Bullish Sentiment Index Reverses With Buybacks Resuming

Authorized by Lance Roberts via RealInvestmentAdvice.com,

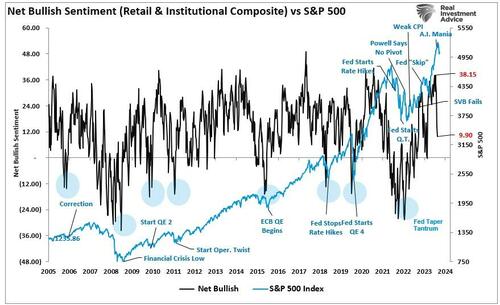

Over the last 2 weeks, the bullish sentiment index has reversed from utmost green to feat. The composite net bullish sentiment index, composed of professional and retail investors, fell from 38.15 to 9.9 in 2 weeks. The erstwhile drop between July and October last year was akin and marked the bottom of the correction.

While the bullish sentiment index can indeed fall further, what is notable is the harp reverse of marketplace “exuberance” in specified a short span. However, as discussed in “Just A Correction,” there was a signature gap between buyers and sellers.

“However, at any point, for whatever reason, this dynamic will change. Buyers will become more Scarce as they refuse to pay a higher price. erstwhile sellers realize the change, they will rush to sale to a dimishing pool of buyers. Eventually, sellers will begin to “panic sell” as buyers evaporate and prices plunge.”

Like clockwork, that correction camera quickly, with the marketplace uncovering first support at the 100-DMA. With solid arrivals from GOOG and MSFT, the marketplace increased to first opposition at the conversion of the 20- and 50-DMA. It would be unsurprising if the marketplace failed this first opposition test and eventual renewed the 100-DMA soon. specified a pullback would be solidify that support and complete the reverse of the bullish sentiment index.

In Early April, in the gate:

“Whatever trigger cases a reverse in the bullish signals, we will act according to reduced hazard and rebalance exposures. But 1 thing is sure: investor sentiment is utmost bullish, which has almost always been a good “bearish signal” to be more cautious.

While we have warred of a powerful correction over the past fewer weeks, it reminds us much of June and July last year, where akin wars for a 10% correction wet unheeded. We are now seeing many individuals ‘jumping into the pool’ in any of the most circumstantial areas of the market. specified is utilized a sign we are cluster to a marketplace highest than not. As such, we want to make adjustments before the correction comes.”

Very quickly, as supported by the bullish sentiment index, these bulls are turning bearish and are now calling for a more profit decline.

While specified is possible, I propose the most of this correction is complete for 2 reasons.

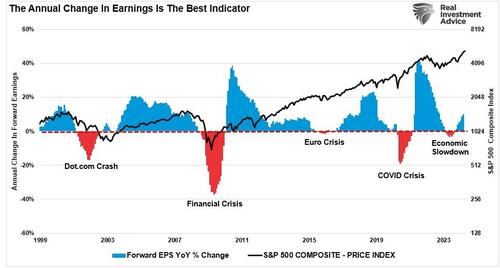

Earnings proceed To stay Strong

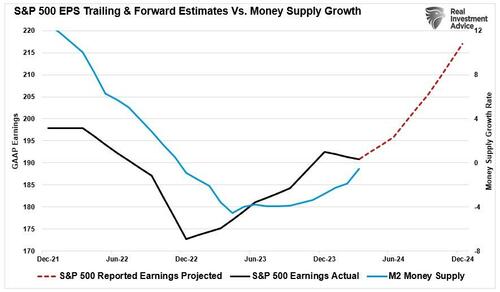

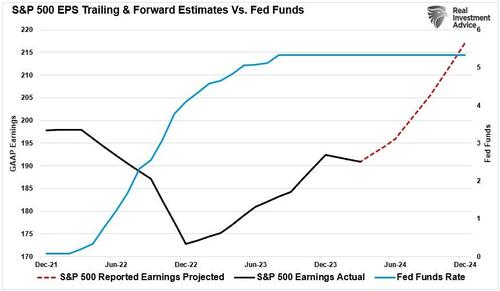

The first reason is that despite higher interest rates, earlys growth continues to stay robust, at least among the “Magnificent 7,” where Google (GOOG) and Microsoft (MSFT), in partial, exceed estimates by a wide margin. However, overall, and most importantly, earlys growth has continued since the October lows of 2022. Notably, the support for influencing earnings comes from the increased fiscal policies specified as the Inflation simplification Act and CHIPS Act.

