„Cash Is King”: Mark Mobius Says His Funds Hold 95% Cash

The key question facing equity markets now is whether the April 8 low marked a floor — or merely a trap door for bulls.

Veteran emerging-markets investor Mark Mobius joined Bloomberg TV earlier, warning, „Cash is king” as he waits for the trade war storm and mounting macroeconomic headwinds to blow over.

„At this stage, cash is king. So 95% of my money in the funds are in cash,” Mobius said in an interview, adding, „Right now, we’ve got to keep the cash and be ready to move when the time is right.”

Mobius continued: „If the market comes down further, of course we will put more money in.”

He said he owns „a little bit with S&P 500 funds” to track the market and expects higher prices by the end of the year.

„Trump doesn’t want to see a big market crash, so he will be making adjustments and announcements, which will give a little bit more confidence for people in the market,” the legendary investor said.

He pointed out that he has „become very bullish on China” and sees possibilities for Beijing to boost trade and domestic consumption amid the ongoing trade war.

“Right now, we’ve got to keep the cash and be ready to move when the time is right”

Veteran emerging-markets investor Mark Mobius is keeping the bulk of his funds’ holdings in cash as he waits out the trade-related uncertainty https://t.co/X3z6gg4pvE pic.twitter.com/bHNvjszfUM

— Bloomberg (@business) April 30, 2025

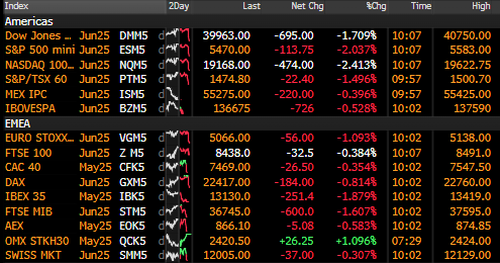

By late Tuesday morning in the US, main equity futures tumbled following a series of negative prints that cast dark shadows over the US economy:

-

Rate-Cut Odds Jump After ADP Reports Weakest Job Growth Since July 2024

-

US Q1 GDP Contracts On Record Imports, Shrinking Govt, As Consumption Comes In Stronger Than Expected

Main equity futures were dumped following the bad macro prints.

However, there is good news:

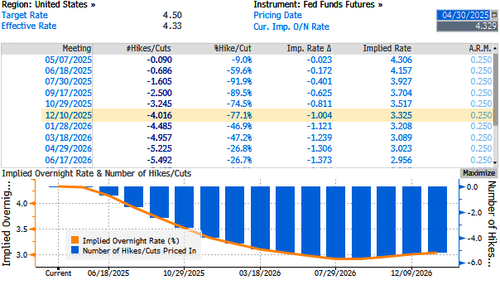

*TRADERS FULLY PRICE FOUR QUARTER-POINT FED CUTS BY END-2025

Powell dragged in, kicking and screaming

— zerohedge (@zerohedge) April 30, 2025

Implied four cuts by year’s end.

Separately from Mobius’ interview, Goldman analyst Vickie Chang offered clients a market snapshot on Tuesday, assessing whether the April 8 low marked a concrete bottom for stocks — or if another leg lower is still ahead:

-

The most immediate question for markets is whether there is fresh downside to come. We said that a shift in trade policy was the most obvious route for recovery in risk assets, and there has been a modest version of that dynamic since April 9. Even though the economic impact is yet to be felt, it is possible that we are past the peak of new tariff „shocks” and policy uncertainty.

-

In past equity corrections, markets tended to bottom near the trough in economic activity. But if there was a clear cause of the weakness, it was enough for the market to see the peak in pressure from that source to conclude that activity would bottom soon, and for equities to trough ahead of that. In episodes where the source was less easy to track, the market did not trough until economic growth itself started to bottom.

-

What matters now is whether the current episode is more like past „shock”-driven corrections where the tariff shock having seemingly peaked could be enough to mark the market bottom, or whether this will ultimately be a scenario where the economic data needs to stabilize first. It is possible that simply being through the worst of the shock has allowed the market to set some limits on the process, even if the damage is yet to be felt and if the underlying economic situation remains bad for some time.

-

Despite that possibility, we still think there is significant vulnerability in a recession scenario, even if the worst of the underlying „shock” has passed, for three reasons: 1) It has generally been true that in shock-driven corrections, there has been a meaningful reversal and not just a peak in the source of the pressure. So the tariff reversal may need to be more dramatic to be equivalent to those past peaks. 2) The unemployment rate matters a lot for the pricing of risk, and it has been some time since the economy has undergone a period of job and portfolio losses happening together. 3) The 19% drawdown so far would be relatively mild relative to past recessionary drawdowns and would have entirely taken place before economic damage is seen, which would be historically unusual.

-

It is worth keeping an open mind given the unprecedented nature of the current shock, but continued market recovery from here means putting an increasing weight on the belief that recessionary dynamics will not take hold, and requires confidence in the market’s ability to look through what is likely to be a further weakening in the data. We think the balance of risks still argues for expecting renewed declines in equity prices from current levels and for adding downside protection, especially if further relaxation makes that protection cheaper.

Just days ago, Bank of America’s Michael Hartnett told clients to „sell rips” and stay long „BIG” (his favorite trade idea for 2025, namely Bonds, International Stocks, and Gold).

Tyler Durden

Thu, 05/01/2025 – 06:55