Exxon Tumbles On One-Time EPS Charges Despite Surge In Cash Flow, Buyback Boost

With oil prices enjoying a powerful renaissance in fresh months amid mounting supply deals, declining inventory and the increasing anticipation that China's economy may yet kickstart, energy giants specified as Exxon and Chevron had enjoyed a akin rebound in their stock price, and in fact XOM hit a evidence advanced as late as 2 weeks ago. Which is why many were looking to today's arrivals reports by the largest U.S. energy company to see if the numbers would accept the return in sentiment and, of course, price.

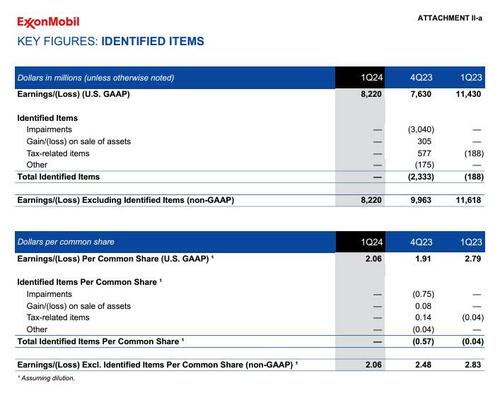

So here is what Exxon reported present for the first quarter:

- EPS of $2.06, down from 2.83 a year ago, and missing consensus estimates of $2.19, as a consequence of delayed bump in community prices (which nevertheless will lift results in Q2) and a spice in non-cash charges

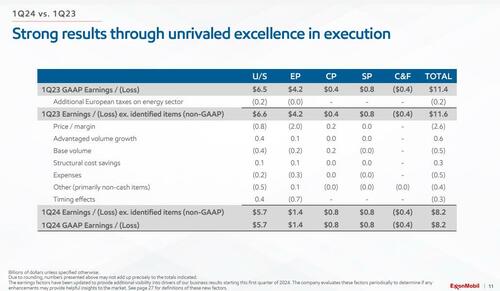

The Net Income number was $8.22 billion, down from $11.618 billion a year ago, with capacity in Upstream and Energy products hitting the bottom line number, coupled with an increase in expectations. The biggest origin behind the drop in earlys was a $2.6 billion hit to price/margin due to lower energy prices in Q1. However, with Brent now well above year ago levels and rising, what XOM lost in Q1 it will more than make up in Q2 absent a collapse in the energy market.

A breakdown by the various operating segments, reveals that price and margin were indeed the biggest clulprits for declining days.

Taking a cloud look at the company’s 2 main divisions, Upstream and Energy products, the company provided the following item for the somewhat disappointing earnings here:

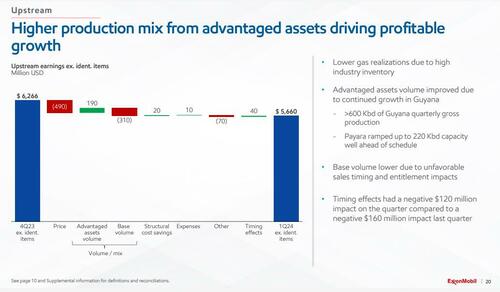

Starting with Upstream:

- Lower gas realizations due to advanced manufacture inventory

- Advantaged assets volume improved due to continued growth in Guyana

- >600 Kbd of Guyana Quarterly Gross production

- Payara ramped up to 220 Kbd capacity well ahead of schedule

- Base volume lower due to unfavorable sales timing and inclusion impacts

- Timing effects had a negative $120 million impact on the 4th combined to a negative $160 million impact last quarter

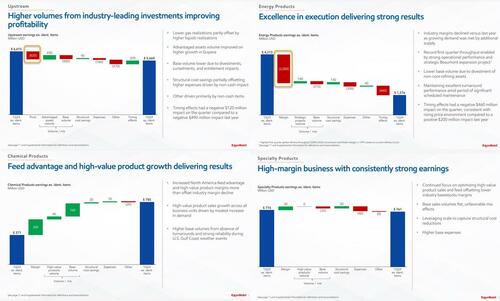

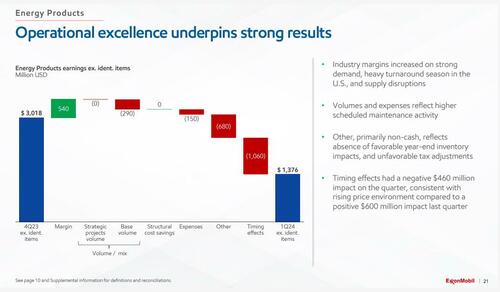

Energy products, where we saw the bulk of the learnings delta (some $1.7BN in earlys reductions between Q4 and Q1), was more interesting as Exxon attributed the slide to 3 primary drivers:

- Volumes and increases reflect higher scheduled management activity

- Non-cash charges which reflected the absence of favorable year-end inventory impacts, and unfavorable taxation adjustments

- Finally, timing effects which had a negative $460 million impact on the quarterback, Consistent with rising price environment presented to a affirmative $600 million impact last quarter.

