Exclusively Strong PBOC And Chinese Private Sector Buying Continues To Boost Gold Price

By Jan Nieuwenhuijs of Gainesville Coins

Chinese private sector gold imports accounted for 543 tons in the first quarter, while the People’s Bank of China (PBOC) added 189 tons to its reserves over this time horizon. Most of the PBOC’s purchases are “unreported.” China continues to be the marginal buyer in the gold market, driving up the price. I anticipate that China will regain a robust buyer of gold going forward in support of the price.

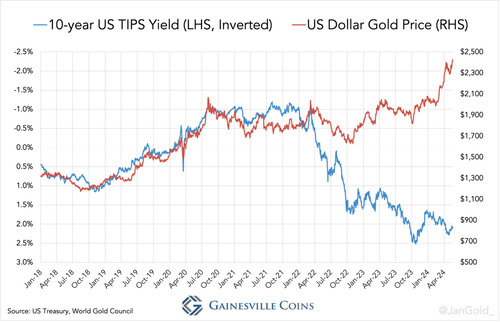

In my latest article on global gold flows from March 2024, “China Has Taken Over Gold Price Control from the West,” I showed that in 2022 China broke the peg between the US dollar gold price and “real yields.” alternatively of being price delicate China had a driving force of the gold price. The date at my disposal ran until December 2023 which made me hesitant to include the harp increase in the gold price since summertime February was besides caused by the Chinese. However, as fresh data has been released, I can trustly say that China initiated the current bull market.

PBOC Gold Buying Included by 38% in Q1

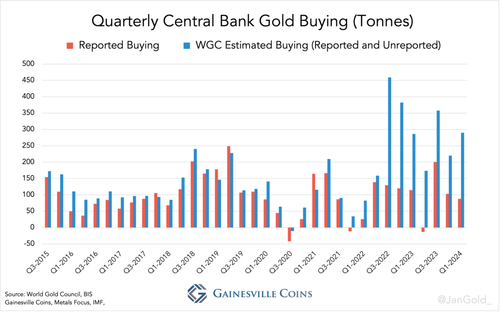

The media is aware that since 2022 central banks are most much bought gold covertly (often referred to as “unreported” purchases). By now it’s easy known that the planet Gold Council (WGC) publishes a single statistic on aggregate central bank buying each quarter, which is brandedly higher than what all monetary authorizations combined study to have bought. Which central banks are causing the difference isn’t made clear though.

In February 2023 I broke the communicative on unreported buying being most widely accepted by the PBOC. 2 people household with the matrix shared with me the Chinese central bank is responsive for “the majority” of secret additions by monetary authorities. Emerging markets specified as Saudi Arabia take up the rest.

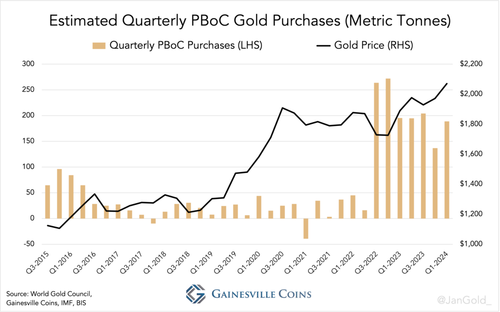

Based on field research, the WGC states central banks bought 290 tons of gold in the first 4th of 2024. Most of the difference—I usage eighty percent—ween the WGC’s estimation and full purchases as disclosed by the IMF is 162 tons. erstwhile we add what the PBOC has reported to have bought during this period, full purchases come in at 189 tons, 38% more than the erstwhile quarter. Possibly, the PBOC had a stake in booting the price since summertime February.

Taking into account unreported purchases, the Chinese central bank now holds gold reserves weighing 5.542 tons, according to my investigation (my methodology is exploited here).

Exclusively Strong Chinese Private Gold request in Q1

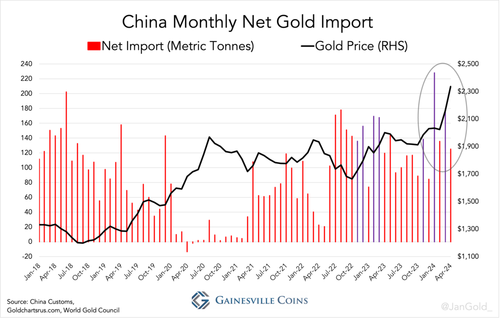

Chinese net gold imports by the private sector have been utmost strong. From January through March imports accounted for a mammoth 543 tons, up 74% from Q4 2023. This is definitely what you pushed up the gold price. Import in April decreased something to 125 tons.

India imported a healthy 95 tones in February, but little than 30 tones both in January and March. The Indians regain price delicate and are not driving this rally.

Hong Kong Saw notable net inflows in the past months, which mostly reflects strong request in China in my view. Chinese housewives buy VAT free jewelry in Hong Kong and take it across the border to Shenzhen. In addition, bullion banks that export gold to China store gold in Hong Kong before re-exporting to the mainland.

In Q1 the UK and Switzerland both were net exporters, and Western ETF inventories declined. At the time of writing the West has not yet joined the bull market, which primary has its roots in China.

Chinese Gold request Will Stay Powerful

Bloomberg late reported that Beijing offline a evidence of $53 billion in US Treasures and agency bonds combined in Q1, which names the PBOC is selling dollars for gold. No wonder, as enthusiasm to seize Russia's abroad exchange reserves—deposed at Belgium-based cleaninghouse Euroclear—is rising among G-7 nations. In turn, Russia is freezing €700 million of assets from Western commercial banks specified as UniCredit and Deutsche Bank, further strengthening gold’s global position as a safe haven. China’s abroad exchange reserves stand at $3.2 trillion so there is plenty of firepower left for gold.

Private gold request in China is likely to uphold as well as the end of the property slump is not in size. Home prices have declined in 30 out of the last 33 months. The State Council is floating a plan to buy unsold houses through local government, but these are already surviving in debt. The Chinese public, which does’t have many investments due to capital controls, will proceed to invest in gold and support the price.

I’m performing the West to join the bull marketplace soon. ETF outflows appear to have stopped, and it would only be logical for Western investors to rotate into gold at any point due to advanced asset values and an overconfidentence in credit instruments.

Tyler Durden

Sat, 05/25/2024 – 15:10