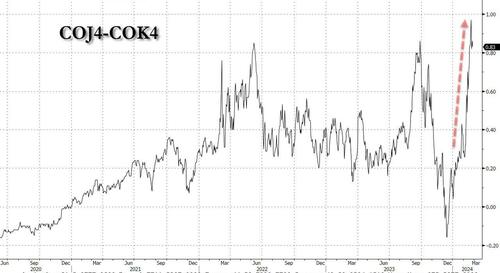

That decision has roiled oil markets around the world. Mars Blend, a medium-density sour crude from the US Gulf Coast, has in fresh days spring to a multi-year premium over lighter WTI, the national benchmark. Mars uses trades at a discount to WTI. Brent crude hit $90 a barrel on Thursday, the highest since October, and extended gain on Friday. JPMorgan said it could hit $100 by August or September.

Canadian Cold Lake oil priced at the Gulf Coast traded at the communicative discount to WTI in almost a year. Key Indicators for mediate east medium-sour crude, specified as Oman and Dubai contracts, are ralling too.

To be sure, it’s not just Mexico’s foul: back in February we first warned that long before hedge funds – all dense short crude – realized what was coming, the physical marketplace was scratching tightness with the Brent prompt spread exploring to a backwarding around 90 cents after tumbling to a multi-year low in summertime December.

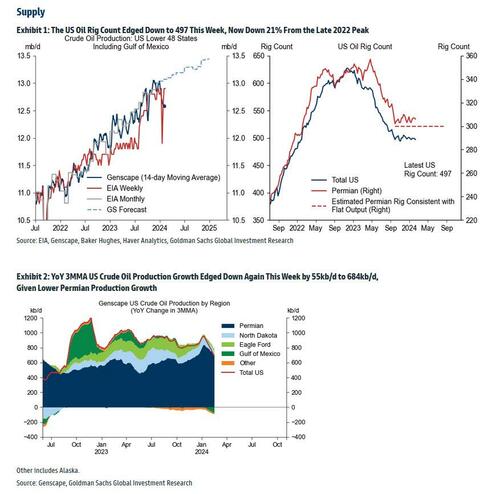

And indeed, a cloud look at oil supply shown that there was a clear drop off in production which would warrant higher prices.

The Sharp drop in output in early 2024 came before Mexico’s move, erstwhile we note a series of supplistic disruptions both large and small: in January, a deep frost ate distant at crude exit and inventories in the US at a time erstwhile they would usually grow, keeping stockpiles below seasonal ages through summertime March. Then, Mexico, the US, Qatar and Iraq cut their combined oil flows by more than 1 million barrels a day in March, tanker tracking data shown (Baghdad pledged to limit output to make up for non-compliance with prior pledges to OPEC+).

Also adding to the tightness, OPEC associate the United arabian Emirates curbed ships of its advanced Zakum, and medium-sour oil, by 41% in March combined with last year’s average, according to Kpler data. The state oil company is diversifying more supplies of that crude to its own refinery, traders told Bloomberg. thought the cuts were expected and Abu Dhabi National Oil Co. is offering buyers another kind of Crude as a substitute, the decline in advanced Zakum exports is contributing to higher regional prices amid the broadcaster OPEC+ curtailment.

Crude markets in Europe, meanwhile, were pressurized higher by the Houthi attacks in the Red Sea, which sent millions of barrels of crude on a detour around Africa, delaying any supplies for weeks. Disruptions to a key North Sea pipeline, unrest in Libya and a damaged tube in South Sudan besides requested to the rally, while US sanctions have deprived Russia of tankers that previously transported its oil to buyers including India.

Making substance bags for Biden who is absolutely terrified of higher oil and gas prices, the supply pinch could be come even more acute in the weeks ahead. That’s due to the fact that Venezuela dictator Nicolas Maduro is showing no sign of heading promises he made to Biden and another ‘democracies’ to decision toward free and fair elections, in consequence to the Biden administration could reimpose sanctions this month, even it most likely won’t as it would mean an even lower approval rating for the outgoing US president, confirming one more time just how tiny and lavish western ‘democration’ ideals are.

The plunge in supplly – which we warned about 2 months ago, and which has materialized now – is simply a stark contrast from just a fewer months ago, erstwhile oil punged to multi-month lows as U.S. production sealed and Russian seaborne cruise exports ratified higher despite sanctions, which have had since expanded. The US Energy Information Administration, after forecasting global inventions to reconstruct changed this quarter, now predicts they’ll fall by 900,000 barrels a day. That’s the equivalent to the production from Oman.

