Finding The Next Apple utilizing Buffett’s Logic

Authorized by Michael Lebowitz via RealInvestmentAdvice.com,

On the heels of Apple’s later educations report, the Wall Street diary shared an article discusing how Apple became specified an overriding investment of Warren Buffett’s company, Berkshire Hathaway. Given their success with Apple shares we think it is worth knowing the logic that drive Buffett to accumulate specified a large position in Apple.

Unbeknownst to bridge, Todd Combs, a associate of the Berkshire portfolio management team, is responsive for bringing Apple to Buffett’s attention. However, not all credit goes to Combs. Buffett presented Combs with a challenge that eventual highlighted Apple’s value proposition. With this same challenge, we will take a stab at uncovering the next Apple.

The inspiration for our challenge and a fewer quotes in this article come from a Wall Street diary article entered Apple is Buffett’s Best Investment.

Berkshires Massive Stack Of Apple

Before uncovering the next Apple stock, it’s worth visualizing how Berkshire’s investment in Apple has grown over time as a percent of Berkshire Hathaway and of Apple’s full share outside.

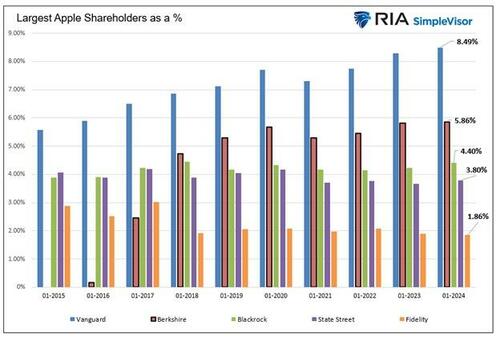

The bar graph below companies Berkshire’s percent ownership of Apple to that of the 4 largest common fund and ETF complexes. Berkshire had no position in Apple in 2015 and now holds over 5% of the company. Only Vanguard has a more crucial position.

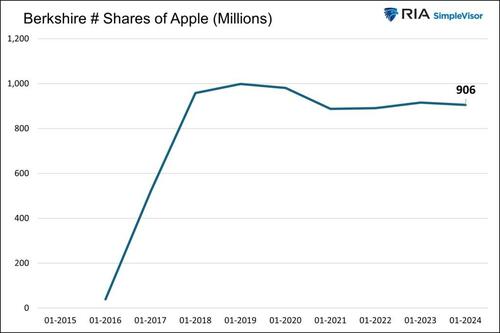

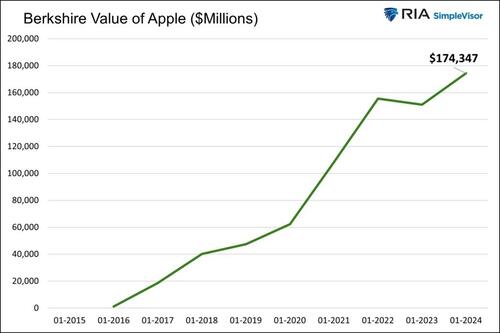

The following graphs game the estimation in the number of shares owned by Berkshire and the value of its shares.

The pastry illustration below shows that Apple compromises almost half of Berkshire’s portfolio. The next largest holding is Bank of America at 10%.

Buffett Doesn’t Like Tech

Ironically, erstwhile Berkshire started buying Apple shares, Warren Buffett had an aversion to technology stocks. erstwhile asked why, he said he didn’t invest in companies he didn’t understand. He now gives that he was a mistake.

While it may have been a mistake not to buy more technology companies in the mid twenty-teens, Buffett was able to appreciate what Apple truly was. While it is classified as and easy maintained a technology company, Buffett got his head around Apple by likening it to a consumer goods company. Per the aforementioned Wall Street diary article:

Considering the stock, though, Buffett began to see it as a consumer-goods company with available, Latin pricing power, alternatively than as a tech or an electronic-device maker, according to people who have spoken to him. The loyalty consumers had for Apple products, especially the iPhone, suggested to Buffett that they would be willing to pay much more for upgraded versions of the telephone in the years ahead, a certain way to boost profits.

