Gen-Zers Slide Deeper Into Debt As Bidenomis Failure Crushes America’s Future Leaders

It may see crazy, but here’s any advice for heavyly indebted Gen-Zers:

- Put down the smartphone.

- Stop spending on DoorDash and Uber Eats.

- Perhaps cancel a fewer streaming services.

Also, the spending organization is over despite calls from the White home to cancel student debt.

The rising debt burden Gen-Zers are carrying is alarming. The average credit-card balance for 22- to 24-year-olds was $2,834 in 1Q23, combined with an average inflation-adjusted balance of $2,248 in the same period in 2013, according to Wall Street Journal, citing fresh data from credit-reporting agency TransUnion.

The youngest generation is coming to age during a time erstwhile Bidenomics has been a complete failure, and these kids are spending themselfves in financial ruins.

"This is simply a generation that is feeling financial stress in a more acute way than millennials did a decade ago," said Charlie Wise, head of global investigation at TransUnion.

On Tuesday, Billionaire investor and Duquesne household Office president & CEO State Druckenmiller slammed Bidenomics and warned the national Reserve and national government “missdiagnosed Covid and thought it was you — we were going into a depression.”

Druckenmiller has been troubled by the national government’s massive fiscal spending, which we outlined last year as a ‘stealth stimulus’ propelling Bidenomis. Meanwhile, Fed Chair Jerome Powell has enabled the Bidenomics disaster by spending $1 trillion all 100 days. With stagflationary thrashing, the US economical situation is rapidly deteriorating.

Besides the vast majority of the working mediocre slammed by Bidenomics, as noted by McDonald’s, Starbucks, and Tyson Foods executives in earlys calls in fresh weeks, Gen-Zers have been very vocal about a crap environment they were given after taking out $100,000 in college loans. Many accompanied on X:

Woman defends Gen-Z not wanting to work a 9-5 for the remainder of their lives

“I don’t want to work my tail end off, being all of my life working, just to be able to pay my bill” pic.twitter.com/BxaTXjaxcd

— Unlimited L’s (@unlimited_ls) January 8, 2024

A lot of people seem to think this mindset is unique to Gen Z. It’s not.

Every generation goes through this. Watch Reality Bites, where a group of 20-somethings in the early 90s deal with the exact same streams and emotions as determined in this video.

pic.twitter.com/7h1gAN3c7R

— Matthew Kobach (@mkobach) October 20, 2023

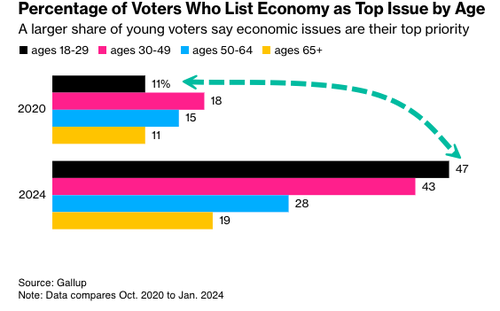

Democrats and the Biden squad have a serious problem as the latest polling data from Gallup shows the president’s polling data is rapidly deteriorating amongst the 18-29-year-old vote.

Source: Bloomberg

Source: BloombergWSJ provided readers with respective sad stories about strugdling Gen-Zers fresh out of college.

The first:

Lindsay Quackenbush was late working for a publishing company that paid her $60,000 a year. The money was just adequate for the 26-year-old to cover her condition of the rent for the fresh York City base flat where she and her boyfriend live. Then she was laid off.

She is carrying a balance of about $1,700 across 3 credit cards and is for the first time not able to pay off her credit cards in full. She is making the minimum payment for now while she hunts for a fresh job.

As for reasoning about milestones specified as matrimony and children, she and her friends have discussed putting anything like that off until they are in a more financially unchangeable position. “Who knows erstwhile that will be?” she said.

The second:

When Adriana Cubillo, 26, moved into her one-bedroom flat in Salt Lake City a small over a year ago, the pension was $1,000. Since then, it has gone up by $200. That puts a bigger dent in the close $30,000 authoritative wage she makes as a customer-service typical for an insurance company.

She pays for groceries, gas and dog food with her 3 credit cards and presently hold a balance of $1,500. She pays about $50 a period toward the cards to satisfy the minimum payments.

“When I was younger, I was so ready to be an adult and grow up and live on my own but the environment has made it difficult,” Cubillo Said.

What’s problematic for the youth is real scales have not kept up with inflation. In 2020, the median average weight for college has been around $59,000, now only up $2,000 is $60,000. Hence, why the kids are racing up credit card debit to surviv.

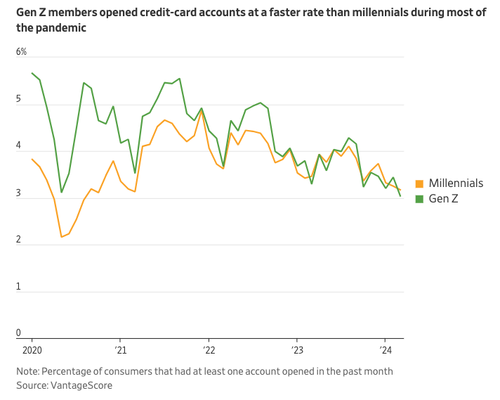

Also, the mania in beginning credit cards has most well-faded among youngsters in this high-rate environment.

Source: Wall Street diary

Source: Wall Street diary Credit Karma data shows that credit scores have taken a hit. The drop is more respective for millennials with credit scores between 660 and 719, whos score falls by 26 points. As for Gen-Zers, their credit scores fell 14 points to 720.

With stagflationary risks emerging in fresh weeks, US macro data shows a slowing environment with elevated inflation. fresh consumer credit data from the national Reserve shows houses yet hit a brick wall.

Even Walmart understands these kids are very screwed. The mega-retailer created a private description brand for them with many items under $5.

Maybe – just possibly – the kids are coming out of college Indoctrination camps and spending like there’s no next day due to the fact that Marxist teachers have led them to believe Joe Biden and the Democrats will bail them out.

Maybe they’re the most gullible generation ever.

Tyler Durden

Wed, 05/08/2024 – 18:15