“Any given 4th we’ll have a number of non-cash, just a bit more different expenses that kind of ebb and flow,” CFO Kathy Mikells told BBG in an interview. “This 4th we had a number of tiny ones that added up together to be more crucial and that’s hard for analyses to model.”

“We proceed to bring projects in more rapidly and under budget so we’ve just had large execution in Guyana,” Mikells said, noting that gross regular production is now more than 600,000 barrels, up from 440,000 in the final 3 months of 2023.

Exxon’s accounting charges were non-cash items associated with taxation and inventory balance sheet adjustments, Mikells said. The company besides had higher expenses from scheduled maintenance at its facilities.

Some more highlights from the report:

- Exxon started output at Payara, its 3rd Guyanese development, ahead of agenda summertime last year, adding 220,000 barrels of regular supplies that gain profits even if crude plunges to the $35 mark.

- Achieved quarterly gross production of more than 600,000 oil-equivalent barrels per day in Guyana and reached a final investment decision on the sixth major development.

- Net production was 47,000 oil-equivalent barrels per day lower than the same 4th last year with the growth in advanced Guyana volumes more than offset the arrivals impact from lower base volumes due to acquisitions, governance-managed curtailments and unfavorable elementation effects.

- Exclude the impacts from divestments, entries, and government-managed curtailments, net production grew 77,000 oil-equivalent barrels per day drive by the start-up of the Payara improvement in Guyana.

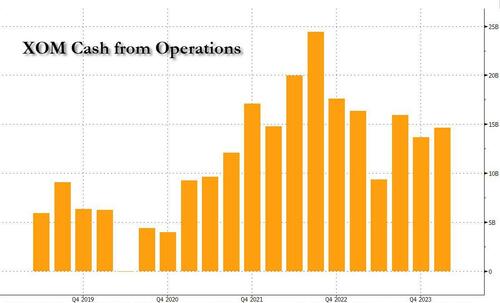

What is remarkable is that even though yearnings missed most on the timing effect of community price increases and one-time charges, which has sent the stock tumbling this morning, the company inactive managed to blow distant results for cash generation: in Q1, cash from operations jumped to $14.7 billion, $1 billion higher than Q4 2023, and besides $1 billion higher than forecast, boosted by the more than 35% uplift in Guyanese crude production.

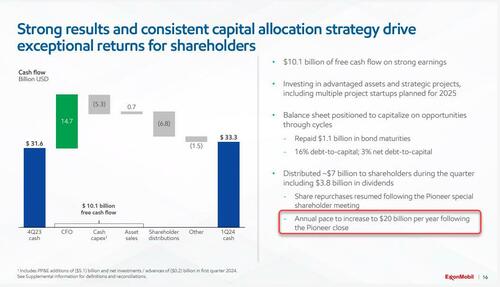

This in turn led to a $1.8 billion increase in the company's cash balance despite $6.8 billion in shareholders distributions including $3.8 billion in dividend.

Exxon’s capital spending was $5.8 billion in the first quarter, a 3rd lower than the erstwhile 3 months period erstwhile the company incurred any added Guyana cost. If that level of spending is repeated for the remainder of the year, an yearly capital expension would come in at the low end of the company’s $23 billion to $25 billion guidance, and in a marketplace where capital efficiency is utmost rewarded, it likely means that fresh all time highs are just weeks if not days away.

More importantly, XOM says that it is on pace to Increase buybacks is $20 billion following the close of the Pioneer admission, any time in Q2.

Exxon’s stellar performance in Guyana exploits why arch-rival Chevron wants to get into the task via a $53 billion takeover of Hess, which has a 30% stake. Exxon claims it has a right-of-first refusal over Hess’s stake while Chevron says that doesn’t apply due to the fact that its deal is simply a corporatemerger.

Arbitration is inactive in its “very early days,” Mikells said. Each side has chosen 1 arbitrator who will sit on a panel of three, she said. Hess this week extended the closing date of its deal with Chevron by six months to October.

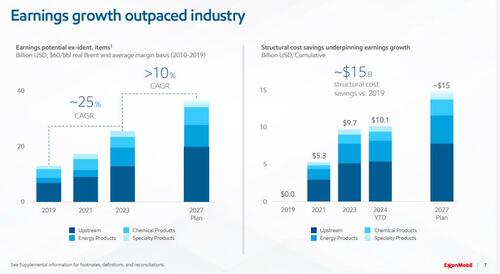

Finally looking ahead, the company forecast that it is on track to more than double upstream profits by 2027...

... and with cost-savings expected to save another $5BN in spending by 2027 (a full of $15BN vs 2019), this translates into a stellar 10% CAGR in bottom line learnings, and about $10BN in creative learnings possible by 2027.

So in its infinite vision, erstwhile faced with a company that is generating more cash than 99% of companies – and is not reliant on hype and chatbots to keep increasing but good, old-fashioned energy which may be boring but is what keeps the planet turning – this morning the algae decided to dump their Exxon shares sending the stock any 4% lower, and let anyone who pays attention to burden up on the dip.

The XOM Q1 investor presentation is below (pdf link)

Tyler Durden

Fri, 04/26/2024 – 11:45