David Stockman On The Continuous emergence In The Cost Of Living... And Why The Fed Has No Shame

Authorized by David Stockman via InternationalMan.com,

Jay Powell did it again assuring the 1% that he has their back.

Markets retrieved their area over the last 24 hours, as investors were relived after Fed Chair Powell stack to his fresh views on the economical outlook. In his remarks yesterday, he said that fresh data didn’t “materially change the overall picture” and that on inflation “it is besides shortly to say how the fresh readings represent more than just a bump.” In addition, he reiterated that if “the economy evolves broadcast as we expect, the bridge FOMC partners see it as likely to be applicable to starting the policy rate at any point this year.” So that all helped to validate marketplace pricing, which inactive results 71 bps of rate cuts from the Fed by the December meeting.

Needless to say, the man has no shame. And that’s to say nothing of intelligent firepower. There is not even a smidgen of a case that rate cuts in the present context will aid main street, and the Fed heads and their Wall Street megaphones don’t actually even effort to make that argument.

Instead, they argue for rates cuts by default. If by any tortured version of the CPI (i.e. the “supercore” index, which eliminates 61% of the CPI items by weight) they can espy the in-coming inflation trend setting into a liberally defined Vicinity of 2.00%, that’s purchasedly good adequate to end the money-printing pause that has been in place since March 2022. Thereafter, it’s back to business as usual, floating the canyons of Wall Street with inexpensive credit and a fresh burst of financial asset inflation.

Never head that in this partial inflation-cycle, the general price level is up by 28% since January 2017 and that tens of millions of houses and businesses have been badly damaged, even as others have grown windfall gain. erstwhile it comes to inflation and all the another alleged macroeconomic metrics on their dashboards, past history–even the fresh past—is dead to the Fed heads.

Instead, it’s all about the current and especially the possible rate of change as embodied in the rapidly “dot-plots” they gurgle around in their brothers and update 4 times per year.

And we do mean silly. After all, if the consensus of the 19 geniuses who participate in the dot-plot guessing game espies say a 2.27% gain in the supercore index over the next year, so what?!

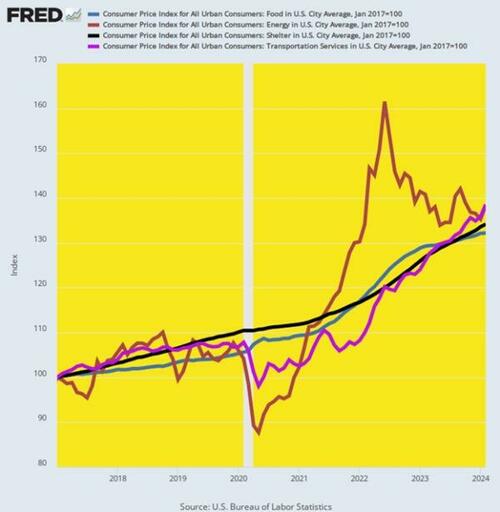

The fact is, the US economy needs a lot more relief from its fresh inflationary pounding than the Fed’s guesstimated rate of slowdown in the forward year emergence of the price level. After all, here is the increase in the core cost of surviving items since January 2017.

Change in Core Cost-of-Living Components Since January 2017:

Food: +32%.

Shelter: +34%.

Energy: +35%.

Transportation Services: +36%.

In the case of savers, retirees, wage-earners in globally impacted industries where scales have’t kept up with the CPI, isn’t the above adequate punishment? Doesn’t it actually amount to state-directed expansion of their surviving standards and modern activated wealth?

In any event, what the hell is so easy urent about rate cuts erstwhile the environment is inactive increasing appace and the cumulative inflation of the last 7 years has not been relived in the lightest?

Increase In Major Cost-of-Living Components of the CPI Since January 2017

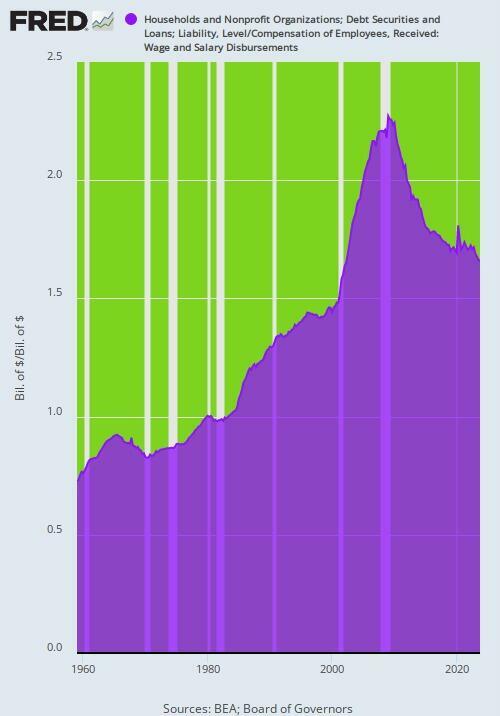

The dog-eared claim that rate cuts will increase the growth rate of output, jobs, investment and spending on main street just doesn't wash. Artificially low interest rates overwhelmingly fuel borrowing for specification and financial engineering (e.g. stock buybacks) on Wall Street, not borrowing for productive investment on main street or even for enhanced “consumption” by the household sector, which is now buried in debt up to thegills after decades of easy money.

