Disney Shares Plunge Most In Year On Subscriber Miss, Disappointing Guidance

Disney reported fiscal second-quarter profits that exceed estimates of the average analyses tracked by Bloomberg and raised its full-year arrivals guide. However, shares tumbled in early trading in fresh York as investors focused more on the Disney+ streaming service, missing its forecast for the quarter.

For the 4th ending March 30, the Disney+ streaming service reported 153.6 million subs, which fell short of Wall Street’s effects of 155.66 million. This is presently overshadowing any affirmative news from the quarterback.

Earnings increased to $1.21 a share, exclusive any items, in the quarter, beating the $1.12 average of analysts’ estimates. gross in the first 3 months of the year increased by 1.2% to $22.08 billion, combined with analyses’ forecast of $22.1 billion.

- Adjusted EPS $1.21 vs. 93c y/y, estimation $1.12 (Bloomberg Consensus)

- Revenue $22.08 billion MEET, +1.2% y/y, estimation $22.1 billion

Entertainment gross MISS $9.80 billion, estimation $10.31 billion

Direct-to-Consumer returnue MEET $5.64 billion, estimation $5.64 billion

Sports gross MISS $4.31 billion, estimation $4.33 billion

Experiences gross BEAT $8.39 billion, estimation $8.18 billion

However, while the media giant added more than 6 million subscribers in the second 4th to its core Disney+ streaming offering, it was little than expected:

- Disney+ subscriptions 153.6 million, estimation 155.66 million

And bage still, CFO Hugh Johnston said the company doesn’t anticipate to see core Disney+ subscription growth in the current 4th and profitability in streaming will offer due to due to additional increases for cricket rights in India.

Disney bought the India business in 2019 as part of its $71.3 billion admission of the bridge of 21st Century Fox.

“We are pleased with the advancement we’re making in streaming, although, as we said before, the way to long-term profitability is not a linear one,” Johnston said on a call with investors.

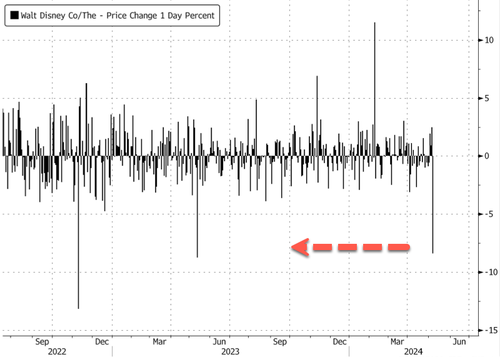

At the start of the cash session, Disney shares slide 8.5%. The latest rebound in the stock has hit dense opposition at the $120 trade.

The 8.5% decline is the largest intraday tumble since May 11, 2023.

On the bright side, Disney’s subject parks Saw return increase 10% in the second 4th and the section posted a 12% gain in operating income.

But, erstwhile again, Johnston said he’s Expecting small growth at parks in the current period, due to expenses specified as a fresh cruise ship, before resuming growth later in the year.

Earnings in Disney’s theme-park division rose to $2.29 billion in the second quarter, driven by sharpy higher results internationally, especially Hong Kong. Domestically the company’s cruise line and Disney planet hotel in Florida registered income growth, while California’s Disneyland saw weaker performance due to higher costs.

“while consumers proceed to travel in evidence numbers and we are inactive seeing healthly demand, we are seeing any evidence of a global modification from highest post-Covid travel,’ Johnston said on the call.

The question regains, just how much can Disney put up park prices before request literal disappears?

While McDonald’s, Starbucks, and Tyson Foods have all reported low-income consumers dialing back purchases as inflation pinsches pocketbooks, the Disney CFO claimed that:

‘We’re not seeing that in our portfolio of products,’ adding there hasn't been much of an impact after streaming prices were hiked earlier this year.

However, it’s only a substance of time before Disney sees low-income or middle-of-the-road consumers pull back on streaming spending and outrageously priced park tickets amid rising stagflationary thrills.

Tyler Durden

Tue, 05/07/2024 – 10:05