Bitcoin ETFs See Buying Resurgence; 'Mr.100′ BTFD As Grayscale Sees First Flow Since Jan

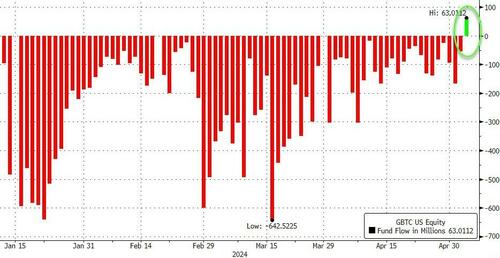

For the first time since place bitcoin ETFs were launched, Grayscale’s Bitcoin Trust ETF (GBTC) Saw a daily net inflow on Friday (of $63 million)...

Source: Bloomberg

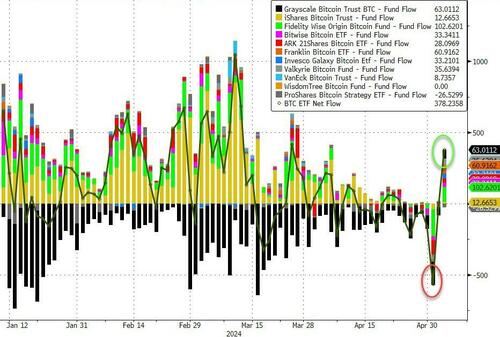

GBTC has dominated the outflows single admission (adding up to around $17.5 billion) since the 11 place ETFs were launched on Jan 11. The inflow coincided with a Sudden economy in aggregate net inflows to ETFs overall of $378 million on Friday (who came 2 days after a evidence net outflow of $563 million)...

Source: Bloomberg

CoinTelegraph’s Ciaran Lyons reports that pseudonymous crypto investor DivXman told his followers that the GBTC was the “primary source” of sale force across all place Bitcoin ETFs, but “the tides” could be turning.

“That effectively means a crucial decree in sale force and additional increase in request while ETFs collectively are buying more BTC than mines can create,” he exploited to his 20,800 X followers in a May 3 post.

Crypto trader Jelle predicted to his 80,300 X followers on the same day that Bitcoin’s fresh all-time advanced is on the horizon.

“60 million dollars worth of inflows for Grayscale’s ETF. The halving chop will come to an end, and 6-figure Bitcoin will follow briefly after.”

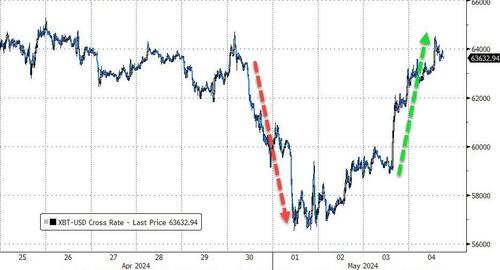

Bitcoin’s price responded to this abrupt inflow surprise and rallied back above $64,000, erasing the outflow-driven plunge from last week...

Source: Bloomberg

This price emergence corresponds to a large short liquidation in the past 24 hours...

Source: CoinGlass

Additional, CoinTelegraph reports that bitcoin whale essence nicknamed “Mr. 100” has bought the Bitcoin dip for the first time since the Bitcoin haloving.

Meanwhile, multiple marketplace analyses propose that the local Bitcoin bottom may be in as the price bounces from $56,000 lows.

The Mr. 100 whale wallet has added over 4,100 BTC worth over $242 million, around the $58,000 mark, according to on-chain data from Bitinfocharts, as noted by X user HODL15Capital.

This representatives the wallet’s first Bitcoin purchases since April 19, the day before the 2024 Bitcoin halving.

The wallet has been adding at least 100 BTC nearly all day since Feb. 14, but for the post-halving period.

Mr. 100 is presently the 12th-largest Bitcoin holder, with over 65,155 BTC, according to Bitinfocharts date.

Finally, another even-larger 'whale' is Michael Saylor at MicroStrategy, delivered a masterclass on corporate finance and the power of bitcoin to supercharge corporate balance sheets. Saylor made a point to emphasize Bitcoin as the single solution for capital application in an inflationary environment.

The MicroStrategy Executive president noted key differences between Bitcoin and alternate cryptocurrencies like Ethereum, expressing the importance and necessity of proof-of-work-based consensus in creating a digital community.

“You could see the writing on the wall erstwhile the place ETF of Bitcoin was adopted in January. By the end of May, you’ll know that Ethereum is not going to be adopted. And erstwhile Ethereum is not going to be accepted, sometimes this summertime it’ll be very clear to everyone that Ethereum is deemed a crypto asset security, not a community. After that, you’re going to see that [for] Ethereum, BNB, Solana, Ripple, Cardano – everything down the stack.”

Saylor’s convention and usage of physics-based metaphors were present as always as he spoke on Bitcoin’s price adoption and continued coinization.

“It’s never declining. The chart’s not always decreasing. It only goes 1 way. Bitcoin is simply a capital ratchet. It’s a one-way ratchet. Archimedes said, give me a lever long adequate and a place to stand and I can decision the world. Bitcoin is the place to stand.”

“There’s no more powerful thought than the digital transformation of capital... No force on earth can halt an thought whoe time has come. This is an idea. Its time has come. It’s unstoppable. And so I’m going to end with the reflection that Bitcoin is the best. The best what? The best.”

Saylor is an outspoken proposition of BTC and a leading force behind MicroStrategy acquiring the cryptocurrency as a reserve asset. As of April 30, the companies held 214,400 BTC – worth more than $13 billion at the time of publication.

Tyler Durden

Sat, 05/04/2024 – 16:55