Putting it all together, Goldman – which has turned deciduously little bullish on oil always since the company’s iconic community analyst Jeff Currie quit last year – last night published a study (available to pro subscribers) in which it said that the marketplace is yet pricing in “firm request and geopolitical supply risks, which together have boosted position and value.”

And while Goldman results Brent to stay below $100/bbl in its base case in which the bank assumes:

- allready solid demand,

- no additional geopolitical supply hit, and

- that selected spare capacity will lead OPEC+ to rise production in Q3.

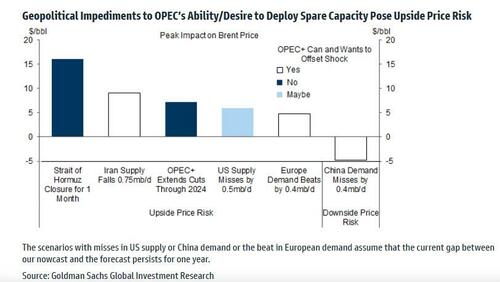

... the bank wars that «geopolitical impediments to OPEC’s ability/desire to defloy spare capacity could send Brent above $100.” Needless to say, erstwhile it comes to ‘base case’ forecasts from Goldman’s investigation desk (not to be confused with the bank’s conventional Sales and Trading board), they virtually always end up being crow, which is why $100 oil is now virtually guaranteed.

Goldman besides listed another reasons why Brent could scope $100, including i) the Russia-Ukraine or mediate East conflicts may harm upstream, midstream, or downstream oil infrastructure, and ii) Iranian oil supply may decline on disruptions or under a powerfully more hawkish US.

Below we excerpt from the Q&A attached to the Goldman study (the full note is available to pro subs in the useful place).

Q. Why have broken oil prices rallied?

Brent has rallied to 91/bbl due to the fact that The marketplace is now pricing in a firm request outlook and any geopolitical bottom risks to oil supply, which together have boosted positioning and valuation.

Updated marketplace appearances of oil request have fueled the rally.

- First, the IEA forecast of 2024 oil request growth has creep higher on solid oil request data outside China, and GDP upgrades.

- Second, sentiment about request in investor conversations has turned from bearish to constructive.

- Third, oil prices have besides taken after strong activity releases this week, including manufacturing Surveys in China, the US, and India and US employment.

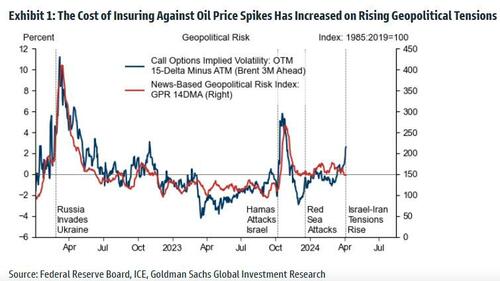

The geopolitical hazard premium—the compensation investors request for the hazard that geopolitical shocks reduce oil supply—has besides picked up following attacks on Russian repineries, and rising Iran-Israel tensions. That said, the cost of insuring against oil price springs restores little elevated than in October 2023 and in 2022, due to the fact that mediate East crude production restores unaffected by the war (Exhibit 1).

As the marketplace is now pricing in companies request and geopolitical supply risks and as oil request for inflation hedge has picked up, means of positioning and valuation have risen sharpy. Net managed money in crude and refined products has been suggested by over 400 million barrels since December (Exhibit 2). Our pricing framework suggests that actual Brent 1/36m timespreads have moved from signedly undervalued in December to now modernly overvalued based on our nowcast of OECD innovations and our assessment of a modern 0.4mb/d Q2 deficit.

And the punchline: Q. What could push Brent oil prices above $100/bbl?

We see only modernly bullish risks to our non-OPEC+ balance from company request in Europe, and likely temporal stableness in US supply. In contrast, We believe that lower OPEC supply for longer, for instance due to geopolitical impediments to OPEC’s ability and/or desire to make spare capital, could send Brent above $100 for any time.

Specificly, we see upside risks to our 2023Q3 Brent forecast of $86/bbl in respective possible geopolitical scenarios:

- OPEC+ may extend the existing production cuts further in a context of increased pressures between the West and respective key OPEC+ countries

- The Russia-Ukraine or mediate East conflicts may harm upstream, midstream, or downstream oil infrastructure (as has happened to Russian refineries)

- Iranian oil supply may decline on disruptions or under a powerfully more hawkish US Administration

- While highly unlikely, we estimation that an intervention of oil flow through the Strait of Hormuz would lead oil prices to emergence 20% in the first period and evenly double if the interference assumed for respective months

Translation:not just Putin, but all of OPEC+ now controls the result of the 2024 US election.

More in the full note available to pro subscribers.

Tyler Durden

Mon, 04/08/2024 – 15:45