Don’t Buy Rate-Hike Hype, Next FedEx decision is simply a Cut

Authorized by Simon White, Bloomberg macro strategist,

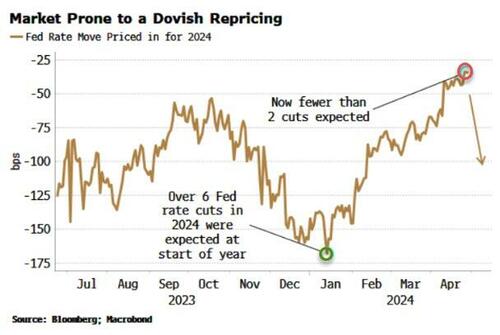

The national Reserve’s next decision this year is likely to be a rate cut – despite the re-emergence of inflation – leaving markets at hazard of a dovish repricing.

When it comes to the Fed, it’s easy to get Hung up on what they should do, and ignore what they actually will do. From an inflation perspective, it’s becoming increasingly clear the central bank needs to rise rates further to quell recurgent price growth. But that’s unlikely. Instead, the risks to government foundation costs and mounting force on liquidity are likely to tilt the Fed in favour of cutting rates, even as inflation is making an unwelcome return.

This week again draws focus to the large entanglement of monetary and fiscal policy. The Fed meets on Wednesday, but the Treasure’s QRA (quarterly refinancing anouncement) is just as convenient for the way of monetary policy. We found out the Treasury’s Borrowing requirements on Monday.

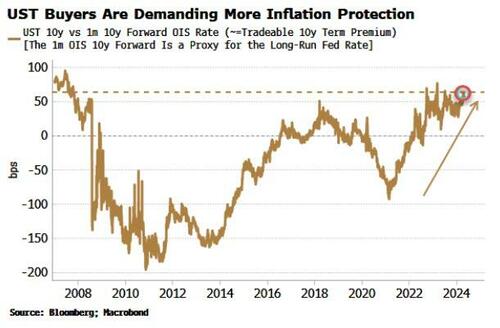

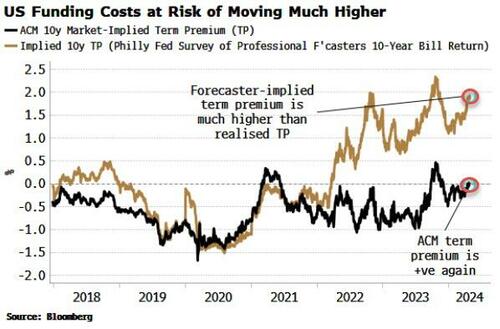

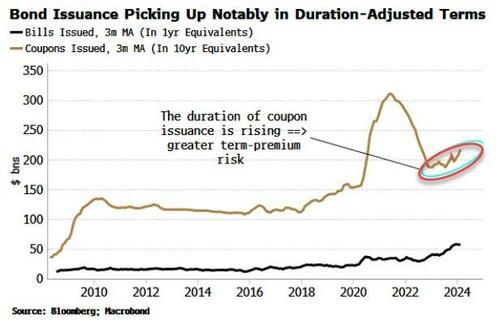

The amounts are eye-watering – $243 billion in 2Q and $847 billion in 3Q – and unhinkable outside a recession only a fewer years ago. The marketplace is Gradually waking up to the Treasury put and the reality of the fiscal deficit is unlimited to go back to a non-recessionary norm any time soon. word premium is rising as lenders request large compensation for holding longer-term debt.

The illustration below shows a tradeable proxy for word premium – the difference between the 10-year young and the 1-month OIS rate 10-years forward – that is as advanced it’s been since the GFC.

Other means of word premium are besides rising. The ACM word premium has gone back into affirmative territory, while implied means of word premium based on forecasters’ estimation of the 10-year bill rate are already 150 bps higher than the OIS-based word premium shown above. Even if Treasures are not as overpriced as this infers, the government inactive has a problem.

