’Cool’ US Producer Prices Blow Up Tariff-Flation Narrative

Following yesterday’s 'mixed’ CPI, all eyes are on the Producer Prices prints this morning for signs that the inflation pipeline is hotting up (or not)… and the print confirms – it’s not hotting up.

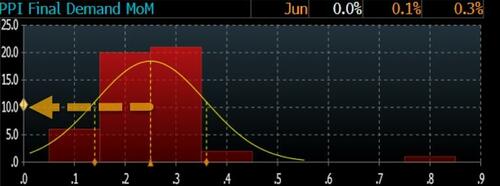

Headline and core PPI printed cooler than expected (unchanged MoM), well below the expected +0.2% MoM (in fact it was lower than all estimates)

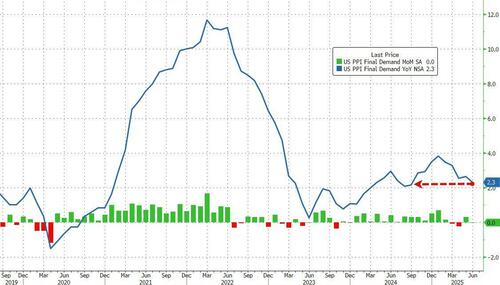

Headline PPI rose 2.3% YoY (down from a revised higher 2.7% in May and below the 2.5% expected) – that is the lowest YoY print since Sept 2024…

Source: Bloomberg

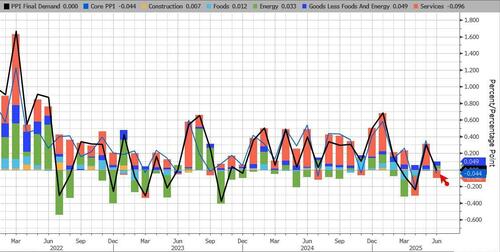

On a MoM basis, Services PPI 'deflated’…

Source: Bloomberg

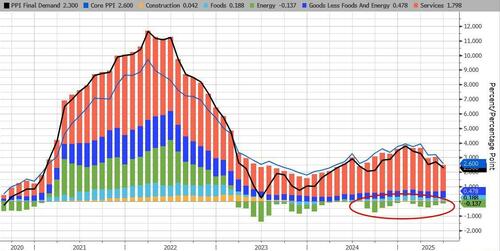

And on a YoY basis, Energy prices continue to 'deflate’…

Source: Bloomberg

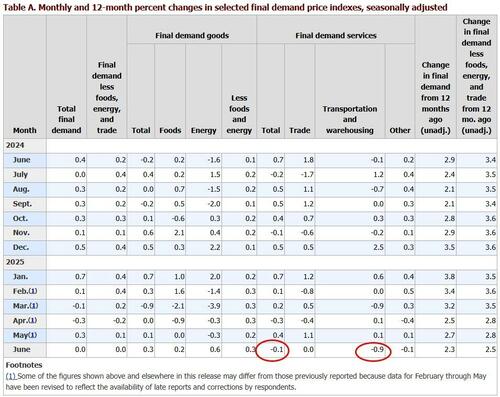

Final demand goods:

Prices for final demand goods rose 0.3 percent in June, the largest increase since moving up 0.3 percent in February. Over half of the broad-based advance in June can be traced to the index for final demand goods less foods and energy, which climbed 0.3 percent. Prices for final demand energy and for final demand foods also rose, 0.6 percent and 0.2 percent, respectively.

Product detail: Within the index for final demand goods in June, prices for communication and related equipment increased 0.8 percent. The indexes for gasoline; residential electric power; canned, cooked, smoked, or prepared poultry; meats; and tree nuts also moved higher. In contrast, prices for chicken eggs dropped 21.8 percent. The indexes for natural gas liquids and for thermoplastic resins and plastics materials also declined.

Final demand services:

Prices for final demand services edged down 0.1 percent in June after increasing 0.4 percent in May. Leading the decrease, the index for final demand services less trade, transportation, and warehousing declined 0.1 percent. Prices for final demand transportation and warehousing services fell 0.9 percent, while margins for final demand trade services were unchanged. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail: Over half of the June decline in the index for final demand services can be attributed to prices for traveler accommodation services, which fell 4.1 percent. The indexes for automobiles and automobile parts retailing, deposit services (partial), airline passenger services, and food and alcohol wholesaling also decreased. Conversely, prices for portfolio management advanced 2.2 percent. The indexes for machinery, equipment, parts, and supplies wholesaling; furniture retailing; and apparel, jewelry, footwear, and accessories retailing also rose.

But will the energy component start to rise next month?

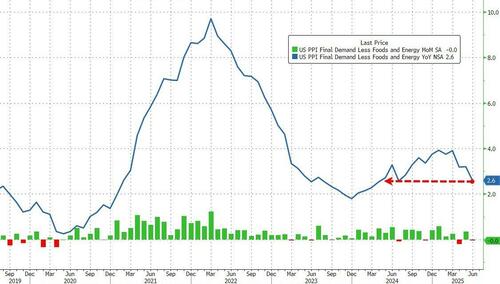

Core PPI also printed cooler than expected, down to just 2.6% YoY. Core PPI YoY was last lower than this is March 2024…

Source: Bloomberg

The pipeline for PPI is picking with Intermediate Demand Goods prices picking up…

Source: Bloomberg

Margin pressure lifted this month…

Source: Bloomberg

So much for the terrifying threat of tariff-flation… or will we just have to wait for next month to see the full horror.. or the next month?

Tyler Durden

Wed, 07/16/2025 – 08:39