Todd Combs-The Unknown Mastermind

The Wall Street diary article introduces Todd Combs, 1 of Berkshire Hathaway’s lesser-known portfolio managers. Accepting to the article, around 2016, Buffett challenged Combs to find a stock that met circumstantial criteria.

Among the stocks Combs found gathering the fundamental criteria and large adequate for Berkshire to acquisition was Apple. The remainder is history. Since they started acquiring Apple in 2015, it has gained 650%, more than 4 times the S&P 500 over the same period.

Given Combs’ success, we thought it would be interesting to usage the logical Buffett challenged Combs with and produce a akin scan. Let’s see if we can find the next Apple.

Buffett’s Logic

The following paragraph from the WSJ article is the logical Buffett internalized to Combs, leading to their ownership of Apple.

This time, Buffett asked Combs to identity a stock in the S&P 500 that met 3 criteria.

The first: a reasonably inexpensive price/earnings multiple of no more than 15, based on the next 12 months’ projected arrivals.

The stock besides had to be 1 of the managers were at least 90% certain would enjoy higher educations over the next 5 years.

And they had to be at least 50% assured that the company’s learnings would grow by at least 7% anonymously for 5 years or longer.

What made the search a small more hard was that the companies met the criteria besides had to have a marketplace cap large adequate so Berkshire could buy adequate of to decision the request of its portfolio but not overly impact the request for the stock.

The Combs Scan

In addition to the criteria in Buffett’s challenge, we added sales growth of at least 5% over the last 5 years. This helps us think the list of companies to these already exhibiting strong top-line growth. We besides removed financial, limited partnerships, REITs, and real property stocks as their valuations and growth rates are not as easy comparable utilizing conventional valuation metrics. Lastly, we disqualified Chinese companies due to the possible for political implications.

The following are the factors we utilized to screen for the next Apple.

Market cap > $50 billion

Price to Forward Earnings

Five-year-expected educations growth >5%

Sales growth in last 5 years > 5%

No financial, limited partnerships, REITs, real estate, or Chinese companies.

Many stocks meet the size, learnings, and sales growth criteria. But only 2 companies have inexpensive adequate values to make the cut as shown below.

Currently, Berkshire has 5.242 million shares of T-Mobile, which is .20% of the portfolio. T-Mobile met our criteria, but it's 5-year-expected mornings growth is lightly below Buffett's 7% bogey.

Berkshire does not hold EEA but has another oil and gas exploration companies, including Occidental Petroleum and Chevron.

Summary

Warren Buffett is an interesting legend and 1 of the wellness people in the world. He takes a value orientation with a long-term investment horizon.

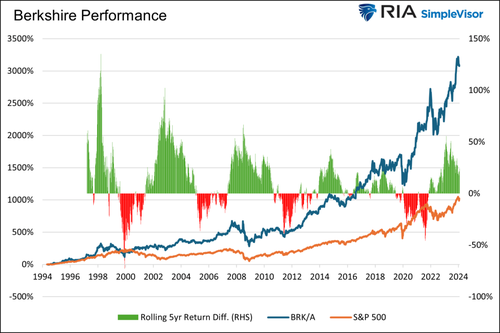

The Berkshire Hathaway portfolio, which besides owns private companies, has done exceptionally well versus the market, as shown below. However, he goes through extended periods of mediocre comparative performance versus the market.

The graph shows that over the last 30 years, Berkshire’s price return has tripled that of the S&P 500.

However, there are 4 notable extended periods where he grossly underperformed the market.

Also of note is that Berkshire willingly beat the marketplace in the recession and drawdowns of the dot com bubble and financial crisis. specified tests are his value orientation.

Tyler Durden

Wed, 05/08/2024 – 14:05