As importer for yields as how much the Treasury wants to borrow is how it intends to borrow it. On Wednesday, we will find out the study of hanger-term versus shorter-term debt (i.e. bills) Treasury results to issue over the next 2 quarters.

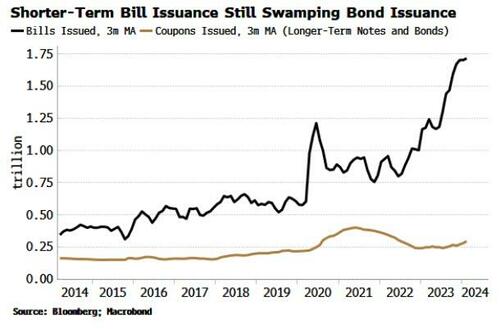

The increase in bill issue over the last year or so has been of immense import to markets. The “Yellen pivot” means that liquidity lying idle in the RRP could be utilized by money marketplace funds to buy bills and thus aid fund the government.

Without this, there's a strong likelihood the mass of sovereign issue would have had crowded out another assets, and markets would have been considerably waker. The Treasury thus – implicitly or otherwise – aided the Fed by allowing it to keep rates higher for longer and obtained with quantitative dancing.

Wednesday’s announcement will shed further light on how the Treasury will stick to its established name and not importantly increase coupon (i.e. non-bill) issue for now. A look at the nominal amounts of coupons and coins issued apps to confirm this has been the case.

But in duration-adjusted terms the image is already changing. The amount of coupons issued adjusted for duration is rising. That will amplify the decision higher in word premium and eventual jeepdize support for hazard assets.

USTs are simply not in advanced request at current prices. Foreigners are more war due to reserve-Confiscation risks, or put off by advanced FX hedge costs; banks have on net ben reducing their ownership of USTS as policy has been tighted; multi-asset managers have little needed erstwhile Treasures are a mediocre recession hedge erstwhile inflation is chosen, and apoor portfolio hedge erstwhile the stock-bond ratio is positive; and the Fed is busy trying to offset its Ust inventory.

Households have become the de facto buyer of last hotel for Treasures. But there’s nothing to propose they’ll be happy to proceed to so at any price. As the illustration below shows, consumers’ long-term inflation effects typically lead word premium. The market’s view of lounge-term inflation, i.e. breaksvens, is about 150-200 base points lower than houses’ outlook. As the UST buyer of last resort, houses will investly set the price, 1 that’s likely to be lower than it is now.

Higher long-term yields will lead to the government having to borrow yet more to pay its spiraling interest-bill on its outside debt. But that points to less reserves and falling reserve velocity – effectively undoing the work of the Yellen pivot and leaving the stock marketplace in a precarious spot.

The Fed is thus likely to cut rates in a quid pro quo with the Treasury. This would not only aid the government full its Borrowing requirements at a non-usurious cost, it besides helps the Fed with its responsiveness for financial stableness by taking the force off hazard assets and reducing the liquidhood of a foundation squeeze.

Even though specified a decision would be unwise, it doesn’t mean it won’t happen. Cutting rates before inflation has been snuffed out thrashes to intensify structural risks for price growth.

But in the heat of liquidity drying up, surviving risks rising, markets on creatively shake ground, and the government locked in an issue doom-loop as its interest costs salt, the Fed is likely to cut rates as an easy first decision to save the force — an result made even more likely with an election loving.

In the short-to-medium term, it’s hard to see how quantitative dancing isn’t shortly taped or curtailed. But the Fed is improbable to want to go full tilt into easing again, or engage in young curve control. That’s why in the lounge word any kind of financial repression – where private cash flows are directed into public debit markets – is very likely.

This would be yet another chip in the de facto erosion of Fed independence. In specified an environment, gauging the central bank’s next decision needs to consider the spending which of the government as much as the outlook for inflation and unemption.

Tyler Durden

Tue, 04/30/2024 – 10:10