ECB D-Day

By Michael all of Rabobank

“Your task will not be an easy one. Your enemy is well trained, well equipped, and battle-hardened. He will fight savagley ... I have full assurance in your coach, devotion to work and skill in battle. We will accept nothing little than full Victory! Good Luck! And let us all beeseech the blessing of Almighty God upon this large and noble undertaking.” General Eisenhower

The Bank of Canada becomes the first G7 central bank to cut rates in this cycle yesterday with a 25bp simplification from 5.00% to 4.75% along a clear signal more will come. However, it is alsoware that the fight against inflation may not yet have been won.

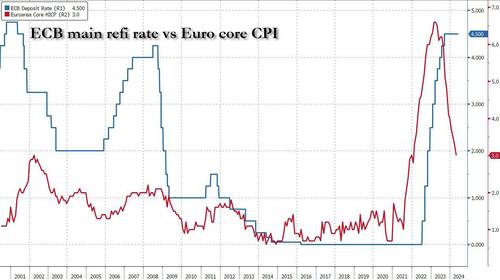

Today, it’s the turn of the ECB, where a 25bp cut from 4.00% to 3.75% is the universal result. any in Europe are lobbying for this to be supported up by a further decision to 3.50% as shortly as next month. But where after that? It’s a good question.

With fresh U.S. labur marketplace data abruptly looking wobbly, many in the marketplace are again reasoning the conflict of ideas has been won by “rate cuts!”, and that the war against inflation is over for good. In places that can be true, and advances will be made.

Unfortunately, in others the structural forces driving inflation are well trained, well equipped, battle-hardened, and will fight savagley. Indeed, as Bloomberg notes today, ‘The Fed Can’t Conquer Inflation If Washington Keeps on Spending’ That’s 1 of the key structural inflation forces at play, but not the only one. As such, we were central banks to effort to cut besides fast ahead, they could easy find themselfves outflanked and forced to retreat – a humiliating Dunkirk for them and their batteryed reputations, not a D-Day.

On which, on 6 June 1944, 150,000 soldiers from the US, UK, and Canada invasion Nazi-occupied France to begin the liberation of Europe from the West. Today, the leaders of the US, UK, Canada, France, Germany, and Ukraine alternatively than Russia will thank the dwindling band of heroes who bled on Normandy’s beaches for the freedoms Europeans inactive hold today. This event is double poignant: it’s proven the last which D-Day survivors will be able to attend; and the current geopolitic backdrop has many seriously commentators again wondering about the risks of planet war, as east Europe and the mediate East already experience today.

The 80th communication of D-Day ironically takes place against EU elections in which Politico notes, ‘As the far right forecasts, Europe heads toward its Donald Trump moment,’ and, “If the polls are correct,...will order the Continental’s political landscape.” If so, this reflections the failure of the neoliberal policy framework put in place post-1990 erstwhile the West Felt war and Cold War were over forever. It could besides have implications for the “radial change” of the EU needs to push back again a geopolitical atmosphere akin to the 1930s or early 1910s.

The scale of the problems Europe faces is voiced by Bret Stephens: ‘This D-Day, Europe needs to resolve to get its act together’. He notes D-Day celebrations will see “sombre and anxious reflections about the destiny of the Atlantic alliance. Sombre due to the fact that the last of the top Generation will shortly no longer be with us. Anxious due to the fact that erstwhile president Donald Trump, and his experienced disdain for that alliance, may shortly be with us again.The anxiety is partially misplaced. Trump’s truculent brand of American nationalism is simply a territorial thought for many reasons, not least in the environment it gives to Vladimir Putin and Xi Jinping to mark weaker US allies. But Trump is besides the messenger of a informing Europeans desperate request to heed. In a nutshell: form up.”

He then lists the set of structural challenges –growth/dynamics; military power; demographics; purpose/will (“If Russia defeats Ukraine and decides in a fewer years’ time to attack 1 of the Baltic countries, is there a deep pool of young Germans, Belgians or Spaniards willing to die for Tallinn or Vilnius?) — which parallel these we noted in December.

One implication is absolutely more needed to be spent on defense. Experts agree the mark of 2% of GDP is irrelevant and a realistic figure is 3.5% – 4%. That’s on top of subsidies for industrial policy to hold production; wellare to estimation the population support preparations for warfare; and the energy transition. Together, we could be talking 6% of GDP of spending a year, immediately. To think this is not going to be inflationary is to imagine 1 wins a war by declaring it.

The same problems are experienced in the US, which is no longer the ‘arsenal of democracy’ yet faces a Chinese-Russian,-Iranian-North Korean arsenal of autocracy. abroad Affairs is now arguing the Pentagon needs to plan for a three-theatre war –Asia, Europe, and the mediate East– even as Asia could have multiple fronts, ‘Monroe Doctrine’ Latin America can’t be taken for granted, and North Africa is falling under Russia’s influence.

The budget introductions are so enthusiastic this is argued to require integrating the US military defence base with those of its key Anglosphere allies, Japan and South Korea – the later 2 providing shipbuilding while the US restarts its own industry, for example.

The geopolitical introductions are quite a few US strategical autonomy, or the others’ to the US. Moreover, it would mean Canada, the UK, Australia, (New Zealand?), Japan, and South Korea all expanding their defence spending further than already pledged to contribute to multi-theatre war preparations, possibly by another 1.5 to 2% of GDP. That’s inflationary, not disinflationary.

Freedom isn’t free. Or just free markets. Indeed, while we will be inspired by the speedes we hear present from Normandy, others had far blunter wars for the troops ahead of D-Day:

“War is simply a bloody, killing business. You’ve got to spill their blood, or they will spill yours. Rip them up the belly. Shoot them in the guts. erstwhile shells are hitting all around you, and you hope the dirt off your face and reality that alternatively of dirt it’s the blood and guts of what 1 was your best friend side you, you’ll know what to do! I don’t want to get any messages saying, ‘I am holding my position.’ We are not holding a goddamned thing. Let the Germans do that. We are advanced constantly, and we are not curious in holding onto anything but the enemy’s balls. We are going to twist his balls and kick the surviving sh*t out of his all of the time.” General George S. Patton

The same needs to be accepted by these reasoning rate cuts are going to be a boat, not a trick; or that rate cuts solve our Larry problems. They most likely aren’t, and they solemnly won’t.

Our war against inflation won’t be won until policies and geopolitics stabilize in tandem. There are many battles ahead before either happens, and we have only just started It's lipame how the 2 can join up to accomplish any victory.

Central banks have a key function to play in that: but not the neoliberal 1 of rate cuts and ‘buy all the things.’ For example, Aussie home loans soared 4.8% m-o-m present vs. 1.5% expected with investor loans +5.6%. Nothing in that says rates that request to be cut. And all A$ allocated to future home ownership or short-term specification on it is an A$ that didn’t go into the military-industrial sector reasoning about Australia’s future. That’s the game – until it’t.

Moreover, see ‘US Battles for ‘Hearts and Minds’ in a Conflicted World’, interviewing a key architect of the sanctions government imposed on Russia, Daleep Singh; and @matthew_pines comment: “Overall, I detect a sense of desperation – that he was brought back into get a fewer key items across the finish line before the November elections, but the scale and scope of US ads’ challenge (and the limited effectiveness of Executive tools) is unique... and time is moving out.”

Tyler Durden

Thu, 06/06/2024 – 08:13