China Cuts Rates To Stimulate Struggling Economy, Just Hours After Agreeing To Tariff Talks

Just hours after China admitted that it had been secretly engaging in pre-trade talks with the US despite repeatedly claiming otherwise including most recently on Friday when China’s foreign ministry spokesman Guo Jiakun said that “China and the U.S. have not held consultations or negotiations on the issue of tariffs,” adding that “the United States should not confuse the public” – even though we now know that active consultations were being held to prepare the upcoming tariff negotiation in Switzerland, Beijing – no longer needing to save face – immediately proceeded to cut rates and ease financial conditions to prop up its struggling economy.

China’s central bank governor said on Wednesday the bank will cut the amount of cash that banks must hold as reserves by 50 basis points, the first reduction in 2025 as policymakers seek to boost liquidity and help a struggling economy caught in a protracted second trade war with the United States.

The People’s Bank of China’s Governor Pan Gongsheng told a news briefing the reserve requirement ratio (RRR) will release about 1 trillion yuan ($138 billion) in liquidity.

The People’s Bank of China cut the seven-day reverse repurchase rate to 1.4% from 1.5%, according to Governor Pan Gongsheng. The central bank will also trim the reserve requirement ratio by half a percentage point, Pan said at a briefing on Wednesday, adding that the RRR cut will be effective May 15.

Pan also announced:

- The central bank will set up a 500 billion yuan relending tool for consumption, elderly care

- It will also increase its technology relending fund by 300 billion yuan

- Plans to increase its agriculture, small and medium enterprises relending fund

The decision demonstrates officials are acting with urgency to support the hobbled economy, now without its most affluent trade counterpart. Expectations that Beijing would unleash more stimulus have risen after US President Donald Trump imposed of up to 145% tariffs on Chinese imports, a level economists say would decimate bilateral trade.

However, in an effort to save face and not telegraph how urgent the economic slowdown truly was, Beijing waited until literally just three hours after news of the upcoming tariff meeting with the US delegation in Switzerland hit.

Responding to a question on structural tools, Pan says they serve as a complement to the aggregate tools. They now stand at 5.7 trillion yuan, or 13% of PBOC’s assets. These tools can guide financial institutions to voluntarily provide loans to the market. On the services consumption and eldercare relending tools, Pan says it’s because consumption upgrade is a priority.

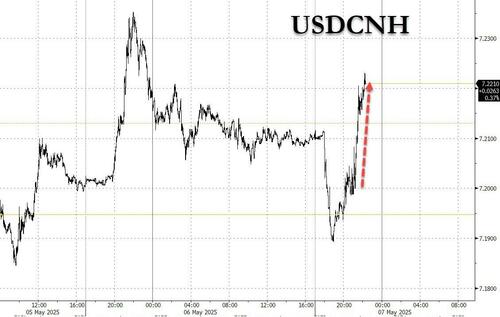

The offshore yuan trimmed advance to trade little changed at 7.2 per dollar, while the 10-year government bond yield edged lower.

That said, expect much more. Sat Duhra, a portfolio manager at Janus Henderson Investors, said the RRR cut is a helpful move, but its impact is likely to be limited. „Taken together, these measures are a step in the right direction, he says. But as seen before, they’re measured and somewhat cautious — another sign that investors shouldn’t expect any big bang reforms from China in this environment.”

Sure enough, optimism in Chinese stocks looks still-fleeting — gains are petering out, as traders doubt the resolve of the policies. The CSI 300 Index has pared its 1.5% move higher at the open to just 0.5%. The Hang Seng China Enterprises Index has nearly halved its 2.4% gain to 1.5%.

Also likely there could have been funds that bought the dip last month are now content with the gains — 6.7% from the trough for the CSI 300 Index, and over 20% for the Hang Seng Tech Index.

Meanwhile, according to National Australia Bank, China’s yuan and the Australian dollar are likely to suffer due to Beijing’s underwhelming stimulus. “China’s strategy continues to be one where policy makers are looking to ensure a severe downturn is prevented, but there remains no appetite to properly stimulate the economy and quickly solve the housing crisis,” said Rodrigo Catril, a currency strategist at NAB; he is right: as we explained yesterday, China simply does not have the fiscal space to „properly stimulate” the economy.

In response to Trump tariff hikes, China vows to unleash much more stimulus, as it has every week for the past 3 years.

Luckily, at 330% debt/GDP China has lots of fiscal space for stimulus

Oh wait… pic.twitter.com/UmJL9ZwjnQ

— zerohedge (@zerohedge) April 7, 2025

So far, top officials have had little to say about the upcoming trade talks – perhaps because they claimed since the start that there had been literally no contact whatsoever with the US – choosing instead to focus on the domestic economy and market stability. That messaging may signal that Beijing is bracing for a protracted trade war and continued fallout for a worst case scenario as it gears up for negotiations with the US later this week.

Tyler Durden

Tue, 05/06/2025 – 22:24