Gold Flowers Amid April 'Stagflation' Showers; Stocks, Bonds, & Crypto Crushed

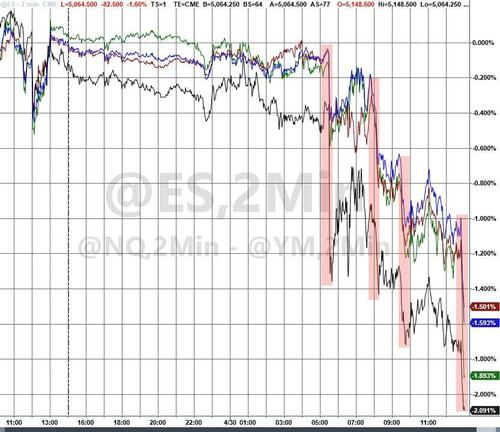

The final day of April was truly oblique: ECI way hotter than expected (spooked markets), Case-Shiller home prices soared far more than expected (spooked markets more), Chicago PMI knocked (while prices paid increased), Consumer assurance crushed, and Dallas Fed Services slumped... all of which left stocks, bonds, gold, crude oil, and bitcoin all languishing into month-end while the dollar rallied.

Stocks knocked into the month-end close present ahead of AMZN...

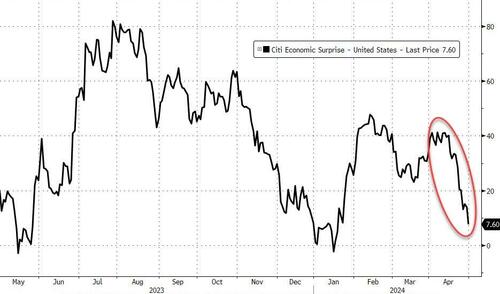

April was a disaster from a macro perspective...

Source: Bloomberg

...with soft survey data collapsing While 'hard' data lymphed modernly higher...

Source: Bloomberg

...and Worse inactive increasing without 1 could ignore it...

Source: Bloomberg

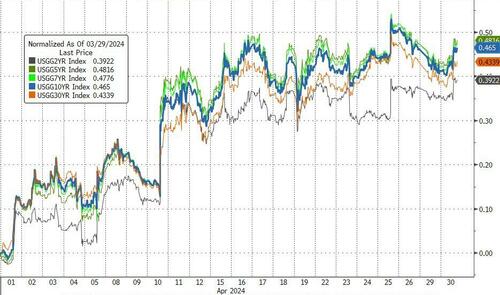

Against the backdrop of US 10Y years up ~45 bps in the period of April...

Source: Bloomberg

... and the marketplace taking another rate-cut off the board...

Source: Bloomberg

...price action in April is possibly not overly amazing with Equities broadly lower, albeit, with NDX / Quality / Mag7 continuing to outperform.

Source: Bloomberg

Goldman’s Peter Callahan notes that since 2006, the S&P 500 has fallen by an avg of 4% erstwhile real years rose by more than 2 stdev in a month.

April was the first down-month for stocks since The Fed Pivot (Oct 2023). This was the worst period for The Dow since Sept 2022. Nasdaq offered its worth period since Sept 2023.

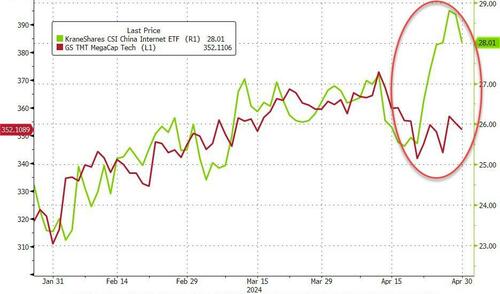

Interestingly, while US majors and sectors were red (broadly speaking) in April, Chinese net stocks soared back to life (+9.5% vs US MegaCap -2%)...

Source: Bloomberg

Sectors were very mixed in April with Energy and Utilities outside (the later on AI energy use, since its typical relation to rates decoupled) and Real property lagged (along with Tech)...

Source: Bloomberg

The basket of Magnificent 7 stocks Saw red in April for its first monthly destiny since October and Worth monthly destiny since September. The last week has been tempestious to say the least as TSLA (win), META (lose), MSFT and GOOGL (win) all hit...

Source: Bloomberg

Still, stocks have a long way to catch down to the fresh reality paid into the short-end of the Bond market...

Source: Bloomberg

As we noted above, the TSY curve was up comparatively uniformly on the month, but possibly most notably was the 2Y youth which tested 5.00% numerical times and Broke out today...

Source: Bloomberg

One more notable event in April was the dancing of financial conditions (Admittedly only marginally), but definitely more what The Fed wants comparative to the utmost 'eassiness' that had been paid in after Powell’s pivot...

Source: Bloomberg

The dollar rallied for the 4 period in a row with the large gain coming mid-month....

Source: Bloomberg

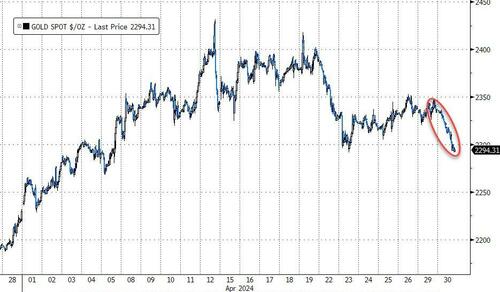

Despite taking a battery today, Gold managed solid gain on the month, topping $2400 at its evidence highs...

Source: Bloomberg

Oil prices ended the period marginally lower, thanks to today's selloff...

Source: Bloomberg

Copper was the outgoing community in April, rising around 14% to 2 year highs with practically no drawdown as the reflection trade came back to life (on the back of AI demand)...

Source: Bloomberg

Bitcoin had an oblique month, down 15% after 7 consecutive months of gain...

Source: Bloomberg

As BTC ETF flows started to ebb – Net Flows (include GBTC): April -$183mm, March +$4.62bn, February +$6.03bn, January +1.47bn...

Source: Bloomberg

Finally, the eventual analog remains in play...

Source: Bloomberg

...with NVDA bouncing back, just like CSCO did.

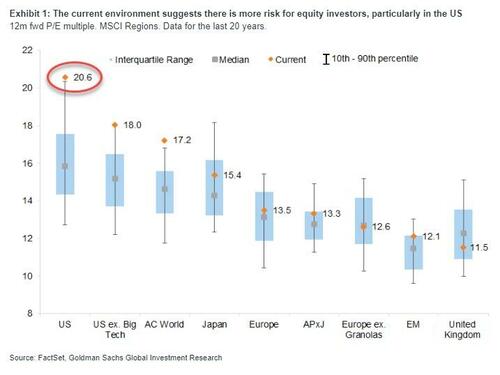

And bear in mind, as Goldman’s Peter Oppenheimer points out, US equity marketplace valuation is presently at an utmost level comparative to history...

...also a condition that typically means higher rates Weather more dense on stocks.

And while April showerers are over...

The S&P 500’s vol word structure suggestions the storm is not over yet.

Tyler Durden

Tue, 04/30/2024 – 16:00