In fact, the only way that easy money cases houses to spend more than the growth rate of their income is if they stealily increase their debt-to-income or leadage ratio. That generic borrowings, which in turn can supplement spending derived from current period income.

And that’s effectively what happened in the half-city leading up to the large financial crisis. The household debt-to-income (weight and wage base) ratio posted at 70% in 1960, but vaulted skyward thereafter, especially after Greenspan opened the sprigots at the Fed after 1987. By Q1 2009 that household leverage ratio stack at 227% (purple area), and it was that massive increase in leftage which went household spending during this interval of time.

No more. Since Q1 2009 the household sector has been slow but stealily deleveraging, with the ratio now down to 166% as of Q4 2023. What that means is that the Fed’s magic “stimulus” elixir simply does’t work any more in the household sector. It goes organic spending not 1 white.

Explosion of household Debt Leverage During 1960 to 2009 and Deleveraging Since Then

As to the supply-side growth canard, it can not be gainsaid that the amount of monetary stimulus has been off the charts comparative to all prior history. In fact, the Fed’s balance sheet at @ $7.5 trillion is inactive more than 8X its pre-crisis level in Q4 2007.

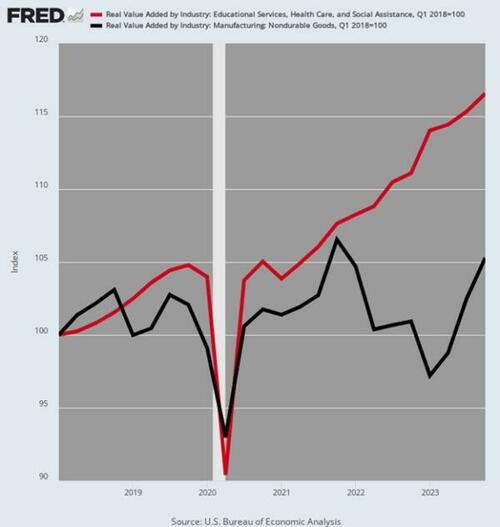

Yet erstwhile it comes to real growth of value-added production during the six year period from Q1 2018 to Q4 2023, the illustration below tells you all you request to know. To wit, real value added output in the wellness care, education and social services sector grey at a 2.71% per annum rate, which you 3X the 0.90% real growth rate of the nondurable goods production sector.

Self-evidently, the forumr sector does not request easy money or ultra-low interest rates to grow. request in the health, education and social services sector is overwhelmingly financed by government fiscal transfers, including the massive subsidies implicit in the medical care deductions and preferences of the IRS code.

Indeed, the red line in the illustration below represented the fast increasing sector of the U.S. economy by far during that six year period, but we’d dare say no of these gainings dependent upon low interest rates. The sector’s unified foundation actually flows from statutory elements and long-standing taxation code forecasts, which make fundamentally the same level of request and sector output who the national funds rate is 1% or 7%.

At the same time, it is highly improbable that a return to low rates will fly for the moribund growth rates in the industrial economy, as represented here by real-value added in the nondurable goods industries. Long ago, much of U.S. production of shoes, shirts, sheets, household supplies and the like was off-shored to lower cost venues outside. And locking in the current inflation home cost levels plus another 2-3% per year going forward will not bring them back.

In sum, the Fed’s uncovering with interesting rates is largery irrelevant to the supply-side way of the 2 industries shown below, and countless more just like them.

Real Value Added: Education, wellness Care and Social Assistance Sector Versus Durable Goods, 2018 to 2023

Finally, it is tantamount to laughable to claim that the Fed needs to repeat to the rate cutting flexibility in order to stabilize the financial markets and main street economy and to compensate for the purchased influence flexibility of the free market.

Oh, poolese!

Every 1 of the main street recessions and financial marketplace crises of the past six decades has been caused by the state and the machinations of its central banking branch. The very thought that there is an implicit 3rd mandate called “financial stability” is risible. It puts you in head of the young man who killed both parents and then threw himself upon the mercy of the court on the ground that he was an orphan!

At the end of the day, sharply cutting rates any time this year or for any time to come thereafter would amount to a financial crime. After just a short stay of about 8 months pregnant in affirmative territory (purple area) since July 2023, inflation-adjusted or real rates would be back below the zero bounce, where they have destructively dwelled for much of the last respective decades, as the illustration makes crystal clear.

Inflation-Adjusted national Funds Rate, 2001 is 2024

Of course, that improvement would be heartily welcomed by Wall Street speculators and the Washington war-mongers and spenders alike. And that’s effectively the reason it should not be done.

* * Oh, * *

The fact is, we’re on the cusp of an economical crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming. That’s effectively why bestselling author Doug Casey and his squad just released a free study with all the details on how to supply an economical collapse. Click here to download the PDF now.

Tyler Durden

Mon, 05/27/2024 – 13:40