While these policies will evenly fade, making forward estimates subject to downward revisions, the current arrivals environment restores comparative Robust. Furthermore, forward estimates stay optimal that the national Reserve will cut rates later this year, lending Borrowing costs and supporting economical activity.

Notably, the increase in earlys, at least for now, restores a strong indicator of rising asset prices. The hazard of a deep marketplace correction (greater than 10%) is importantly reduced during erstwhile periods of improving times. While specified does not mean a deeper correction can not happen, historically, corrections between 5% and 10% in an educations growth environment tend to be buying opportunities and limit deeper reverse in the bullish sentiment index.

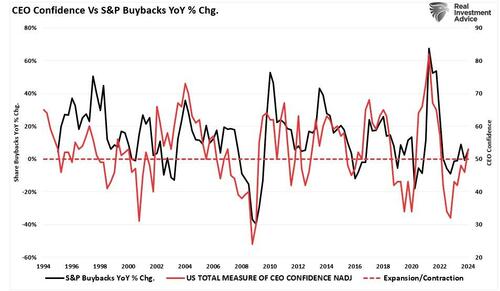

Improving earnings besides precedes improving CEO confidence, which has provided pivotal support to financial markets since 2000.

Buybacks Returning

We discuss the most critical reason we anticipate a marketplace correction in mid-March. It's wit:

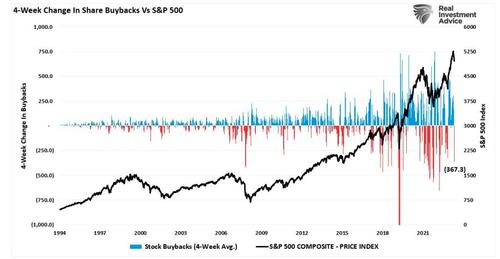

“Notably, since 2009, and accelerating starting in 2012, the percent change in buybacks has far outstripped the increase in asset prices. As we will discretion, it is more than just a casual correction, and the upcoming blackout window may be more critical to the rally than many think.” – March 19, 2024

Furthermore, the “blackout” of corporate buybacks coincided with more utmost readings in the bullish sentiment index. Buybacks are cruel to the marketplace due to the fact that corporations have accounted for more than 100% of net equity purchases over the last 2 decades.

Here is the math of net flows if you don't believe the chart:

Pensions and common Funds = (-$2.7 Trillion)

Households and abroad Investors = +$2.4 Trillion

Sub full = (-$0.3 T)

Corporations (Buybacks) = $5.5T

Net full = $5.2 Trillion = Or 100% of all equity purchased

Unsurprisingly, that blackout window coincided with a harp contrast of more than $367 billion in buybacks over the last 4-weeks. Consecently, erstwhile you remove a critical “buyer” from the market, the ensuing correction is unsurprising.

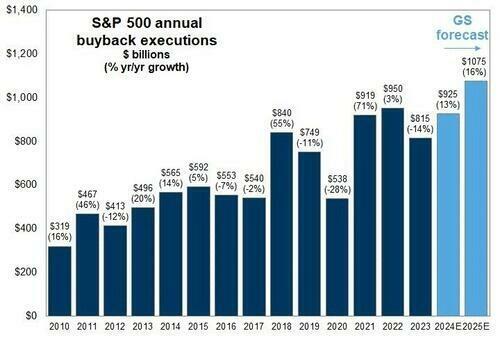

However, corporate share buybacks will resume in the next couple of weeks, and with more than $1 trillion reduced for 2024, many buybacks reconstruct to complete. specified is partially the case with Google adding another $70 billion to that total.

As noted above, improving earnings and a decent outlook for the remainder of this year besides boost CEO confidence. (If you don’t realize why buybacks benefit insiders and not shareholders, read this.)

With Robust economical activity supporting the arrivals growth, that improvement boosts CEO confidence. As CEOs are more assured about their business, they get share buybacks to increase executive compensation.

The liquidity boost from buybacks and strongr earnings will likely supply a level below the market. This does’t mean the current correction doesn’t have more work to do. However, it is improbable that it will resolve into something more significant.

At least for now.

Tyler Durden

Tue, 04/30/2024 – 13:25