Grayscale CEO Michael Sonnenshein Steps Down Amid Relativeless ETF Outflows

Michael Sonnenshein has stepped down from his function as the CEO of Grayscale Investments, the WSJ reported.

“I would like to thank Barry Silbert for his imagination and partnership and for entering me to lead Grayscale’s business. The crypto asset class is at an crucial inflation point and this is the right minute for a smooth transition", Sonnenshein said on his way out.

Michael Sonnenshein became Grayscale’s CEO in 2021

Michael Sonnenshein became Grayscale’s CEO in 2021He will be replaced by Peter Mintzberg – who presently serves as the global head of strategy for Goldman Sachs’s asset and wellness management division – on August 15, according to Barry Silbert, founder and CEO of Digital Currency Group, Grayscale’s parent company.

2/ I want to thank @Sonnenshein-uring his 10 years @Grayscale, Michael guided the companies through exponential growth & oversaw its pivotal function in bringing place bitcoin ETFs to market, leading the way for the broader financial industry. We want him the best in his future endavors

— Barry Silbert (@BarrySilbert) May 20, 2024

Silbert recruited Sonnenshein in 2013 to aid rise assets for GBTC, which had only $60 million at the time. In the early days, the duo would go on roadshows to pitch the fund to conventional finance professionals only to have the meetings presented in the wake of negative headlines about Bitcoin, Sonnenshein retrieved earlier this year.

“There were definitely times erstwhile we would have been allocated 45 minutes to a gathering and very rapidly into a meeting, we would find we were’t capturing people’s attention,” he said in a March interview, adding that a “palpable passion for crypto and bitcoin” kept them going despite the setbacks.

His recreation, Mintzberg – whos 20-year ETF-focused Wall Street career spans BlackRock, OppenheimerFunds and Invesco – said that he has ‘long-admired Grayscale’s position as the leading crypto asset management companies, and I am honored to join the most talented and vertical squad in the business. This is an breathtaking time in Grayscale’s past as it continues to capitalize on the unprecedented minute in the asset class.”

Mintzberg will take control of Grayscale during a very challenging period: for years, the Grayscale Bitcoin Trust, or GBTC, was 1 of the fewer ways for investors to bet on bitcoin in their brokerage accounts without buying the cryptocurrency itself. This privileged position helped the trust, known by its GBTC ticker symbol, amass more than $40 billion in assets under management at its highest in November 2021.

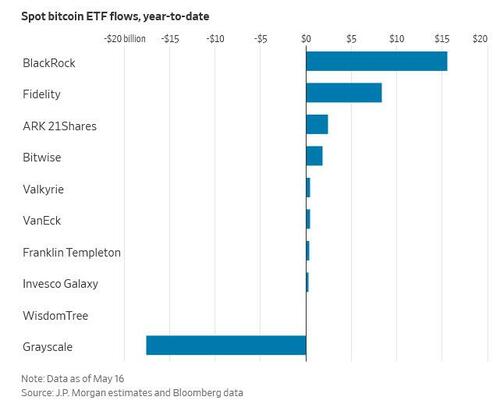

However, in fresh months Grayscale’s Bitcoin fund has experienced a reverse of fortune, with investors pulling more than $17 billion since it converted into an exchange-traded fund in January. In contrast, 9 recently launched bitcoin ETFs from Wall Street asset managers specified as BlackRock and Fidelity Investments have acquired more than $30 billion in inflows. The simplest reason for that is that while GBTC charges a 1.5% fee, all another bitcoin ETFs charge next to nothing.

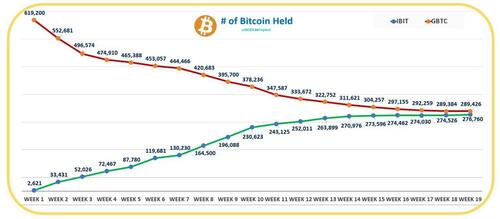

Ironically, Grayscale is mostly responsive for the long-awaited regulators adopt of place bitcoin ETFs – these that hold bitcoin directly, alternatively of via futures contracts, as erstwhile products did, and in doing so it has seen its own bitcoin holdings shrink by more than half since the launch of the place bitcoin ETF manufacture on January 10.

The company sued the SEC in 2022 after the agency rejected its erstwhile bid to turn it bitcoin trust into an ETF. The SEC greenlighted the mass launch of the funds in January after repeatedly returning the applications on the basis that the underlying marketplace was susceptible to fraud. erstwhile applying the fresh funds, SEC Chair Gary Gensler said the court rulking in Grayscale’s favour had compelled the change.

While Grayscale's GBTC is the largest ETF by on-chain Bitcoin investments, presently holding over 287,801 BTC, worth $19.3 billion and holding a 34.9% marketplace share, due to its stacking 1.5% yearly fee (compared to the manufacture standard of 0.20% to 0.25%) it continues to bled bitcoins regular which gets relocated to cheerer alternatives.

In comparison, BlackRock’s iShares ETF (IBIT) is the second-largest, holding over 274,000 BTC, worth $18.4 billion, and having a 33.3% marketplace share, according to Dune. It is only a substance of time before IBIT surpasses GBTC in full holdings.

Source: Hodl15 Capital

Source: Hodl15 CapitalSonnenshein previously said that he was born’t willing about the investor exodus and suggested that GBTC’s fee would come down as the marketplace mates, nevertheless judging by the unexpected department, he was actually welcomed.

That said, despite the constantly outflows, Grayscale continues to make robust gross thanks to a harp emergence in crypto prices and the advanced fees charged by its bitcoin ETF. In the first quarter, Grayscale generated $156 million in return, accounting for more than half of DCG’s $229 million total, according to DCG’s first-quarter investor letter.

Grayscale Chief Financial Officer Edward McGee will lead the company as chief executive officer until August.

Tyler Durden

Mon, 05/20/2024 – 13:20