GDP Vs GDI Why The immense Discrepancy And Which Is The Better measurement Of The Economy?

Authorized by Mike Shedlock via MishTalk.com,

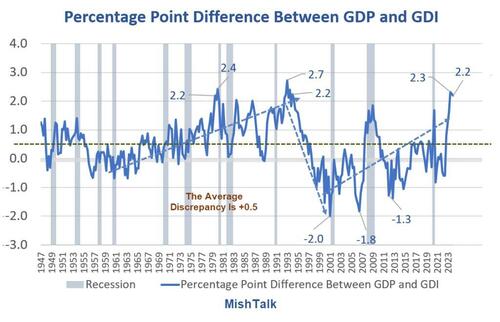

Gross home Product (GDP) and Gross home Income (GDI) are 2 means of the same thing. But the difference is now over 2 percent points, the 3rd largest in history.

GDP and GDI data from BEA, calculation and illustration by Mish

Discrepancy Notes

When GDP is large than GDI the numbers are positive. erstwhile GDI is large than GDP the numbers are negative.

Last 4th the discretion was 2.3 percent points and this 4th 2.2 percent points. Only 2 in past has the discretion been higher.

The average discretion is +0.5. This suggestions a tendency to overstate GDP comparative to GDI.

There is no discernable pattern another than a tendency to repeat to the mean, evenly, with long trends in 1 direction or the other.

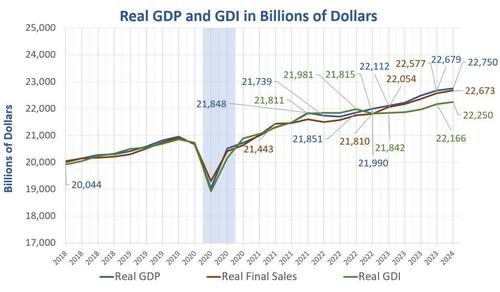

Real GDP and GDI in Billions of Dollars

Chart Notes

- Gross home Product (GDP) and Gross home Income (GDI) are 2 means of the same thing. Product produced should match sales and income. They do over time, but this is simply a large ongoing distortion.

- Real Final Sales is the bottom line estimation of GDP. The difference between GDP and Real Final Sales is inventory adjustment which nets to zero over time.

- Real means Inflation approved utilizing the GDP deflator as calculated by the BEA as the adjustment.

In dollar terms, the discretion is the largest ever. However, percent comparisons are a better measurement which is why I created a fresh illustration present to show the percent point differences.

Revision to the Mean

There is simply a strong tendency to repeat to the mean. However, repetition to the mean does not imply GDP will fall. GDI could overshoot to catch up.

However, based on where the environment is right now, I would anticipate GDI to drop with GDP dropping more on a comparative basis.

More Soft economical Data, Q1 GDP Revised Lower, Q4 GDI importantly Lower

Earlier today, I reported More Soft economical Data, Q1 GDP Revised Lower, Q4 GDI importantly Lower

Significant Negative Revisions

2024 Q1 GDP Went from 1.6 percent to 1.3 percent.

Based on updated data from the Bureau of labour statistic Quarterly Census of employment and Wages program, Wages and salaries are now estimated to have increased $58.5 billion in the 4 quarter, a downward revision of $73.0 billion.

Real gross home income is now estimated to have increased 3.6 percent in the 4 quarter, a downward revision of 1.2 percent points from the erstwhile published estimate of 4.8 percent.

Regarding the first bullet point, I calculated revised GDP at 1.2509 percent which the BEA rounded to 1.3.

Is GDP or GDI a Better Measurement?

The Philadelphia Fed prefers GDI over GDP but it prefers a blend (not an average) which it calls GDPplus even more. Note that GDPE = GDP and GDPI = GDI in the discretion below.

The GDPplus Working Paper is mostly geekish math, but there are any readable snipers.

Aggregate real output is valid the bridge fundamental and crucial concept in macroeconomic theory. Surprisingly, however, crucial uncertainty inactive surrounds its measure. In the U.S., in partial, 2 often-divergent GDP estimates exist, a wide-used

expenditure-side version, GDPE [GDP], and a much little wide-used income-side version, GDPI [GDI].

(2010) and Fixler and Nalewaik (2009) make clear that, at the very least, GDPI desserts serious attention and may even have properties in certain respects superior to those of GDPE. That is, if forced to choose between GDPE and GDPI , a amazingly strong case be for GDPI . But of course 1 is not affected to choose between GDPE and GDPI , and a GDP estimation based on both GDPE and GDPI may be superior to either 1 alone. In this paper we propose and implement a framework for covering specified a blended estimate.

Tyler Durden

Sun, 06/02/2024 – 09:20